State regulators are sounding alarms about the negligible impact of the SEC’s Regulation Best Interest rule as the regulator devotes less time to retail advice standards than other priorities in Chair Gary Gensler’s first six months on the job.

In

The findings warrant more explanation from the SEC about what NASAA has described as problems with sales of alternative products, inadequate disclosures to clients and a lack of mitigation or elimination of conflicts of interest, NASAA President Melanie Senter Lubin and Reg BI Implementation Committee Chair Andrea Seidt said at a press conference. They stopped short of calling for amendments to Reg BI or a new rule altogether, though.

Wealth managers “definitely need some clarification and additional guidance” from the SEC, Seidt said. “There's a lot of opportunity, and I’m optimistic that the SEC will take the report seriously, and we'll be able to work with them.”

NASAA shared an advance copy of the report with the SEC, Seidt noted. Representatives for the SEC didn’t respond to requests for comment on the findings. Gensler has said his team is focused on trying to

With Senter Lubin saying that “many broker-dealer firms still are not abiding” by Reg BI, NASAA’s report suggests that wealth managers and advisors may not yet know whether the rule requires them to change any practices. The state regulator organization quizzed the hundreds of firms about their policies and procedures before the rule was implemented in 2018 and a year after it went into effect. The 225 firms manage 77.6 million retail accounts and employ 316,000 registered representatives.

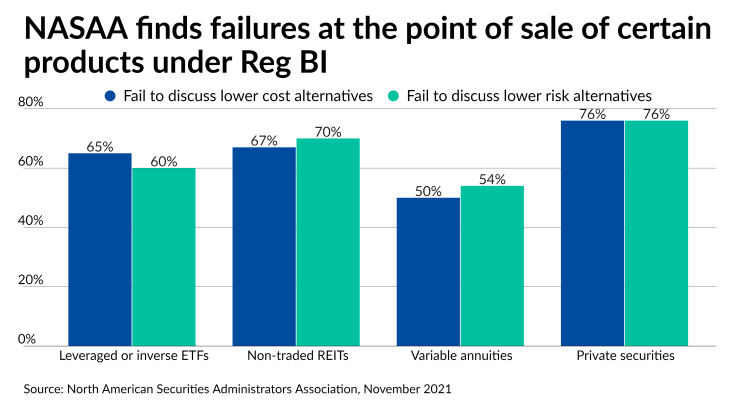

In 2018, only 11% of the firms prohibited sales of private securities, non-traded REITs, leveraged ETFs or variable annuities, according to NASAA’s report. This year, none of them forbid the products. Nearly two-thirds of the firms recommending the products, or 65%, fail to mention alternative products that charge lower fees or come with fewer risks at the point of sale. Just 4% of them made changes to their investor profile forms enabling them to match clients with the products more carefully. And 3% went backward under Reg BI by dropping information from investor profiles relating to education level, longevity risk and tolerance for alternative products. After the implementation of Reg BI, the overall share of firms offering the “complex, costly and risky products” climbed 11%, NASAA’s report found.

“As compared to the conduct reported by these firms in 2018 under the suitability standard, there were slightly more firms engaging in pro-investor best practices and slightly fewer engaging in harmful conflicts,” the report said. Still, most firms “have remained fairly stagnant and continue to operate precisely the same under Reg BI as they had under the suitability rule.”

The findings will place more urgency on the SEC to issue more guidance about the rule or possibly pursue enforcement cases, according to Michael Edmiston, president of the client attorney group the Public Investors Advocate Bar Association. The organization has called for brokers to be required to fully understand any product they’re recommending to clients, a fleshing out from the SEC of exactly how firms must rein in conflicts of interest, more disclosures on the Customer Relationship Summary form and one single standard of care at all times for dually registered wealth managers acting as both BDs and RIAs.

“Clients don't recognize when their financial professional is wearing the broker hat and when he or she changes to the advisory hat,” Edmiston said. “That lack of knowledge is something that financial professionals will sometimes seek to exploit to their advantage.”

On the other hand, industry trade groups reject the idea that Reg BI has had a minimal effect. Groups like the Financial Services Institute, which advocates for independent brokerages and advisors, and the Securities Industry and Financial Markets Association, which represents BDs, investment banks and asset managers, have

In a statement, SIFMA President Kenneth Bentsen said that firms had already altered their operations ahead of the Obama administration’s 2016 fiduciary rule, which an appeals court vacated in 2018 after groups such as SIFMA and FSI challenged it in court.

NASAA’s report “misses the mark in terms of the numerous and substantial changes that firms have made to enhance investor protection and satisfy the best interests of their retail investors,” Bentsen said. “Firms maintained those material changes because they would also help the firm comply with Reg BI. The report fails to recognize these significant changes made in response to Reg BI, thereby discounting the true benefits delivered by Reg BI in terms of the positive changes it inspired and requires.”

In a statement from FSI, General Counsel David Bellaire said that its members “have made significant changes and invested substantially to ensure full compliance with Reg BI and are committed to acting in their clients' best interest.”

Senter Lubin and Seidt acknowledged that Reg BI remains relatively new and pledged to work with other regulators and the industry on bringing more firms up to speed. The weaknesses speak to the need for more information from regulators for wealth managers and advisors rather than immediate enforcement cases, Seidt said. For example, they’re not seeking to end the sales of private securities, non-traded REITs, leveraged ETFs or variable annuities outright.

“There's a right place, time and investor for these products,” Seidt said. “The investor complaint data and state enforcement data indicate that firms are not selling them to the right investors … There just needs to be better matching and certainly better disclosure than we are seeing right now under Reg BI.”