When Stifel Independent Advisors CEO Alex David resigned from his prior brokerage of a dozen years, he learned for the first time of an internal investigation and allegations against him.

In comments visible on his FINRA BrokerCheck

David made a formal response, calling the omission of the LLCs “inadvertent and an oversight.” He said that the entities have accounts with Wells Fargo Bank, he asked for and received approval for other outside business activities and he had never even known about the firm’s investigation. No one has alleged any wrongdoing or client losses as a result of the LLCs or by David over his three decades in the industry.

And yet the disclosure stains his public record with a red dot — the same mark that appears against a broker accused of fraud, unsuitable recommendations or other harmful conduct.

Some financial advisors and securities attorneys view such regulatory dings as an abuse of wealth managers’ responsibility to inform the public about a broker’s conduct and scrutinize any outside business activities. Through frivolous disclosures of minor infractions or even false accusations, brokerage firms punish former registered representatives for leaving the company, according to advisors and attorneys. The formal filings lack any appeals process other than costly arbitration claims that come after the allegations are already public, with little chance of significant awards and almost no likelihood of regulatory punishment for the firms.

The case of Mark Munizzi, a former UBS compliance officer who won an appellate court decision on Nov. 19 confirming a payout that will ultimately reach $13.5 million, represents “a unicorn” outcome that shouldn’t “encourage anyone that employees will have a fair shot” against brokerage defamation, said Munizzi’s attorney, Steven Gomberg of Lynch Thompson.

“At this point he's unlikely to ever obtain employment in the industry again,” Gomberg said. “FINRA has no process in which brokers can contest the filing at all. You would think that, in something so important to someone's career, there would be a process in which the broker could challenge it with FINRA.”

Gomberg acknowledges that clients should have access to advisors’ records when deciding whether to hire them, but he said the regulator currently has “no remedy” penalizing UBS after a panel of arbitrators found the firm defamed Munizzi and two courts upheld the decision. With a lot of discussion among regulators, attorneys and wealth managers over

Representatives for FINRA declined to comment. In May, the regulator

“We are planning to come forward with a discussion paper looking at expungement more generally to really provide some data and some background so that we can help inform the dialogue and then follow that up with stakeholder engagement sessions with NASAA and the states, with the SEC, with FINRA there and potentially other participants to really work through this in a holistic way,” Cook said.

‘Unfair’ system

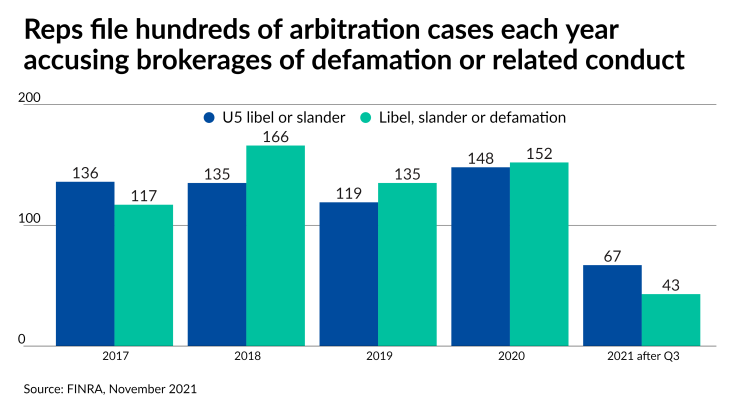

The issue constitutes one of the most commonly discussed topics in cases filed by reps against firms, according to FINRA statistics. In the first three quarters of 2021, there have been 110 arbitration claims alleging defamation, slander or libel in any form; in the prior four years, there were 1,108. FINRA’s officials “don't really care if there are defamatory statements about brokers” in Central Registration Depository files and “they know full well that it’s an inadequate system,” said attorney Lisa Bragança of

Bragança, a former SEC Division of Enforcement branch chief in its Chicago office, now helps lead the expungement reform efforts of the Public Investors Advocate Bar Association as a board member of the PIABA Foundation. She sees U5 defamation as an example of common cause between the organization and registered reps across the industry.

“It's a peculiar system where brokerages can just put anything on there and it then requires a full-on arbitration decision to get that taken off,” Bragança said in an interview. “We as investor advocates also overlap to a substantial degree on the interests of good registered reps who get smeared by their former firms. … There should be a regulatory process for removing that, not an arbitration.”

