SAN DIEGO — TD Ameritrade Institutional, long considered a leader among RIA custodians for its open access integrations of third-party software, has unveiled important updates to its Veo One platform and a new iRebal Model Market Center.

The firm's announcements came at the firm’s National LINC 2017 Conference, an annual gathering for independent RIAs, which has more than 3,200 people registered this year, including more than 2,000 RIAs.

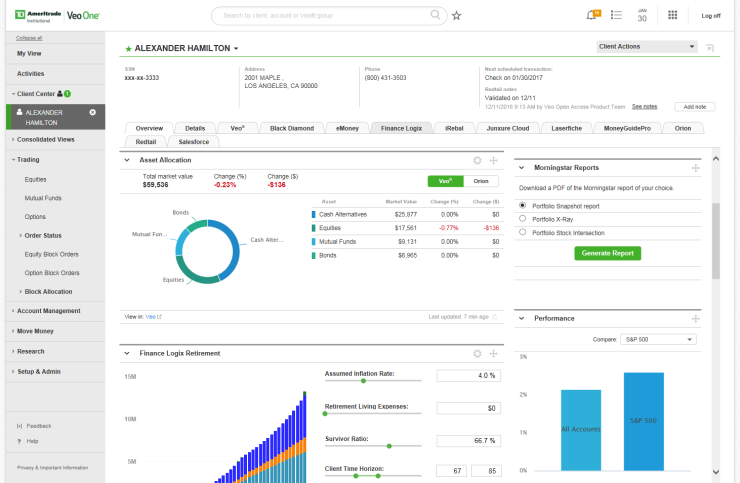

Perhaps the most significant announcement is the general release of VEO One, TD Ameritrade’s next generation platform for advisers. The platform, which has been in beta testing with a limited number of advisers for months now, provides a unifying technology experience that is unique among custodial offerings. No other RIA custodians offer the depth and breadth of providers that VEO One does.

The platform is relaunching with virtually all of the functionality of its predecessor, with the rest to follow shortly. VEO One currently includes fourteen integrated partners: Junxure, Redtail, Salesforce for CRM; eMoney, Envestnet/FinanceLogix and MoneyGuidePro for financial planning; Advent/Black Diamond, Morningstar and Orion for portfolio management; and DocuSign, LaserApp, Laserfiche for digital enterprise content management. TD Ameritrade’s iRebal rebalancer and ThinkPipes trading platform are also part of the VEO One ecosystem. A fifteenth integration partner, AdvisoryWorld, will be added shortly.

Additional partners will be added to the system on a regular basis. TD Ameritrade estimates that most, if not all of the over 100 current VEO integration partners will be onboarded over the next several quarters.

So what makes VEO One different from its predecessor? It “got the data moving,” according to Jon Patullo, the managing director of technology product management at TD Ameritrade Institutional. By this he means that third-party providers could pull data from the TD Ameritrade platform and use it in their applications. In some cases, third-party software could also push data to TD Ameritrade.

MIND THE GAP

VEO Open Access was a major improvement over what preceded it, but there were a few major gaps that adviser and the third-party vendors wanted addressed.

For one, the adviser didn’t necessarily have a unified view of all relevant data. So, for example, if you were a planner and spent most of your time in your planning software, the status quo was probably OK. However, if you needed to see relevant data that resided in your CRM displayed on your computer screenwith financial planning and portfolio management software displayed, you’d need to toggle back and forth between programs.

-

TD Ameritrade Institutional’s revamped Veo platform allows planners to integrate information across third-party providers with a single sign-in.

December 12 -

Advisor tech is now ground zero in the battle plans of the industrys giants as they look to deploy integrated, bundled systems to capture more mind- and wallet-share of independent advisors.

April 20

VEO One addresses this gap by bringing widgets to the VEO One system from your various software vendors. Advisers can customize their VEO One dashboards so that the widgets containing the information relevant to their needs are displayed at all times.

Another gap is related to sharing information across applications. Under the previous framework, if you changed a client’s address in your CRM, the change could be pushed to the TD Ameritrade platform, so the two platforms were in sync. Changes originating on the TD Ameritrade platform could likewise be sent to the CRM. But what if you made a change in the CRM and you wanted it reflected not only at TD Ameritrade, but also in your planning software and your portfolio management software? That was not previously possible, but it is now.

What if there is a change in household members? This appears straightforward at first glance, but that isn’t always the case. Why? Because the “household” in CRM might be different from the “household” for portfolio management purposes. VEO One is powerful enough to let the user specify, when a change is made in one application, what, if anything it should communicate to each other connected application.

Yet another positive change is that it empowers co-creation. In the past, third-party providers that wanted to integrate with VEO or enhance their integrations required TD Ameritrade employees to collaborate with them. This created bottlenecks when demand for TD Ameritrade resources exceeded supply. Now vendors will be able to do a lot more of the development with less required of TD Ameritrade once they are admitted to the platform. This should lead to more rapid deployments and additional innovation.

Large RIA’s can make use of these development tools as well. To cite just one example, they could create their own robo adviser by leveraging TD Ameritrade’s digital account opening tools, and leveraging iRebal for trading and rebalancing.

