Women may control more than $20 trillion in wealth, but they are less likely to hire financial planners to advise them than men, according to a new study from U.S. Bank.

“While we know that women have more money and power than ever before, the survey results tell us they aren’t getting the most out of it,” said Gunjan Kedia, U.S. Bank’s vice chair of Wealth Management and Investment Services.

Women are less engaged with personal finance than men, less confident about managing money and nearly half associate negative emotions with financial planning, according to “Women and Wealth,” a survey of 3,000 women and men across the United States.

The findings are paradoxical because women control 51% of private wealth in the U.S. and own approximately 40% of businesses, Kedia said.

“Women would rather talk about their vaginas than talk about money,” she said.

What can advisors do to help women take more control of their finances?

“Schedule one-on-one sessions with women clients,” Kedia advised. This allows them to bring up topics and priorities they don’t address when they’re in a joint meeting with their partner.

Men and women have an array of different attitudes toward money, the study showed. One explanation may lie in the “money messages” formed from an early age, said Amy Zehnder, wealth dynamics coach for U.S. Bank.

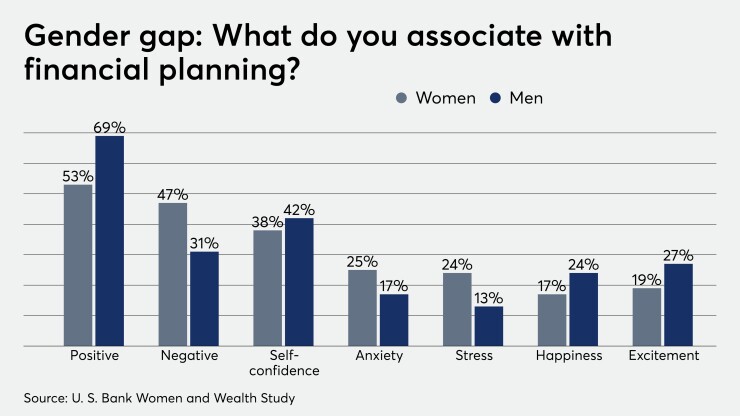

These messages are a result of cultural influences, gender, generational values and technology, Zehnder explained. The survey found that 47% of the women surveyed associated negative words like fear, anxiety, inadequacy and dread with financial planning compared to only 36% of men. And while more than two-thirds of men associated positive words like happiness, excitement and pride with managing money, just over half the women surveyed did.

Less than half of women surveyed said they felt confident in their ability to manage their finances.

Slightly less than half of women surveyed said they felt confident in their ability to manage their finances, compared to 61% of men. But in everyday life, women worried less about making ends meet or paying bills than men did. For example, 19% of men said they struggle to make payments on their bills versus just 12% of women, and 22% of men said they are worried about how to make ends meet, compared to 16% of women.

And while 61% of men said they talked about money with their friends, less women (52%) did the same. Nearly half of men surveyed said they use a personal financial or budgeting app, but only 37% of women were similarly engaged with their personal finances.

One stumbling block for women may be that they start to engage with finances later than men, according to the study.

While 72% of women younger than 35 use a financial advisor, that’s significantly less than the 83% of men in the same age group who work with financial professionals.

“Both women and men who engage early with their finances, whether it’s with a financial advisor, using a digital app, or just watching shows and listening to podcasts about money, will be more confident about their finances,” Kedia said.