Differences in state laws add additional complications to the procedure. Standards of “absolute immunity” for firms in New York and California often prohibit any money damages in arbitration awards even when there’s intentional defamation, with a “qualified immunity” in a majority of the other states ruling out other significant payouts, according to attorney Robert Herskovits of Herskovits PLLC. A client of his who

“It is certainly not unusual for there to be tens of thousands of dollars of costs,” he said. “It's really an unfair system for the financial advisor. If you're going to create a system of mandatory disclosure in which an individual is the subject of that disclosure, the same individual should have a cost-effective means of challenging that disclosure. And FINRA doesn't have that.”

For instance, one former Wells Fargo advisor spent about $3,000 to simply state their side of the story in a BrokerCheck comment after the firm cited the rep for a policy violation based on conduct it had already approved, the ex-broker told Financial Planning. The broker discussed their 2020 departure from the firm anonymously out of fear of further recrimination. Trying to get the disclosure expunged could have cost another $75,000, according to the rep.

“It's just a terribly unfair process that is absolutely to the benefit of the firms and to the detriment of registered representatives, because of what it requires to have yourself heard and the attorneys required to do so,” the broker said. “I’m not aware of any consequence in reality that a firm has in doing something like this, putting a disclosure on haphazardly.”

The churn of advisors leaving firms may represent the only true fallout from the common brokerage firm tactics. Returning to the example of the CEO of Stifel Independent Advisors, David’s team has added three teams with a combined $425 million in client assets since rebranding under the firm’s push for a more significant footprint in the independent channel. Two of the teams came from Wells Fargo FiNet.

Representatives for Stifel declined a request to speak with David about the BrokerCheck disclosure. Representatives for Wells Fargo declined to comment as well.

Fear tactics

Firms assisting breakaway advisors in launching RIAs have encountered many of the same tactics. Brokerages try to retain the business from advisors and clients through fear and other “aggressive tactics that find themselves in the legal realm,” said Shirl Penney, the founder of RIA platform Dynasty Financial Partners. Often, their actions backfire, such as clients who are offered discounts and “see right through”' the firm’s behavior, Penney said. The greater flexibility of launching an RIA and the ability to own your own practice will prompt more advisors across the wealth management marketplace to make the move regardless, he said.

“You can try to put speed bumps, potholes and roadblocks to slow that migration a bit, but, at the end of the day, some of the best advisors and their clients are going to continue to make the migration,” Penney said.

The fear element does cause advisors in a branch to take notice. Advisor Matt Kilgroe of St. Petersburg, Florida-based Cyndeo Wealth Partners

“They were kind of put on their back heels to try to figure out what they were going to do next,” Kilgroe said. “A lot of the ones that I refer to there have turned out to be very successful in the next round, doing their own RIAs or going independent. But I think I made the decision along with my partners that we didn't want to succumb to that. We didn't want to live in that fear.”

Many advisors and firms have decided to do the opposite, based on exposure to complicated cases. Unfortunately for Munizzi, the former UBS supervisory executive from a branch in Chicago, a competitor that offered him a job rescinded it to avoid any legal risks after noticing that the wirehouse was

In December 2019, a FINRA panel had ordered UBS to pay $11.1 million in awards and damages after Munizzi accused the firm of defamation, as well as a violation of the Illinois Wage Payment and Collection Act and interference with “prospective economic advantage” from future employment, the award document

“The arbitration award reflects that the arbitration panel found that UBS made false statements about Mr. Munizzi,” Appellate Court Justice Mary Lane Mikva wrote in the judgment. “Therefore, the disclosures on the Form U5 were neither ‘frank’ nor ‘accurate.’ There is no public policy favoring false or defamatory disclosures by employers.”

Representatives for UBS declined to comment on the case.

The ruling affirmed a circuit court decision in October 2020 for Munizzi and against the firm’s first appeal of the award. Due to rising interest payments owed as part of the award and attorney costs for the appeals, the award is growing at a rate of about $3,000 a day up to an eventual payout of $13.5 million, according to the attorney, Gomberg.

UBS now has about a month to file a motion for leave to appeal. Besides the payments from the wirehouse, though, the only people suffering any consequences from the case are his client and the arbitrators, who probably won’t get selected to serve on future panels simply because they decided in favor of the large award to Munizzi, Gomberg said.

“The money will give him financial security, but it's not going to replace his relationships or his sense of worth,” Gomberg said. “We're very pleased with the results, but it doesn't in any way change the organic problems that exist which could be addressed in some way by FINRA.”