TRANSPARENT WORKFLOW

Both advisers and TD Ameritrade have been anxious to have more transparent operational workflows. With VEO One, they will have it. Now, advisers will be able to track all open case files from within VEO One. They will be able to see what has been received by TDA, where it is in the workflow process, and if it is in good order or not. If a client sends a check to the adviser as part of an account funding process, the adviser can now scan the check for processing at TD Ameritrade.

The new platform is the foundation upon which future enhancements will be deployed.

There’s more to VEO One than what is currently available. The new platform is the foundation upon which future enhancements will be deployed. Later this year, TD Ameritrade will provide an analytics and benchmarking tools from FA Insight, according to Chris Valleley, the director of technology solutions at TD Ameritrade. TD Ameritrade acquired FA Insight last year.

By inputting some data points, advisory firms will be able to benchmark themselves against peers in the region, similar firms nationally and against other demographics. VEO One will also provide operational analytics. For example, the platform will include a “NIGO Report Card”. This report will indicate to advisers which workflows between the firm and TD Ameritrade are working well and which ones aren’t. It should also help pinpoint where the problem is, so operational gaps can be addressed.

Analytics will also address client segmentation, what technologies they are using and what technological opportunities exist, as well as the percentage of business processed electronically. The goal is to make advisers more successful at leveraging the technology available to them through TD Ameritrade and their partners.

iREBEL SUPERMARKET

Another major innovation announced at LINC and launching soon is the iRebal Model Market Center. This new offering, which will be made available to the over 10,000 users at over 2,500 RIA firms can be thought of as a supermarket of model portfolios constructed by well-known asset managers. This platform will lower the barrier to entry for managed accounts, says Danielle Fava, the director of institutional product strategy & development at TD Ameritrade Institutional.

“Today, the separately managed account purchased through a turnkey asset management program (TAMP) is fairly inefficient,” she says. There are trading and administration fees. The adviser has no discretion over that the sub-account manager does. The adviser gives up control. They are operationally inefficient.

The iRebal Model Market Center allows advisers to pick a model and add it into an existing iRebal process. When a manager makes a change, it will be reflected immediately in iRebal. One significant difference between the typical TAMP sub account process and the iRebal process is that in the former case, the trades just happen. In the case of iRebal, the adviser can review the proposed changes before they happen, and the adviser has the discretion to override trades when necessary.

iRebal Model Market Center will offer two types of models: those developed by product manufacturers and others. These models will be available to all iRebal users at no charge, and will be the only models available initially. Fava declined to name the initial list of product manufacturers, but she indicated that there will be at least five providers at the outset. The list is likely to include some of the biggest names in the business that already have existing relationships with TD Ameritrade.

In the second phase of the rollout, third-party investment managers will be able to offer their models on the Model Market Center. Advisers will typically pay a fee to make use of this intellectual property. Providers are likely to include managers that advisers are familiar with from various TAMP programs, but it could also include new entrants, including RIA firms that have developed their own models. TD Ameritrade will not impose any fee for this service. Advisers will only pay the fee charged by the third-party manager.

One appealing aspect is that it is not an all-or-none proposition for advisers. Firms can use a sleeve approach to blend some in house management with Market Center models. So, for example, if a firm has a successful domestic strategy of their own, but no expertise with international equities, they can blend multiple strategies and manage it all in iRebal.

According to Fava, the iRebal Model Market Center addresses a number of trends that are taking place within our industry: the move to passive investing, the move to a model based approach to managing assets, and lower fees. Managing models of ETF’s is easy and inexpensive with iRebal.

BROAD IMPLICATIONS FOR ADVISERS

Although Fava did not specifically mention it, the Model Market Center could have broad implications for how advisers manage money. As third-party managers become available, in many cases it will be cheaper to buy their portfolios through the Model Market Center than, say, through a mutual fund offering with an identical strategy, while offering the adviser greater control over tax related decisions and cash levels.

The Model Market Center could have broad implications for how advisers manage money.

“Increasingly, are clients are deciding that their time is not best spent on stock picking,” said Fava. Their time can better be spent servicing existing clients and acquiring new ones.

RIA firms that custody at TD Ameritrade might not be the only ones that leverage iRebal Model Market Center. A number of digital advice platforms, including those of Riskalyze and Adviser Engine use, or plan to use iRebal as their rebalancing engine. These firms may also leverage the Model Market Center.

NOT GOOD NEWS FOR EVERYONE

While this new development is clearly good news for advisers, it might not be welcome news to TAMP providers currently providing services to TD Ameritrade clients.

When I asked Fava about this, she provided a predictably neutral answer: “With regard to Managed Accounts, we see advisers falling in two distinct categories: advisers who want to outsource management and trading versus advisers who want to retain discretion. The advisers who desire a true outsourcing arrangement (i.e. turnkey) will continue to be directed toward and partner with a TAMP. Advisers who want to retain discretion and control of the trading are better suited for the iRebal Model Market Center.”

It is difficult to imagine that any TAMP will welcome this news. For advisers that already custody with TD Ameritrade, use iRebal, and currently have portfolio management and reporting capabilities, iRebal Model Market Center should be more efficient, more customizable and less expensive.

Competition among RIA custodians on the technology front remains fierce, but TD Ameritrade’s ability to innovate and differentiate has proven noteworthy. With their latest announcements, they continue their tradition of delivering the tools their advisers want.