When naive investors make rash or foolish decisions, it’s time to fight fire with fire.

That’s the new approach the SEC is taking to educate people who buy and sell risky stocks frequently or on a whim, often on apps like Robinhood Markets. The digital retail brokerage, an object of scrutiny for its game-like look and feel, offers fast, free trading on a platform full of animated graphics that critics say encourages excessive risk-taking.

In a bid to counter such “gamification,” Wall Street’s regulator

Tacky leisure suit

The anchor of the SEC’s digital effort is “

Next, it’s his opponent’s turn. “I’m going to do some research first,” “Julie” says, declining to invest in any of the options. “We can do research?” a clueless “Brad” asks. A voice then intones that “investing is not a game” before referring viewers to

The twist of the SEC’s approach is not lost on industry experts.

“Yes, they’re sort of doing the very thing they’re criticizing,” said Scott Smith, the director of advice relationships at Cerulli Associates. “But the end goal is different.” While Robinhood “is gamifying to create revenue," he added, the SEC “is gamifying to educate consumers."

‘Free stock!’

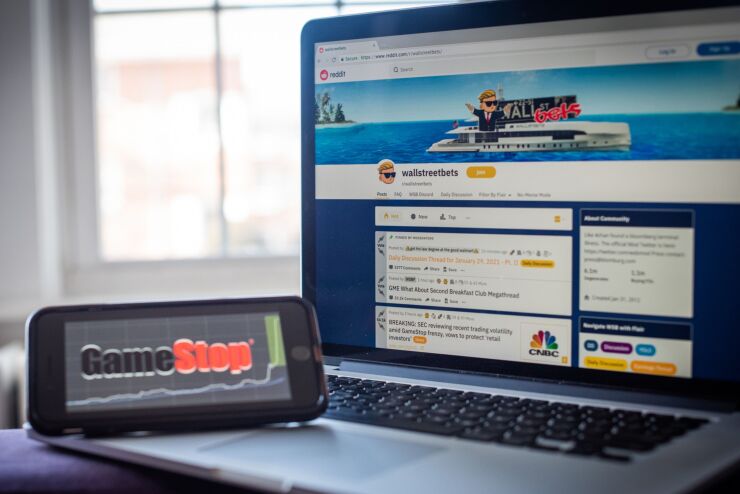

Robinhood has drawn scrutiny over whether its playful features — some no longer in existence — encourage inexperienced investors to make ill-considered moves, often with complex products like cryptocurrencies and options that can lose big money. In an age where posts on Twitter, TikTok and Instagram routinely dispense financial advice, investing from a recommendation on social media can lead to unhappy outcomes.

Last August, the SEC

Financial advisors can achieve up to 10.25% annual return, betting on recent college graduates who don’t want to damage their credit.

Until March 2021, Robinhood offered a

Zero-commission brokers like Robinhood, Schwab and E*Trade are also under SEC scrutiny for

Publicly-traded Robinhood didn’t respond to a request for comment.

Risk, shmisk

Jim Crider, the CEO of Intentional Living FP in New Braunfels, Texas, said that while game-like features that introduce people to responsible investing can potentially be helpful, they can also turn things into a casino, not a long-term plan.

“We’ve seen with young investors a conversion of investing into speculation, thanks to over-gamification,” he said.

Lori Schock, director of the SEC’s Office of Investor Education and Advocacy, said in a

The regulator is trying to drive ordinary investors to

In January 2021, as small investors sent shares in GameStop soaring after hyping them on social media, the SEC

Robinhood has a different take on risk. Its “What’s the stock market?” module says: “Myth: Investing is gambling. The truth is ... it’s up to you. The stock market can be whatever you want, whether that’s a place to build wealth over time, or a place where you make big, risky bets.”

Isn’t it ironic

Whether it’s game-like investing apps or the SEC’s game show, “the human mind is very influenced by simple sound bites, vivid and salient images and dramatic narratives,” said David Hirshleifer, an economics professor at USC’s Marshall School of Business in Los Angeles who specializes in behavioral finance.

At the same time, he added, “it is extremely ironic" of the SEC "to use a game show format as a way of combating investor reliance on memes.” While he said it can “potentially make sense” to fight fire with fire, doing so “can legitimize the idea that it’s good to think casually about investments and to treat it as entertainment.” The SEC didn’t respond to requests for comment.

Smith of Cerulli said that amid the explosion of social media, getting the attention of Main Street investors, especially younger ones, is an uphill battle. "To get any form of connection or engagement, it has to be amusing or exciting," he said. "No one reads the 50-page disclosures.”