Our weekly roundup of industry highlights

SEC holds first asset management advisory committee meeting

At its inaugural asset management committee meeting, the SEC discussed how new or amended regulations have altered the landscape of compliance and the trend of consolidation that has swept through the financial industry.

The biggest firms have grown bigger and the smaller firms have found it harder to compete on their own, the regulator found.

"I want to know how these trends are affecting firms' ability to serve investors," Commissioner Elad Roisman said in a statement. "In particular, are they able to innovate to serve customers and clients? Or, are investors' choices of products and services becoming more limited as these trends persist?"

BlackRock's green ETF adds record cash

After announcing its newfound focus on social investing and ESG, the BlackRock iShares ESG MSCI USA ETF (ESGU) recorded its biggest-ever inflow in January, totaling $1.15 billion, Bloomberg reports.

Increased attention to the ESG sector comes after CEO Larry Fink warned that climate change could upend global finance and would put more of its efforts on the products in his annual letter to corporate executives. As a result, BlackRock plans to integrate sustainability criteria into portfolio construction and risk management, exit investments with high risks from ESG-related issues and launch new products that screen out fossil fuels, according to Bloomberg News.

The cash injection to ESGU, which has a net expense ratio of 0.15%, prompted a massive spike in the fund's assets. After taking in $1.18 billion over the course of 2019, the fund grew 77% overnight and now oversees $2.7 billion.

Index fund giants under FTC scrutiny

The Federal Trade Commission has begun asking financial firms and asset managers about their communications with shareholders as part of a larger investigation into mergers, according unnamed sources in an article from Bloomberg News.

The agency plans to investigate both buyers and sellers to determine their largest shareholders, the full extent of their influence and their communication records with the concern that fund houses are harming competition among companies who own shares jointly, the article says.

"This is evidence they're taking it seriously," says Martin Schmalz, a finance professor at the University of Oxford, referring to the FTC. Schmalz is a co-author of one of the seminal papers on the effect of index-fund ownership on competition.

RESEARCH

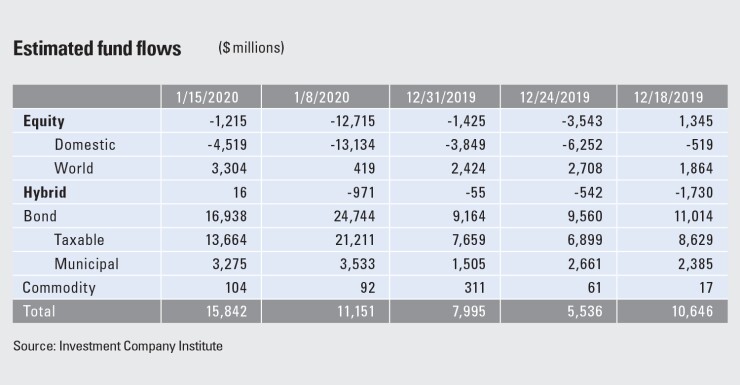

Long-term funds doubled their inflows last year

Long-term funds collected $414.6 billion in 2019, more than twice as much as 2018's $168.3 billion, according to Morningstar's annual fund flows report.

The inflows boost to the sector is due almost entirely to record inflows for both taxable-bond and municipal-bond funds, which collected $413.9 billion and $105.5 billion, respectively for the year, and $50.3 billion and $10.2 billion, respectively for December.

Despite the S&P 500 gaining 31.5% in 2019, active U.S. equity funds saw $41.4 billion in outflows, the sixth year of net outflows during the decade-long bull market, according to Morningstar. Meanwhile, passive U.S. equity funds had $162.8 billion in inflows, finishing the year with 51.2% market share based on total assets.

PRODUCTS

Fidelity launches new bond model portfolios

Fidelity's new suite of bond funds includes four fixed-income strategies using mutual funds and ETFs designed to maximize risk-adjusted total return as well as accommodate a range of risk preferences, including duration and credit risk, according to the firm.

The new offering expands the company's lineup of model portfolios and also supplements Fidelity's Bond Income Model Portfolio, launched in 2019, which aims to maximize risk-adjusted yield.

"Think of model portfolios as a recipe — they can serve as a starting point for advisors but allow for a level of customization based on their clients' needs," says Matt Goulet, senior vice president at Fidelity Institutional Asset Management.

