New Jersey is currently taking comment on its proposed fiduciary rule, after years of public debate over federal and state regulator’s efforts to craft a higher standard for brokers and advisors. But the state may be moving too quickly, industry insiders warn.

The American Securities Association — an industry trade group representing regional broker-dealers — is calling on the state’s Bureau of Securities to hold new public hearings to prevent the regulation from wreaking havoc in unforeseen ways.

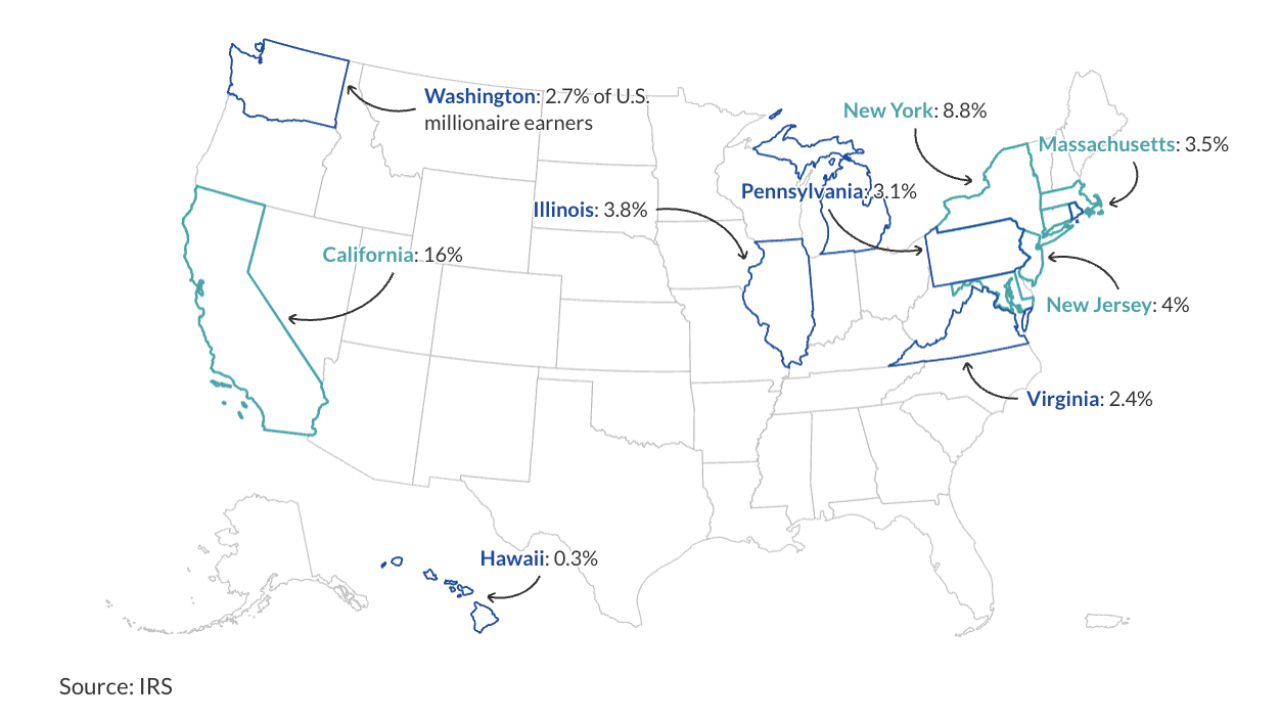

The bureau’s fiduciary rule “would fundamentally alter the relationship that currently exists between broker-dealers and their retail clients in the state of New Jersey and this could have a negative impact on the state’s finances,” Christopher Iacovella, CEO of the American Securities Association, said in a comment letter to the regulator.

The association’s letter is indicative of one way Wall Street firms and groups are responding to the Garden State’s proposal. The other extreme is Nevada, which has faced fierce opposition to its own fiduciary rule.

In its letter to the New Jersey regulator, the American Securities Association echoed some industry concerns about Nevada’s proposal. The association pointed to issues including regulatory costs, compatibility with federal regulations and the length of the proposed implementation period.

“These and other concerns have not been fully developed and are ripe for a public hearing by the bureau,” Iacovella wrote.

He added: “In our experience, a public hearing allows citizens, industry, and policymakers to engage in a fulsome discussion that bolsters transparency and ensures a diversity of views are presented throughout the process.”

Meanwhile, some wealth management leaders have

Default assumptions based on nonexistent children can lead to overaccumulation and unnecessarily delayed retirement.

Advisors continue to exit Commonwealth following its acquisition last year by former rival LPL Financial.

The move comes amid UBS executives' acknowledgement that they're trying to strike a balance between keeping advisors happy and improving the profit margin for their U.S. wealth business.

Brokerage firms and Wall Street trade groups have said they prefer the SEC to take the lead on standards of conduct for advisors and brokers. FSI and SIFMA sued the Labor Department to block its fiduciary rule from going into effect. The SEC’s proposed best interest regulation — which does not impose a fiduciary duty and relies on new disclosures — falls short of what’s needed in the eyes of many investor advocates.

Thomas Rampulla, managing director of Vanguard's Financial Advisor Services division, recently told Financial Planning it was challenging for his firm’s clients to deal with the Labor Department’s rule (it was

“At the state level, if there are 50 different standards, that would be really hard,” says Rampulla. His division serves more than 1,000 advisory firms.

“For us, there should be some uniform standard,” he says. “We believe that financial advisors should have, whether you call it fiduciary or best interest, a requirement to put clients’ best interest first.”

New Jersey’s proposal would go farther than the SEC’s Regulation Best Interest to raise standards of conduct for advisors and brokers. The state regulator is currently taking

For investor advocates, fiduciary regulation is a long overdue investor protection.

“Between the DoL rulemaking, the SEC rulemaking, the Nevada rulemaking — the views are out there. And based on what NJ has proposed, it looks like they took that into account, from both sides,” says Christine Lazaro, director of the Securities Arbitration Clinic at St. John’s University and president of PIABA.

Lazaro also attended New Jersey’s public hearings on its pre-proposal, noting that the state regulator took statements at that time in addition to comment letters and other feedback from the public and the industry.

“The New Jersey proposal seems stronger to us than what the SEC has proposed. So to the extent it offers strong protections, we’d like to see it move forward as quickly as possible,” Lazaro says.