Most clients make conventional IRA investments in vehicles such as stocks, bonds, index funds, ETFs and CDs. But IRA investors can put their money toward pretty much anything, other than life insurance and collectibles.

Advisers must alert clients to the potential dangers of making unconventional investments in their IRAs. Unintentionally making a prohibited transaction can have a devastating effect on a client’s finances, and you want to have it on the record that you raised appropriate concerns before the investment was made.

Back in December, the Governmental Accountability Office issued a report recommending the IRS improve its guidance on IRA investing in unconventional assets.

Here are some red flags.

PROHIBITED TRANSACTIONS

What is, or isn’t, a prohibited transaction can be a bit complicated. That is why clients often need good explanations from their adviser.

For example, a client can invest IRA funds in a house, but he can’t live there or let relatives or business associates have the space in a manner that would provide a direct or even an indirect benefit to the IRA owner.

The penalty for this is quite severe: The entire IRA account will be deemed distributed as of Jan. 1 of the year the prohibited transaction occurred.

Advisers must alert clients to the potential dangers of making unconventional investments in their IRAs.

For example, if the IRA had a balance of $1 million, and only $15,000 was used in a prohibited transaction, the entire $1 million balance would be deemed distributed. That’s a tax on $1 million (assuming all pre-tax IRA funds) and the end of the IRA account.

In addition, if the client is under the age of 59 ½, a 10% early distribution penalty could apply, adding more pain to the situation.

Another example of a prohibited transaction is a client purchasing her own property for an IRA, or borrowing money from or lending money to her IRA. These acts are considered self-dealing.

Be sure to differentiate this form of borrowing from the 60-day IRA loan, in which a client withdraws funds from their account for a short-term need. Those funds must be returned as a rollover back to an IRA or other qualified retirement account within 60 days, or the distribution becomes taxable.

This is not a prohibited transaction, because it is a rollover. But taking a long-term loan from an IRA, with terms and interest, is indeed a prohibited transaction.

If a person other than the IRA owner engages in a prohibited transaction, they can be liable for a 15% excise tax on the amount of the transaction, not the entire account balance. The penalty will be 100% if the transaction is not quickly corrected.

-

-

Now that the tax-free distribution is back on the books, here's how advisers can take full advantage.

July 25 -

Some advisers and their clients are running afoul of an IRS rule, and oversights can result in substantial penalties.

June 22

Be aware: These penalties can apply to advisers who commit a prohibited transaction with a client’s retirement account.

UNRELATED BUSINESS INCOME TAX

Generally, income earned within an IRA is not recognized for tax purposes. But when a business is operated within the traditional or Roth IRA, that income, in excess of a $1,000 exemption, can be taxable as unrelated business income.

In addition, if funds are borrowed to purchase an asset in the IRA (for example, a mortgage on a rental property), income produced by that asset could be subject to an unrelated debt-financed income tax.

The tax is paid by the IRA, not the IRA owner, personally. UBIT and UDFI taxes are reported on Form 990-T, usually prepared by the IRA custodian. Advisers should double-check that this is done. The tax money is withdrawn from the IRA, but this is not counted as an IRA distribution.

It is an expense of the IRA the same as investment management fees are. The client should be informed that this is an extra cost of making this type of investment with their IRA funds and take this into consideration when evaluating the potential return. Even though the tax is remitted by the IRA custodian, it still comes from the client’s IRA funds and reduces the overall return.

When an IRA needs to borrow funds in order to purchase IRA assets, that loan must come from outside financing, without a personal guarantee from the IRA owner.

-

With retirement accounts being affected by the upcoming fiduciary rule, many advisers aren’t sure what their first step should be.

June 10 -

New reporting requirements allow the feds to focus on hard-to-value holdings in order to boost taxable required minimum distributions.

April 27

A recent case illustrates an example of this scenario. James and Judith Thiessen, through their self-directed IRAs, acquired the stock of newly formed Elsara Corp. Elsara then bought the operating assets of a company, with the Thiessens guaranteeing repayment of a loan Elsara received from the seller as part of the deal.

The IRS asserted that the Thiessens' guaranties, which had not been disclosed on their tax returns, were prohibited transactions that resulted in deemed distributions of the IRAs' assets to the couple. The Tax Court agreed, holding that the guaranties were indirect extensions of credit to their IRAs. They were found liable for a $180,129 deficiency, attributable primarily to unreported IRA distributions.

The Thiessens also owed the 10% additional tax on early distributions, because neither spouse was at least 59½ years old during the year their deemed distributions occurred.