TriLine liquidates renewable energy ETF

TriLine Index Solutions announced the upcoming liquidation and dissolution of the Pickens Morningstar Renewable Energy Response ETF (RENW), according to the firm.

Shareholders of the fund, which has an expense ratio of 0.65%, may sell the product on the NYSE until market close on Jan. 29, the firm says.

Shareholders who continue to hold shares of the fund on the liquidation date, which is expected to be on or about Jan. 30, will receive a liquidating distribution of cash in the cash portion of their brokerage accounts equal to the amount of the net asset value of their shares, according to the firm. TriLine recommended that the fund be liquidated and closed after consideration of the fund's prospects for growth, among other factors.

Segall Bryant & Hamill launches small cap core mutual fund

Segall Bryant & Hamill announced the addition of the SBH Small Cap Core Fund, an actively managed equity mutual fund available in retail (SBHCX) and institutional (SBASX) share classes, according to the firm.

The fund, which has an expense ratio of 1.14%, was launched on Dec. 31 and seeks to identify companies that have historically generated, or are positioned to generate, superior returns on invested capital, the firm says. These companies must possess a sustainable competitive advantage, typically within niche markets, or an identifiable catalyst for ROIC improvement.

With the launch of the Small Cap Core Fund, retail investors can access SBH's Small Cap Core strategy, which to date has only been available to institutional and accredited investors, the firm says.

-

Few dividend-oriented funds use this important metric to find stocks.

February 14 -

Brexit, worries about trade wars and rising interest rates have prompted a selloff in developed country stocks.

January 16 -

Some of the largest and fastest-growing economies in the world are still considered emerging markets.

December 20

Envestnet and Invesco introduce new model portfolios

Invesco paired its high-performing mutual funds with portfolio construction and asset allocation led by experts at Envestnet PMC, the portfolio consulting group of Envestnet, and developed a suite of products that may allow advisors and retail investors to enhance their returns, improve diversification, reduce volatility and manage downside risk, according to the company.

The seven new model portfolios — now available on the Envestnet platform — optimize the advantages of both active and passive fund management, the firm says.

"This active versus passive debate is age-old, but our research continues to show that there are distinct advantages to both," said Ryan Tagal, director of product management at Envestnet PMC. "It's a matter of knowing where an asset manager adds value and selecting the right manager in those cases."

SRI and faith-based investing come together in new fund

Flexible Plan Investments launched the Quantified Common Ground Fund. The goal of the mutual fund, which has an expense ratio of 1.77%, is to offer a risk-managed investment solution that satisfies both Christian and socially responsible investing principles, according to the firm.

Unlike other values-based funds, the Quantified Common Ground Fund seeks to satisfy both faith-based criteria, as defined by the eValueator biblically responsible screening tool, and SRI criteria, as defined by environmental, social and governance data.

The fund also aims to offer investors risk management as well as capital growth, the firm says. It uses a proprietary momentum method of trading to take advantage of factors and sectors that are doing well in the current market environment.

MassMutual Ventures starts international health fund

MassMutual Ventures, the corporate venture capital arm of Massachusetts Mutual Life Insurance, launched a $100 million fund to invest in digital health care, fintech and enterprise software startups in Southeast Asia, according to the firm.

The second such fund from MassMutual Ventures brings capital under management to $350 million, including $150 million spread between the two, according to the firm. The new product is led by two Singapore-based managing directors, Ryan Collins and Anvesh Ramineni.

DeskTrading introduces FX model portfolios

DeskTrading launched Smart Portfolios technology, which provides access to bank and non-bank liquidity providers through a highly scalable, multi-asset, secure and configurable model-based SMA architecture, according to the firm.

Smart Portfolios technology from DeskTrading aims to deliver an alternative to the PAMM and MAM systems, which operate under retail trading conditions and have largely failed to produce the desired benefits for individual traders who want to remain passive earners in the FX market.

DeskTrading says Smart Portfolios will become available on Feb. 3 as part of the XDesk platform. The new portfolios will be benchmarked to custom multi-asset portfolio benchmarks.

Day Hagan and Ned Davis Research launch joint ETF

Ned Davis Research partnered with Day Hagan Asset Management to launch their first co-developed ETF: Smart Sector With Catastrophic Stop (SSUS), according to the firm.

