Thanks partly to a poor market showing at the end of last year, the number of captive advisors bolting for independence slowed during the first months of 2019.

That’s according to TD Ameritrade CEO Tim Hockey, who made the observation during a recap of the company’s fiscal 2019 earnings results.

“Brokers thinking about making the move to independence are choosing to sit tight for a while longer,” Hockey said.

It’s a downturn other industry experts have observed and, like Hockey, most don’t expect it to last. They think a couple of factors may be driving the trend: Investors aren’t making as many incremental additions to their investment portfolios following the recent market uncertainty, and the federal government shutdown in January also has impeded advisor movement.

“The SEC being closed the whole month of January … slowed down some folks who had planned on going independent,” says David Canter, head of the RIA segment at Fidelity Clearing and Custody Solutions. “That being said, the SEC opened back up and they processed the firms that were in the queue.”

Reduced movement into the independent channel is related to a broader slowing across the entire wealth management industry, says recruiter Jeff Nash, CEO of Bridgemark Strategies.

Advisors report what they love — and hate — about tech at companies holding client assets.

“Actual movement has slowed for the first part of the year and I am hearing that around the Street,” he said in an email. However, he added that the hesitancy masks a strong urge by many to potentially make a break: “I think total people evaluating [a move] has increased, especially for the last couple months.”

Despite the lag, TD Ameritrade pulled new advisors onto its platform in the second quarter. TD Ameritrade Institutional now counts around 7,000 RIAs, up from 6,000 in September. The firm says it crossed this new threshold during the first quarter.

Still, the slowdown paired with a drop in clients making incremental additions to their investments led to a “short-term softness in organic growth” at TD Ameritrade this quarter, Hockey said.

He doesn’t expect it to last.

“Our sense was this was a one-quarter anomaly mostly driven by the effect of the market at the end of 2018 and we’re feeling pretty good about the future,” Hockey said on the earnings call.

TD projects some of that growth could come from the newly redesigned client website it launched this quarter, with enhanced security and a new cash management functionality. The simplified features offer more “self-service” for investors and will free up time for advisors.

The custodian has scaled back in other areas, in order to focus on RIAs. TD Ameritrade

Could TD take a cue from

“We are always looking at [other pricing models],” Hockey said. “Subscription models are interesting, but there’s other versions we could consider as well.”

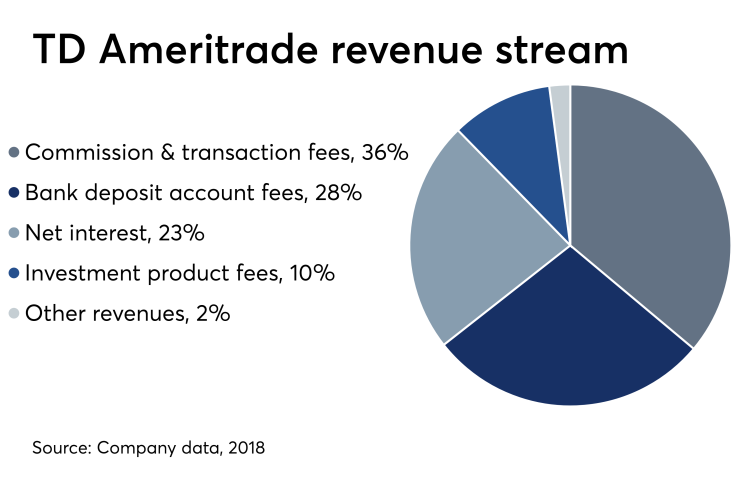

The company’s net revenue rose 2% year over year, from $1.42 billion to $1.45 billion. TD’s revenue fell from $1.52 billion in the first quarter of the firm's fiscal year, which ended Dec 31.