A UBS advisor who generated about $900,000 in annual revenue has jumped to Steward Partners, making him the most recent example of a departure from a non-Broker Protocol firm.

Dean Hoover is also the latest wirehouse advisor to joined Steward Partners, a fast-growing independent firm affiliated with Raymond James. Just last month, Steward Partners

A UBS spokesman declined to comment on Hoover's departure.

-

In a concession to the advisor, he can still respond to client emails and calls, even though he may not initiate contact.

December 13 -

Breakaway uncertainty is forcing the RIA to re-evaluate its growth strategies.

December 10 -

Despite Merrill Lynch’s recent decision to stay in the Broker Protocol, Greg Fleming sees a long struggle ahead.

December 6 -

Morgan Stanley and UBS's exit from the accord spurred a number of advisors to move up their planned career changes.

December 6

In December, the wirehouse followed Morgan Stanley in exiting the protocol, an industrywide agreement that permitted advisors to take basic client contact information with them when they switched firms. While Morgan Stanley

The firm has not filed an injunction against Hoover, according to a search of federal court records.

Hoover now operates from Steward Partners' office in Clearwater, Florida, which the firm opened about a year ago with the hiring of three teams from Morgan Stanley.

Hoover made the move in part because he preferred Steward Partners’ platform and the opportunity to have more input on the direction of the company. Plus, "this office is like a reunion with old colleagues," he says, noting that he worked with several of the advisors in Clearwater more than a decade ago when he was employed with Morgan Stanley.

Hoover, an advisor of 22 years, left Morgan Stanley in 2008 to work at UBS, according to FINRA BrokerCheck records.

"I intend this to be my last stop," Hoover says of his move to Steward. "I'm going to retire here."

For Steward Partners, Hoover is also the latest in a string of new hires.

"We had a banner year last year," says Greg Banasz, head of business development at Steward Partners, which recruited 28 advisors and opened four offices in 2017.

Pointing to the firm's growth in 2018, which so far includes two new offices and 12 hires, Banasz says

"People are running toward the opportunity rather than run away from something," he says.

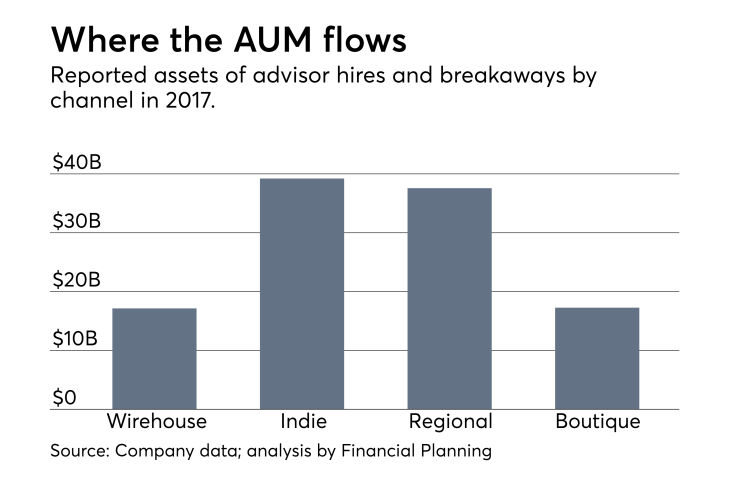

Of course, it's not the only firm that has been benefiting from the movement of advisors from wirehouses to regional and independent firms. Raymond James, for example, has been on an aggressive recruiting push in recent years, adding advisors to both its independent and employee broker-dealer channels. Overall headcount hit a record 7,537 brokers at the end of the most recent quarter,

The recruiting landscape, however, has been in flux since Morgan Stanley pulled out of the Broker Protocol last year. The wirehouse said it did so because competitors were exploiting alleged loopholes in the 2004 industry agreement.

The move was striking in part because UBS and Smith Barney, a Morgan Stanley predecessor firm, were original signatories to the protocol, which now counts more than 1,700 member firms. (Regional broker-dealer Hilliard Lyons is

The departures of Morgan Stanley and UBS prompted industry insiders to question whether the protocol could survive without them. Morgan and UBS have approximately 15,000 and 6,700 advisors, respectively.

Since leaving the protocol, Morgan Stanley has pursued as an aggressive legal strategy, suing departing advisors to enforce non-solicitation agreements.

It's also been unclear if and how advisors could leave non-protocol firms and constitute their books of business elsewhere.

For their part, executives at Steward Partners say non-protocol career moves are still possible if done in a legal and ethical manner. The firm has also added new staff to help with career transitions.

"We've drawn up a plan with our legal counsel and Raymond James legal counsel to make sure we do it appropriately," says Jeff Gonyo, divisional president at Steward Partners.