The new ETF, which has an expense ratio of 0.78%, takes advantage of NDR's proprietary sector and U.S. stock market models and is designed to enhance returns over a buy-and-hold equity benchmark by overweighting and underweighting 11 U.S. large-cap sectors based on NDR's sector models. The strategy also seeks to mitigate the effects of major market declines by reducing equity market exposure through the use of NDR's Catastrophic Stop model, according to the firm.

More than half of them track the industry’s top-performing category.

"There are over 100 diverse indicators in our sector models, which we think provides a more holistic approach," said Brian Sanborn, vice president of investment solutions at NDR. "As we face an increasingly aging bull market, we think a strategy like SSUS could make a lot of sense for investors."

State Street expands investor choice with enhanced suite

State Street Global Advisors announced index changes to four of its low-cost SPDR ETFs, which hold a combined $11.3 billion in assets.

For investors who prefer broad market exposure, the newly positioned funds include the only ETF currently available tracking the S&P Composite 1500 Index. A voluntary fee waiver of 0.10% will be implemented on the SPDR S&P 600 Small Cap ETF (SLY) to lower the fund's expense ratio from 0.15% to 0.05% effective as of Jan. 24.

"There is strong investor demand for S&P benchmarks with over $12.5 trillion in global assets tracking their indices. SPDR is now the only ETF provider that offers the full spectrum of low-cost S&P ETFs spanning the S&P 500, S&P MidCap 400, S&P SmallCap 600 and S&P Composite 1500 — as well as the S&P 500 growth, value and dividend style exposures," says Rory Tobin, global head of SPDR business.

ARRIVALS

Prostar appoints Paul Viscontini head of asset management

Former PwC consultant Paul Viscontini joined Prostar Capital as head of asset management, according to the firm.

His responsibilities include overseeing the growth and development of Prostar's global portfolio, working to develop strategic business execution plans and identifying value creation initiatives. Viscontini is based out of the company's headquarters in Greenwich, Connecticut.

Viscontini has more than 13 years of experience including work at JV Industrial Companies, according to the firm.

KraneShares appoints head of capital markets

Former vice president in the Institutional ETF Group / ETF Capital Markets Group at State Street Global Advisors James Maud joined Krane Fund Advisors as head of capital markets.

Maud will consult with financial advisors and institutions on ETF liquidity dynamics as they invest in KraneShares ETFs through the primary and secondary markets. He is an expert on ETF trading, liquidity, options and equity market structure.

"James' industry experience and technical knowledge is an invaluable resource for our clients as they seek to invest in China's capital markets through KraneShares ETFs," says Jonathan Krane, chief executive officer of KraneShares.

Jim Simons revamps renaissance board

Renaissance Technologies is reshaping the group of directors who will eventually succeed founder Jim Simons in overseeing one of the world's most lucrative hedge funds, according to Bloomberg News.

The firm is doubling the number of members on its board and has promoted Jim's son, Nathaniel Simons, to co-chairman.

The appointments open the way for a new generation of younger directors to guide the $75 billion money manager. The new board at the firm has 10 members, according to the firm.

Four of the five additional directors — Alan Stange, David Lippe, Anne Small and Jim Rowen — are Renaissance executives with key operating, legal and trading roles.

Morningstar appoints head of global growth of indexes business

The former CEO of North America benchmarks and head of strategic accounts for global index provider FTSE Russell Ron Bundy joined Morningstar in December to lead the evolution and growth of its global Morningstar Indexes business, according to the firm.

Also joining Morningstar is Pat Fay, formerly from CBOE. Fay will serve as managing director of Morningstar Indexes.

Since its inception in 2002, Morningstar Indexes has grown asset value linked to Morningstar Indexes to $64 billion (as of Sept. 30), launched hundreds of beta and strategic beta indexes, and embedded the best of Morningstar's independent research into differentiated offerings, according to the firm.

Duff & Phelps names co-chief investment officer

Former executive managing director for Duff & Phelps Investment Management David Grumhaus was promoted to co-chief investment officer, effective Feb. 1, according to the firm.

Also promoted, financial advisor Steven Wittwer was named senior managing director and head of the firm's infrastructure and utilities group, the firm says.

Grumhaus will continue as portfolio manager of Duff & Phelps Select MLP and Midstream Energy Fund (DSE), Virtus Duff & Phelps Select MLP and Energy, an open-end mutual fund, as well as remains head of the firm's MLP and Energy Infrastructure Strategy.