An office of supervisory jurisdiction with 35 advisors left National Planning for Securities America, marking

Dan Cairo of Elite Financial Network, a hybrid RIA with $744 million in client assets, opted for

Cairo met for four hours with LPL representatives after the firm

“I don’t want to be placed into a process that was geared more towards a proprietary platform,” Cairo says. “When you’re an independent advisor, it’s all about options: Do you have the right number of options to properly service and take care of your clients?”

-

The Arizona-based firm serves as a super OSJ, supporting advisors who work for 13 affiliated credit unions as either employees or independent financial advisors.

October 19 -

The move previews what will be a tough recruiting fight for the IBD giant following its massive buy.

September 12 -

Securities America adds 10 advisors in the second recent poach by a Ladenburg Thalmann firm.

August 14

The wirehouses have lost teams overseeing more than $12 billion in client assets over the past month, according to recent hiring announcements.

Elite formally joined the suburban Omaha, Nebraska-based BD on Oct. 16, according to FINRA BrokerCheck. A spokesman for LPL declined to comment on the firm’s departure, and a spokeswoman for National Planning did not respond Friday to a request for a comment.

TOUTING RECRUITING RECORDS

Cairo launched Elite in 1992, six years after he started his financial services career at Advantage Capital. The practice first joined Royal Alliance Associates, remaining with the Advisor Group BD for 16 years before going to National Planning in 2009.

LPL’s size posed concerns for Cairo, as did

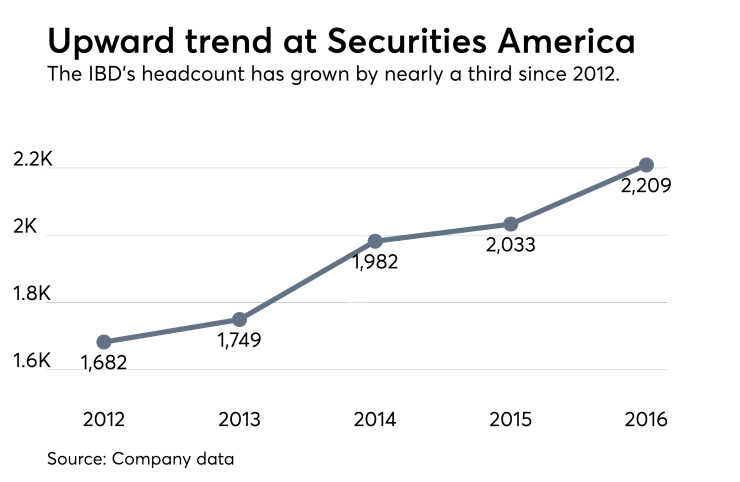

Securities America has set recruiting records each of the past three years, according to Gregg Johnson, an executive vice president for branch office development and acquisitions. With 2016 revenue of $535.7 million and 2,200 advisors, Securities America is the largest of

“We’re able to point to bringing on large producer groups or OSJs in the past,” Johnson says. “Though not ideal, it’s comfortable for us to operate on a shortened timeline.”

LPL’s big buy