IRA-OWNED BUSINESSES

Advisers should also alert clients to the risk of using IRA funds to invest in a business. Yes, it can be done, but there are too many tax traps that are easy to fall into, even with professional guidance. The biggest one is unknowingly committing a prohibited transaction.

The IRS has been looking closer at these transactions for years, especially as they pertain to a Roth IRA. The income inside a Roth can eventually be withdrawn tax free, thereby turning otherwise taxable business income into tax-free retirement savings.

Advisers need to warn clients on the dangers of setting up an IRA to own a business or a corporation, even if there are no loan guarantees. There is still the likelihood of self-dealing by benefiting personally from the business.

One common trap is taking a salary from the IRA-owned business.

One common trap is taking a salary from the IRA-owned business. Another one is providing direct or indirect financing to the IRA-owned corporation. And yet another easy trap to fall into is providing services to the business owned by the IRA, such as fixing up rental properties. It’s best to have the IRA hire outside contractors.

VALUATION ISSUES

The GAO report also found that clients could have difficulty obtaining fair market values for hard-to-value IRA assets.

For instance, if real estate in an IRA is converted to a Roth IRA, the IRA owner would have to provide the fair value for tax purposes. Now these assets are flagged through mandatory IRS reporting on Form 5498 “IRA Contribution Information.” The December 31 fair market value must be reported each year.

One reason for the increased enforcement here was to track the potential for grossly undervaluing multi-million-dollar IRAs invested in business entities or private investments where public valuations were not readily available.

In addition to valuations, IRA owners must provide updates when the value changes. Otherwise, to the taxpayers’ detriment in some cases, distributions may be valued at the last known number.

In at least two Tax Court cases in 2014, the current values were not provided to the IRA custodian, resulting in a tax bill on worthless IRA investments. The custodian did not receive a valid updated valuation, and reported the investment as distributed with the value based on the original investment. The IRA owners in both cases had to pay tax on value that didn’t exist, because valid information was never given to the IRA custodian who requested it.

These valuations are critical for all IRA distributions, including RMDs and Roth conversions.

IRA INVESTMENT LIQUIDITY

The GAO reports that some unconventional retirement assets are difficult to distribute, because they cannot be sold as easily as publicly traded securities. For example, the report cites the difficulty of trying to liquidate a private equity investment. It may not be easy to find investors to purchase that asset.

Once IRA owners reach age 70 ½ and must begin taking their RMDs, liquidity can become a problem. Advisers should ensure a client’s IRA contains funds that can be withdrawn when they need to be.

While assets can be distributed in kind to satisfy RMDs, valuations are necessary to make sure there is enough to cover that RMD. These valuations may involve additional fees, which are an expense of the IRA.

For RMD purposes, undervaluation can result in a 50% penalty for not taking the full amount. The penalty would be based on the amount of the RMD deemed not withdrawn.

It’s the adviser’s job to make sure their clients fully understand these responsibilities, so they can avoid the potentially disastrous consequences.

CLIENT RESPONSIBILITIES

When a client chooses to purchase unconventional assets in an IRA, they often don’t realize the new responsibilities that go with that investment.

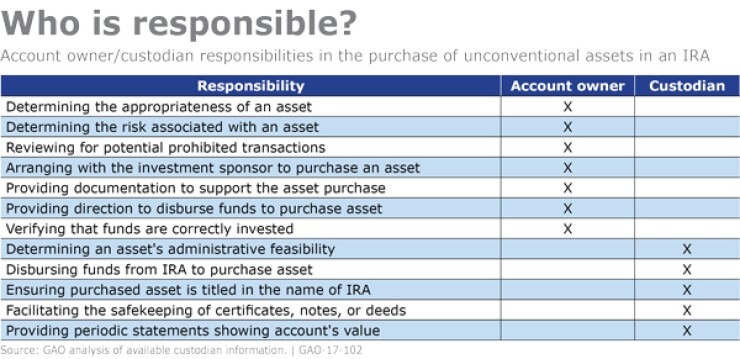

The GAO highlights these responsibilities as follows:

“IRA owners investing in unconventional assets must locate an asset, determine its suitability for their retirement goals and conduct due diligence on the investment and the investment sponsor. In addition, to finalize the purchase, these IRA owners must collect, review and prepare all purchase documents and provide them to the custodian to execute the purchase on behalf of the IRA.”

It’s the adviser’s job to make sure their clients fully understand these responsibilities, so they can avoid the potentially disastrous consequences.