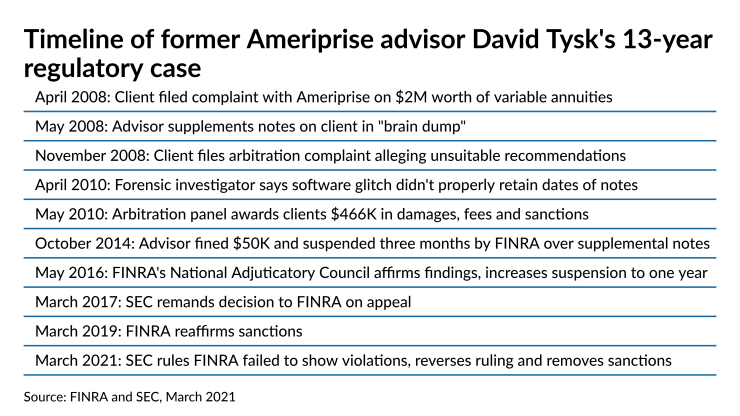

In a rare SEC reversal of a FINRA disciplinary action, a former Ameriprise financial advisor is no longer subject to a one-year suspension and a $50,000 fine.

The March 5

The commissioners’ ruling to “set aside” FINRA’s findings and sanctions isn’t subject to any appeal, according to Tysk’s attorney, Brian Rubin of Eversheds Sutherland. FINRA “failed to establish that the record supports the alleged violations,” the SEC ruled. The annuities prompted an arbitration panel to

FINRA’s case against Tysk revolves around notes Tysk entered into a software program — a self-described “brain dump” of “factually accurate relevant details” — the month after the client’s initial April 2008 complaint, the SEC’s ruling shows. Tysk knew the professional relationship with his then-largest client “was coming to an end” and he “wanted to preserve . . . details of a complicated and personal relationship,” according to testimony included in the ruling.

“FINRA viewed Mr. Tysk’s modifications with beyond a skeptical eye, and they wouldn't listen to the evidence that showed he was not acting unethically when he made the modifications,” says Rubin, who has

Representatives for FINRA declined to comment on the case.

Formerly good friends

Tysk spent nearly 30 years with Ameriprise in a Minneapolis suburb before dropping his registration in 2017,

“Once you have this kind of a disciplinary issue pop up, even if it's being litigated, it becomes difficult to continue working in the industry,” Rubin says.

Ameriprise paid the entire arbitration award in 2010, according to Tysk’s detailed BrokerCheck file. The company referred questions about the case to Rubin, who declined to comment on whether Ameriprise assisted with Tysk’s legal fees. The ruling didn’t require FINRA to pay any of Tysk’s attorney fees, though.

FINRA had alleged Tysk “intentionally” altered the dates of his notes about the client, Guenther Roth, in order to make it appear as though he had entered them prior to the complaint, as well as failing to disclose the supplemental notes during the discovery phase of the arbitration, the SEC’s ruling says. The regulator suspended him for a year, alongside the fine.

In 2017, the SEC remanded an earlier FINRA disciplinary action against Tysk back to the regulator because it “lacked the clarity necessary for us to discern why FINRA had found violations,” according to the commission’s opinion. Tysk had appealed FINRA’s first ruling to its National Adjudicatory Council three years earlier, only to have the regulator increase the suspension from three months to a year.

In reversing FINRA’s subsequent March 2019 ruling, the SEC commissioners cited the fact that Ameriprise’s review found no wrongdoing by Tysk. A forensic examiner concluded that a “bad installation” of software called Act! caused the notes to appear as if they had been backdated. Only 10% of the notes involved the annuities in question, and none of the parties in the arbitration referred to the supplemental notes as part of their arguments, the SEC found.

“Unlike in the cases that FINRA cites, there was no evidence or even allegation that the events Tysk recorded occurred at a different time than the dates that he documented they occurred, which if present would suggest unethical conduct and an intent to mislead,” the ruling states.