A Securian Financial Services firm acquired another practice within its independent broker-dealer in a sign that last year’s record M&A activity has spilled into 2018.

Diamond State Financial Group’s March 12 merger with Wechsler Marsico Simpson expands Diamond State from 28 advisors to 35 advisors with $950 million in assets under administration, the firm says. The Newark, Delaware-based practice also became the seventh-largest firm at Securian, the No. 18 IBD.

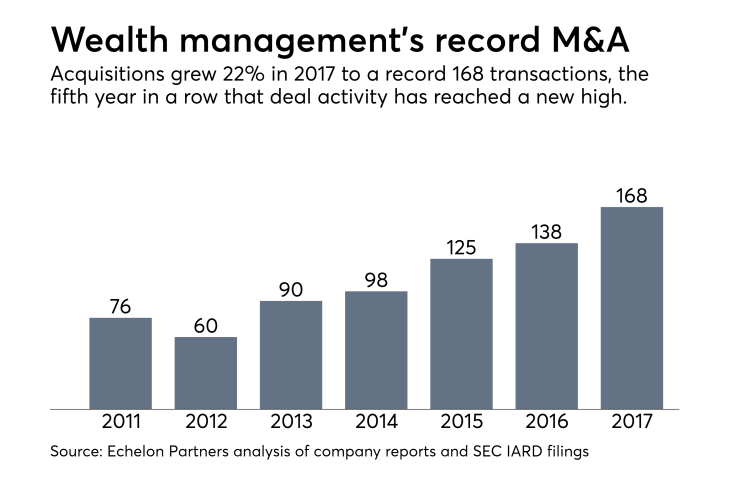

M&A deals in wealth management

An increase in what Echelon calls “peer-to-peer” transactions has fed into the record M&A activity. One Securities Service Network firm, for example, has

-

H. Beck’s incoming president brings experience with her new firm’s earlier ownership structure and its custodian's platforms.

December 20 -

The practice joined Triad Advisors after at least 25 years with its former IBD.

November 9 -

"We've been waiting for the finicky sellers and now they're here," says Echelon Partners CEO Dan Seivert.

March 7

Among recent career changes, Merrill Lynch lost brokers managing $2.2 billion to rival J.P. Morgan Securities.

Diamond State advisors Raymond Bree, Christopher Burgos and Hardik Shah make up the senior management of the newly merged firm. Media, Pennsylvania-based Wechsler Marsico Simpson President Dominic Marsico Jr. serves as an associate partner.

Neither Bree nor Marsico returned requests for comment, but Bree issued a statement in a

“Diamond State Financial Group will help provide added resources and services for Wechsler Marsico Simpson clients who will continue to receive the customized solutions they have counted on for more than 33 years,” Marsico said.

Marsico’s practice has been aligned with Securian for 22 years, while Bree has been with the IBD for 28 years. The combined practice spans 9,000 clients, including specialty divisions at both Wechsler and Diamond State for medical and dental professionals.

Securian’s roughly 40 firms have about 1,100 advisors. The firm’s revenue ticked up 3% to $325.6 million in 2016

Securian’s vice president of individual career distribution, Anthony Martins, released a statement praising the deal and expressing gratitude for Marsico’s two-decade relationship with the firm.

“We are excited about this merger between two longstanding Securian-affiliated firms,” Martins said. “Securian is proud of our relationship with both of them and wish them continued success together.”