Clients text — so firms are spending millions of dollars developing tools that allow advisors to text back.

Firms including

“It still has a few kinks that need to be ironed out, but for the most part it works,” he says.

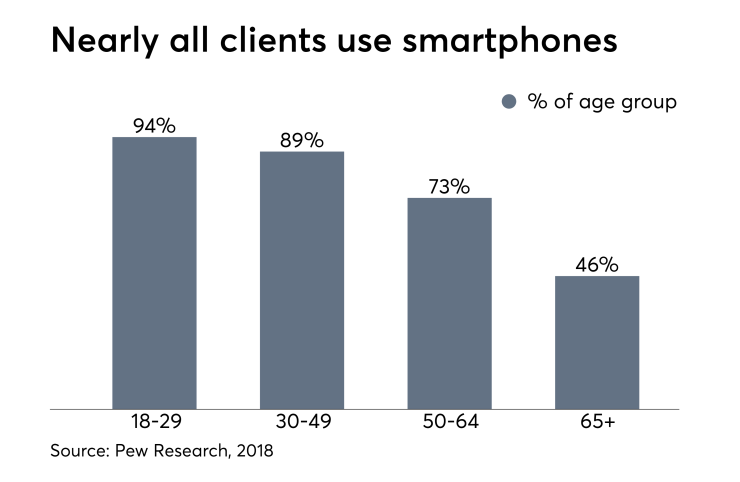

Nearly 98% of households making more than $75,000 use cell phones, according to 2018 Pew Research Center data.

Advisors “feel texting is a necessary communication mechanism to be able to engage with not only the younger generation but even older clients who expect to be able to text,” says Kevin Witt, chief technology officer at Kestra Financial, which launched a text messaging app last summer with CellTrust.

Texting with clients is not as simple as it sounds.

Any communication between advisor and client falls under SEC and FINRA guidelines, one of them being that correspondence

“Screenshots and writing it down are just not going to cut it anymore,” says Brian McLaughlin, CEO of Redtail, which launched a texting app called Speak for independent advisors about a year and a half ago.

At Redtail, correspondence gets archived into the company’s CRM and sent to compliance engines, such as Smarsh. Clients must give consent to participate in the communication, McLaughlin says.

At Kestra, advisors text in an app, but clients receive the message in their phone messages — the same place they would get a text from a friend.

“In some cases, we can make that new number the same as the office number on their desk, a number that’s already on their business cards,” Witt says.

Still, texts will look a little different. Messages sent from independent advisors at Kestra will have footnotes behind a micro URL, including relevant disclosures that include entity structure information for each individual practice, as well as a warning that the text message might contain privileged information.

Without the URL, “The disclosure is typically longer than the length of a text message,” Witt says.

-

Advisors are craving mobile solutions, and vendors are looking to satisfy.

December 6 -

The app also allows clients to use the Zelle person-to-person payments service.

June 25 -

Mobile wealth management products have grown 300% in the past year, with retail banks serving up the majority. But there's an opportunity for RIAs to improve the client experience.

June 6

Firms looking to develop a text-messaging service in-house instead of outsourcing should be wary of certain risks.

“One of the challenges of course is that a client might be talking to one or more advisors,” McLaughlin says. Redtail had to guarantee that messages from the same phone number could be wired internally to make their way to two separate individuals.

Firms should also be wary of group chat capabilities, according to Ahmed.

“You may be communicating in a jurisdiction where you are not licensed,” he says. Additionally, if more than 25 people join a conversation, it may need to be pre-approved under FINRA rules.

Even after technology is built, cybersecurity risks remain.

“You need to make sure that you don’t assume that you know who the other party is. Phones can be hacked. Emails can be hacked,” Witt says. It could be hard to discern whether someone is impersonating a client. Additionally, cell phones are more likely to be lost, he says.

Another question for advisors: Do you want to be this accessible?

“Perhaps with an email that you send on the weekend or late Sunday night, it’s reasonable that the advisor will return that when they get into the office the next day. I suspect that with texting that the expectation might be different,” Ahmed says.

And because texting is more casual, advisors should decline to receive trading instructions over text. “You will have to be very disciplined in how you coach your clients,” Ahmed says.