While all advisory firms have to come to grips with succession planning, smaller RIAs are especially vulnerable to taking a big financial hit if they don't have a strategy in place for the loss of a principal.

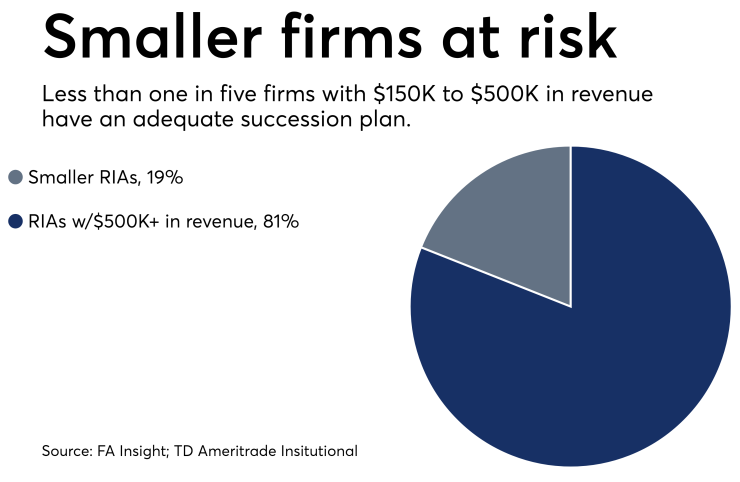

Firms that generate between $150,000 and $500,000 in annual revenue are most at risk if they don't have an adequate succession solution in place, according to a new report from TD Ameritrade Institutional.

Only 19% of the smaller firms surveyed by the custodian said they were prepared to deal with a succession event, in contrast to 100% of firms with $8 million or more in annual revenue.

"Operators [of smaller firms] are most at risk primarily because they have not yet progressed to the point of having a team," the FA Insight report on succession planning, "Beyond Ownership Transition, It's a Smart Human Capital Strategy" stated.

Without a team in place, the report continued, "there are no obvious successor candidates within the firm, whereas larger firms have someone who can step in, at least in the short term."

What can owners of small firms do?

"Looking for the perfect person to take your place is really daunting and it's easy to get paralyzed," Vanessa Oligino of TD Ameritrade.

They need to be committed to growth, so developing a team will be plausible, says Vanessa Oligino, director of advisor business performance solutions for TD Ameritrade Institutional. Having a team means more options and an opportunity to groom a successor. "This is not a strategy for a lifestyle practice," Oligino notes.

Taking action — the sooner the better — is also critical.

"Looking for the perfect person to take your place is really daunting and it's easy to get paralyzed," Oligino cautions. "And it's unlikely you can do it in a year. We hear again and again that firm owners regret they hadn't prioritized looking for a successor sooner. Even though it seems like the time you'll need a successor is far away, getting the right plan in place takes more time than you think."

-

I told clients they need a plan. Turns out, I needed one, too.

February 7 - Unlocking a firm's value while managing a smooth transition.Sponsored by Cambridge Investment Research

-

Whether the plan is to groom from within or look outside, keep these tips in mind.

May 23

Another tip for principals thinking about winding things down: know what's next.

"We've found that if advisors who own a firm haven't determined what they want to do next, they're not ready to let go of the business," Oligino says. "But once they have made that decision, they're enthusiastic about the succession process and it goes much smoother."