Want unlimited access to top ideas and insights?

The SECURE Act’s 10-year limit on tax deferral by retirement account beneficiaries has attracted advisors’ attention, but that far-reaching law also includes three annuity-related provisions — ones which “make it likely that annuities will become more prevalent in company plans,” says Mike Webb, vice president at Cammack Retirement Group in New York.

The one Webb predicts will be “most impactful” provides a safe harbor for plan sponsors offering a lifetime annuity option to participants. As long as the sponsor takes certain steps when choosing issuers, it will satisfy ERISA’s fiduciary requirements and therefore give the employer some protection if the annuities lag expectations.

In addition, the SECURE Act also requires estimates of future annuity income to appear on participants’ statements, which could be helpful in planning for cash flow in retirement.

Finally, plan participants who have chosen an annuity must be given the opportunity to transfer (to another retirement account) or distribute (from the plan) the contract, even if the sponsor discontinues that choice.

“The expected increase in annuity availability in retirement plans under the SECURE Act has been delayed by the pandemic,” says Webb. He believes annuities eventually will appear in more company plans but adds that it is “yet to be determined” whether the resulting contracts will become more participant-friendly in terms of costs and features.

I don’t think floodgates will open but the SECURE provisions provide a good foundation for future growth.

Accentuating the negative

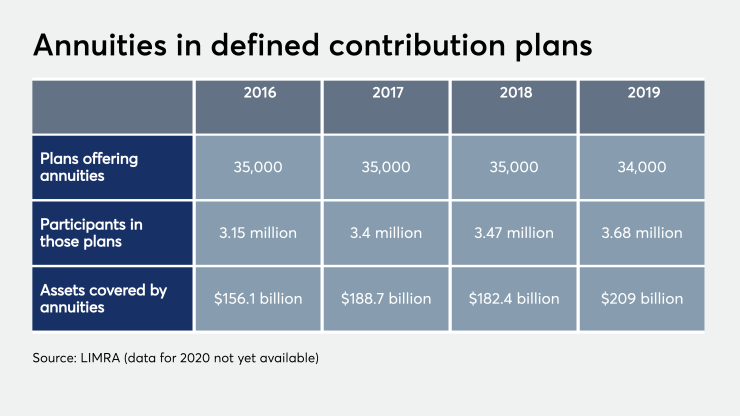

Usage of annuities in employer-sponsored retirement plans has been level in recent years, according to Deb Dupont, associate managing director of Institutional Retirement Research at LIMRA Secure Retirement Institute in Windsor, Connecticut. (The 2019 increase in covered assets was due largely to overall growth in the financial markets.)

Now that the SECURE Act provides a safe harbor for plan sponsors as well as portability and mandated disclosure of projected monthly income for participants, post-pandemic performance may pick up.

“I don’t think floodgates will open,” says Dupont, “but the SECURE provisions provide a good foundation for future growth. Some advisors are hesitant to recommend in-plan annuities, but those who do their homework may find products that can generate guaranteed income for clients.”

But advisors may not eagerly anticipate increased opportunities to put clients’ 401(k) money into annuities — for all the usual reasons related to those controversial instruments. “All annuities are laden with fees and financial hooks,” says Megan Russell, COO at Marotta Wealth Management in Charlottesville, Virginia. “Annuity sellers will say, ‘This annuity does that one thing and this other annuity does that one thing.’ However, I’ve never met an annuity where I’ve liked the whole contract.”

Russell adds that the flexibility of investments, their lower expenses, and their historical returns in excess of inflation, all make them better vehicles than annuities.

These 20 mutual funds and ETFs here are home to roughly $45 billion in assets.

Another skeptic is Michael Gibney, principal and wealth manager at Modera Wealth Management in Westwood, New Jersey. “The cost of annuities would have to come down significantly in order for us to consider this as a recommendation,” he says. “We believe the payout concept of an annuity can be replicated through proper planning without the cost of an annuity.”

As Webb puts it, “Cost, transparency, and complexity are key factors in the decision whether to purchase an annuity. Unfortunately, those factors generally do not favor the participant except at a handful of annuity providers, which can render annuities a non-starter in many company retirement plans.”

Finding a fit

Yet despite all the cautions, some clients might benefit by choosing in-plan annuities from respected providers. “Conceptually,” says Gibney, “the income payout component of annuities may be appealing because they can offer a fixed payout option (similar to a traditional pension), which is certainly desirable. A deferred or an immediate annuity might be chosen, depending on when the account holder plans to address the payout component.”

Thus, selected in-plan annuities could appeal to clients looking for benefits similar to those offered by traditional pension plans. Such clients might “have neither the desire nor the inclination to address the question of how much of a monthly distribution they will need to maintain a comfortable lifestyle in retirement,” says Gibney, but simply wish to “be provided with an amount they will receive.”

This basic concept — locking in a monthly amount of income that will last a lifetime — often comes a high price, Gibney notes. However, “if retirement plans can deliver this concept in a cost-effective manner, then I would welcome this.”

Assuming some company plans may offer cost-effective annuities, “Wealthier individuals for whom Social Security will replace only a small portion of their income, and who have large retirement plan account balances, may wish to convert some of those balances into annuity income as a hedge against adverse market events at the commencement of retirement,” says Webb.

“Such an annuity could provide some protection at the point where the participant needs it most: when account size is often at its largest and thus most vulnerable to a downturn in the markets,” he says.

Webb also says that qualified longevity annuity contracts (which delay payouts to as late as age 85) “might make sense for wealthier individuals with large retirement plan account balances who are attempting to limit their required minimum distribution tax liability.”