The number of state-registered RIAs amounts to 17,688 firms, according to state regulators, who released their first-ever snapshot of smaller practices and warned advisors about areas of enhanced oversight.

North American Securities Administrators Association President Joseph Borg unveiled the

The total RIA population of 30,509 practices includes 17,688 state-registered firms with fewer than $100 million in assets under management and SEC-registered firms with more than $100 million in AUM, which

The number of small RIAs receiving examinations and

The new report follows a checklist

“Both of these efforts were specifically designed to provide free and direct aid to smaller investment advisor shops,” Andrea Seidt, the chairwoman of NASAA’s Investment Adviser Section, said in a statement.

“With these two reports in hand, state-registered investment advisors can quickly identify common examination deficiencies of concern to our member regulators and develop stronger cybersecurity policies, procedures, and practices.”

-

State examiners are finding more shortcomings. At the same time, advisors face bulked-up regulators probing more aspects of their practices.

September 27 -

New rules would set standards of conduct for brokers, require new disclosures and offer interpretive guidance for fiduciary advisors.

April 18 -

Authorities say increased regulatory coordination has boosted scrutiny of firms and advisors.

October 6

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

Deficiencies show up most often in the categories of books and records (64%) and registration (54%), according to NASAA. Client suitability information and disparities between Parts 1 and 2 of Form ADV represent the most common deficiencies in each category.

In addition to the close scrutiny of those two categories, advisors should also expect to supply more information before the examination in the form of pre-exam questionnaires, state regulators say. NASAA held the policy conference at a critical time for regulators, just a few weeks after the SEC proposed its Regulation Best Interest.

The proposal is viewed as a substitute for the Department of Labor’s fiduciary rule, which

"We will take him up on that. I guarantee it," Borg said. "We're going to be digging through that 1,000-page document, and we will be making some very strong commentary. We want to tell them what we like, what we don't like."

Borg welcomes the proposed restrictions on the use of the term "advisor," for example.

"But it's a long way to go from where we need to be," he said. "I think we all agree the suitability standard needs to be raised."

Borg praised Clayton for putting out the proposal, and "making it a primary issue," but he called it a "skeleton" and said that the commission will have to "put meat on the bones" for the rule to have its intended effect of protecting investors from unscrupulous advice.

SEC Commissioner Kara Stein and

State-level regulations may throw a wrench into the SEC’s proposal if they impose

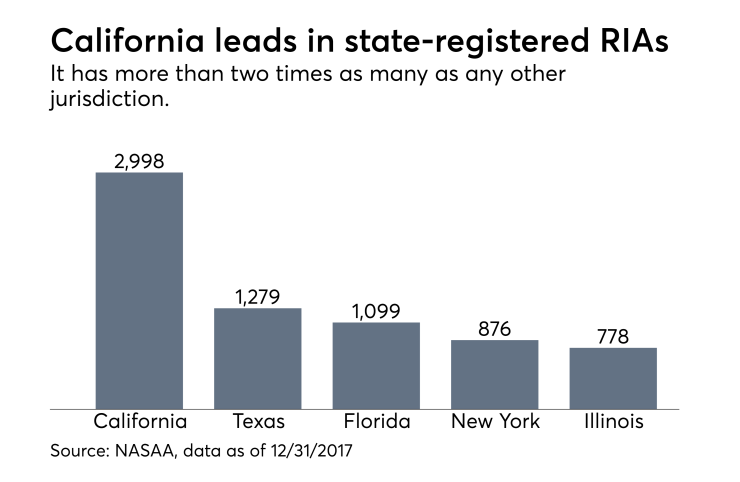

Some 78% of state-registered RIAs consist of only one or two employees, and the vast majority of their clients, 82%, are retail investors rather than high-net-worth clients, according to NASAA. California has the most state-registered RIAs, with 2,988, followed by Texas, Florida, New York and Illinois.

“State advisors dot the landscape in every town, in every state across the country,” NASAA’s report notes.