Sales of variable annuities reached their highest quarterly level in more than five years, with the hottest flavor of the insurance-like contracts driving the upswing, according to preliminary

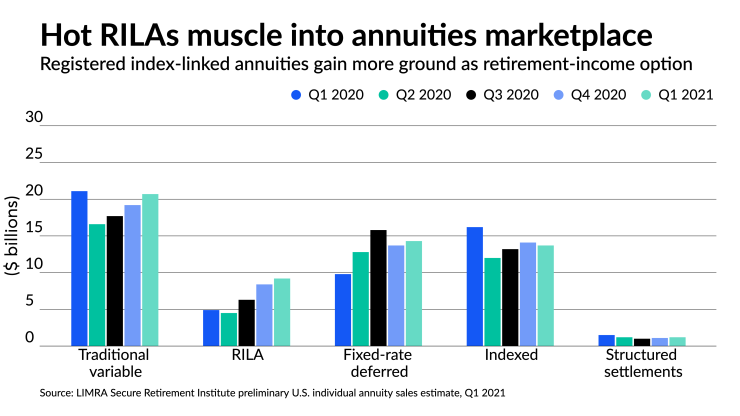

Registered index-linked annuities (RILAs), insurance-industry jargon for consumer contracts that are tied to stock indexes but that allow investors to set the maximum loss they’re willing to endure, totaled $9.2 billion in the first three months of this year.

That’s a 9% rise compared to the prior quarter, and a whopping 89% rise on year-ago levels, according to LIMRA, a trade group of insurance companies.

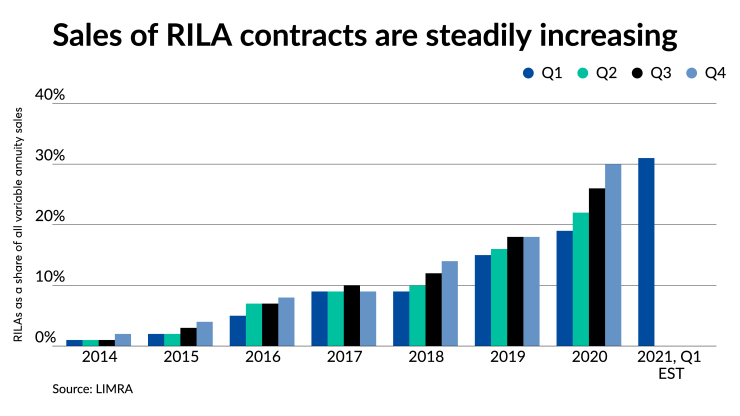

Even though they account for only 11% of all annuities sold, RILAs have emerged as the fast-growing star of the market in recent years, with advisors increasingly seeking to get them into clients’ retirement portfolios and insurers making deals. LIMRA forecasts RILA sales to grow as much as 50% this year, and the RILA market — now one-fourth of all variable annuities sold — to grow through 2025. “The current economic environment favors RILAs,” Todd Giesing, an assistant vice president of LIMRA’s Secure Retirement Institute, said in a statement, citing low interest rates and strong market gains.

Issued by insurance companies and sometimes called the

Aimed at older individuals who are worried they will outlive their retirement savings, annuities get a bad rap because they’re sometimes promoted aggressively in cheesy sales pitches, miscast as an investment (they’re insurance) and just plain confusing. Most employer-sponsored retirement plans

Annuities have been the focus of more than 450 customer

Sales of traditional variable annuities, which account for the lion’s share of all annuities sold — around one in three — showed tentative signs of recovering after more than a decade of losing ground. They totalled $20.7 billion, up 8% on the last quarter of 2020 but down 2% from a year ago.

Overall, sales of both traditional variable and RILA contracts totalled $29.9 billion in the first quarter of 2021, up 15% from the prior year and the highest level since the fourth quarter of 2015.

Sales of fixed-rate deferred annuities, which get compared to certificates of deposit, were $14.3 billion in the first quarter, 46% higher than prior year but only 4% above the prior quarter. Giesing attributed the annual rise to consumers seeking to protect their money in the pandemic economy. While the institute expects sales of the contracts to shrink slightly over 2021, it sees growth rebounding starting next year.

Despite that increase, it’s RILAs that have been the

“RILAs,” he said, “offer better pricing than indexed annuities to investors looking to mitigate downside risk and enjoy potential investment growth as the bull market continues.”