Student loan debt is surging, hitting a new record of $1.5 trillion in the first quarter this year.

Massive student loan debt can cause problems in people’s lives, both financial and emotional, to the point that many view eliminating student debt as more important than retirement planning.

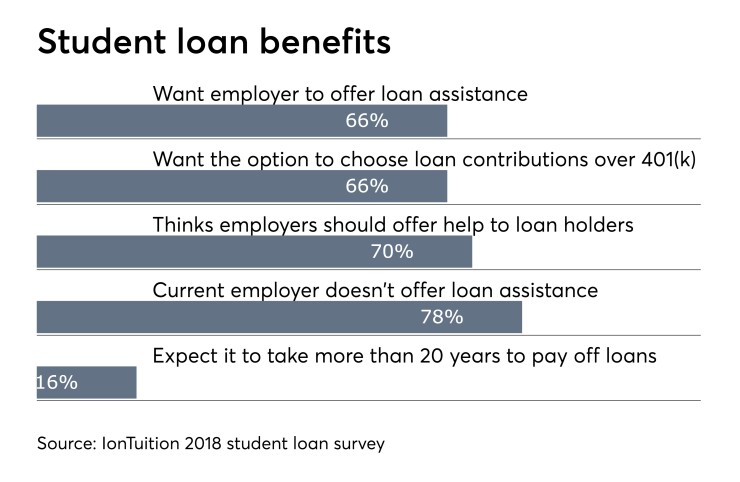

Indeed, a 2018 study from student loan management company IonTuition found that 75% of respondents would rather their employer offer monthly contributions to their student loans over 401(k) benefits.

Student loan debt is the second largest form of consumer debt in the U.S. — behind mortgage loans. It’s become such a problem that those afflicted have put off buying houses, starting families and moving out of their parents homes after college.

Of the 1,000 respondents polled, 37% said are unsatisfied with their current loan repayment plans and 18% aren’t knowledgeable of their repayment options. Only 13% of respondents work for a company that offers a student loan assistance benefit, while 70% believe employers should help workers manage student debt.

A majority of those surveyed — 66% — say they would like the option to choose matching contributions toward their student loan over those for a 401(k). That figure was only 49% in IonTuition’s 2017 survey.

“It’s disappointing to learn, but it’s not surprising,” says Bruce McClary, financial counselor and vice president of communications at the National Foundation for Credit Counseling. “People shouldn’t have to make a choice between a secure financial retirement, over being able to affordably repay their college education.”

But the results indicate that without the proper assistance people will have to postpone one in favor of the other. Student loan debt can impact more than just a client’s retirement and unlike other kinds of debt — mortgages for example — there are no tax benefits for paying down student loans.

Advisor Kelly Hokanson of the Planned Approach in Kansas City, Missouri, isn’t surprised by the study’s findings either. She works primarily with high-net-worth clients, and even they aren’t immune to the burden of student loans. One of Hokanson’s clients left medical school owing more than $200,000 in student debt.

-

Even though the program was created by a large multinational corporation, companies of all sizes could utilize this approach.

September 10 -

This debt “can hurt their ability to take on long-term financial planning because they are concerned with reaching a zero point,” says one therapist.

May 11 -

"This space is getting more diverse, and change is coming from all directions," says Alois Pirker, research director for Aite Group's Wealth Management practice.

May 17

“It doesn’t surprise me because I think it is such a now thing,” she says. “Even under the best circumstances people have a hard time thinking, ‘Oh, in 35 years or 40 years I’m going to be retiring.’ I think it’s a sad state of affairs. I tell my clients you can take out a loan for your kid’s education but you can’t take out a loan for retirement.”

Hokanson looks at this preference among loan holders and says that essentially they are asking employers to pay for their loans and in a way borrowing against their retirement and long term security.

“I hate that that’s the state of where things are,” she says.

The problem with working with a client that has massive student loan debt is that there aren’t many options at that point for advisors to offer.

The trick is getting to families before kids go off to college and changing their perception of what should be considered when looking into schools. While it may feel nice for a client to say their kid got into Harvard or some equally prestigious school, they need think about the correlation between the kind of education the child needs and their desired career path.

“People don’t really think about that,” Hokanson says. “They get on that, ‘Okay, we’re going to go to the four-year school and have that experience.’ And that’s all fine and good, but if people can do that planning on the upfront with clients and kids of clients and get them to see ‘If you take out that student loan here’s what it means to you’ … it makes a huge difference.”