An RIA charged with breaching its fiduciary duty by failing to disclose conflicts of interest is denying the SEC’s allegation that its clients paid exorbitant fees on their mutual funds. The case brings to the fore an ongoing dispute between regulators, who say customers are harmed without knowing it, and wealth managers, who argue they are keeping clients’ costs down and acting within the bounds of the rules as they understood them.

More than 100 wealth managers have

A small RIA is joining the two giant wealth managers in the struggle. Kansas City-based Buttonwood Financial Group and its president, Jon M. McGraw, are rejecting the allegations of the SEC’s Sept. 23

“Buttonwood discussed potential settlement with the SEC, but as a small firm with modest profit margins Buttonwood felt that it could not afford the SEC's settlement demands,” the RIA’s attorney, Sean Colligan of Stinson, said in an email. “Buttonwood also viewed the SEC's settlement demands as unjustified in light of the fact that Buttonwood provided its clients with a low overall cost of investing and therefore its clients suffered no financial harm.”

Colligan also sent a larger statement responding to each of the SEC’s allegations in the complaint. Representatives for the SEC didn’t respond to a request for comment on the case.

Just as in the previous cases and, as outlined as part of

The SEC complaint highlighted the case of one client who held about $5.8 million of a mutual fund with Buttonwood. The fund share class that Buttonwood selected had a 1.11% annual fee when the same product was available with an expense ratio of 0.84%, causing the account to earn about $13,000 less in one year, according to the document.

“Buttonwood and McGraw were almost always selecting the share class with higher expenses even though under the circumstances it was in their advisory clients’ best interest and consistent with their duty to seek best execution to select a different share class of the exact same fund that was available to clients and had lower expenses,” the complaint states.

“In doing so, Buttonwood repeatedly put its interest in not paying the transaction fees ahead of its clients’ interests to earn greater returns,” it continued. “Buttonwood, however, never told clients what it was doing or otherwise disclosed the conflict of interest and how that conflict provided an incentive for Buttonwood to put its financial interest ahead of its clients’ interests.”

The regulator’s respective 2019 cases against Commonwealth and Cetera have yet to reach the trial phase nearly two years later, and the backlog of cases during the coronavirus has “been an advantage for defendants,” says attorney Thomas Lewis of Stevens & Lee, who represents wealth managers in arbitration and other litigation but isn’t involved in any of the cases. It’s more likely than not that Buttonwood or any other firm would settle the case before any trial, he said.

“A lot of trials are still being delayed,” Lewis said. “As a defendant in a civil case, time is definitely on your side.”

Any potential case will revolve around the SEC’s allegation that Buttonwood’s clients were paying higher fees without adequate disclosures from the firm. Buttonwood has 10 employees, five of them advisors, with $510.7 million in assets under management,

“Buttonwood frequently rebalances its clients' accounts to the recommended allocation, which requires many transactions in a year,” Colligan said. “Using institutional share classes instead of NTF share classes (as the SEC complaint suggests) would have required substantial increases to Buttonwood's advisory fees to clients, resulting in far higher client costs than Buttonwood achieved by using NTF share class securities in their portfolios. Contrary to the SEC's claims, the long-term interests of Buttonwood and its clients were aligned in using NTFs to keep the clients' overall cost of investing among the lowest in the industry.”

The firm also rejected the SEC’s assertion that it failed to disclose the conflicts to clients, maintaining that its wrap fee documents, prospectuses and monthly statements included the proper information. In addition, it didn’t see the SEC’s voluntary

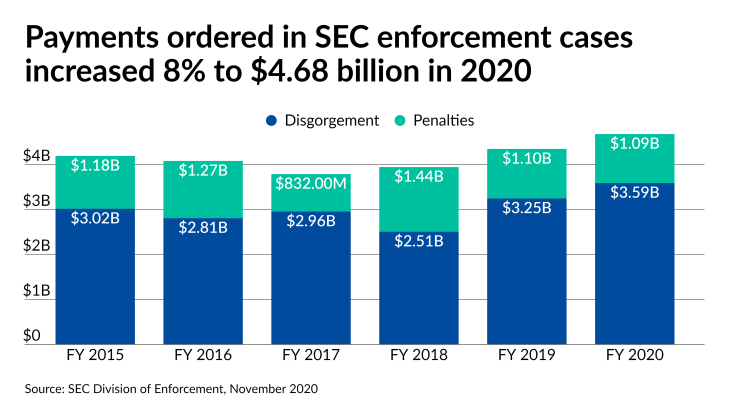

It isn’t clear how much in penalties and disgorgement the SEC seeks from Buttonwood, but the number is likely substantial. In settlements involving similar cases from earlier this month, MassMutual’s MML Investors Services agreed