This year’s election will be particularly consequential for advisors and their clients.

Financial regulation — fiduciary rules in particular — could rebound in 2021. Tax rates will likely change, again. Social Security’s fate is up in the air.

It’s a lot to take into account, even before considering other matters up for grabs, such as immigration, police reform and foreign relations. Even the fate of American democracy, some would say.

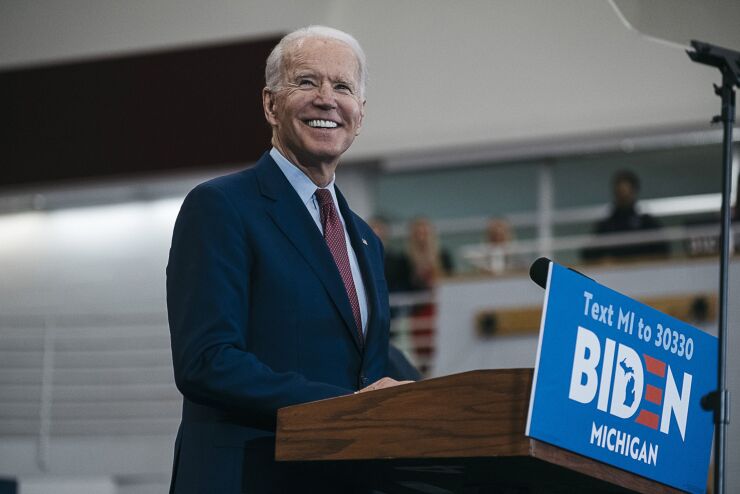

President Trump and former Vice President Biden, as well as their respective parties, have distinctly different visions for the country.

To help advisors make sense of what’s at stake in this electoral contest, here’s a shortlist of key issues to watch.

Regulatory resurgence

Advisors can expect stronger financial regulations from a Biden administration, should the former vice president win. In particular, the Obama administration’s fiduciary rule could make a comeback and the SEC’s Regulation Best Interest, criticized for its broker-friendly approach, could be revised.

Should Trump win, advisors can anticipate a more Wall Street friendly approach to regulation for another four years.

Under the current administration, the SEC avoided crafting a fiduciary rule when it promulgated Reg BI. And the Labor Department has made moves to permit private equity funds in 401(k)s and exclude ESG from retirement plans.

The department’s proposed replacement for the fiduciary rule has been criticized for its allegedly permissive attitude toward conflicts of interests and a hasty rulemaking process. Prior to assuming his current role, Secretary of Labor Eugene Scalia led the legal challenge that vacated the Obama-era rule.

Taxes

Trump and a Republican Congress cut taxes as part of the Tax Cuts and Jobs Act of 2017. Individual tax rates are scheduled to increase to their prior amounts after 2025.

Trump has suggested cutting taxes again, including the capital gains tax. A Trump proposal to enact a 10% middle-class tax cut would include lowering the 22% marginal tax rate to 15%, according to accounting firm Crowe. For 2020, the 22% marginal tax rate applies to income over $40,125 for individuals and $80,250 for married couples filing jointly, according to Crowe.

Biden and the Democrats would reverse some of the TCJA changes, particularly for wealthy Americans. The former vice president has suggested returning the top marginal tax rate to the pre-TCJA rate of 39.6% for income over $400,000.

“The expectation right now is that Biden’s intent is to unwind at least some of the corporate tax cuts that were implemented under the Trump administration [and that] may not bode well for the market because corporations will pay higher taxes,” says Marc Pfeffer, CIO of CLS Investments.

The Labor Department’s short comment period is one reason to get up to speed, fast.

Solita Marcelli, UBS Global Wealth Management's Americas CIO, said last month that the firm expects Biden’s proposed corporate tax plan would raise revenue by about $500 billion. The impact of that would be offset by his economic and infrastructure plans, which involve increased federal spending.

“There would be likely winners and losers from tax policy changes,” Marcelli says.

Social Security

With

The numbers suggest it won't be possible to delay any decisions much longer.

Markets and the economy

UBS’ Marcelli expects market volatility leading up to the election itself, but not in the long term.

While a Biden win “doesn't feel as capital friendly,” investors need to stay focused on broader horizons, says Pfeffer of CLS Investments.

Plus, there are constraints on what any president would like to accomplish during their time in office. Congress has a say. Campaign promises get ditched. And events, whether it be 9/11 or coronavirus, have a way of reordering presidential priorities.

In 2021, policy choices may be limited due to the current crisis, Marcelli says.

“Bringing the economy back to its feet will be the priority for whoever wins the election,” she says.