Ameriprise agreed to pay $4.5 million to settle charges that it failed to safeguard clients’ money after five registered representatives stole more than $1 million over a four-year period,

The firm of 9,906 employee and independent advisors did not put reasonable policies and procedures in place to protect the money, the regulator says. The four independent advisors and one paraplanner committed “numerous fraudulent acts,” including forging documents, according to

In one example, Ameriprise’s “Analysis Tool” which was designed to monitor whether or not checks were made payable to a representative of the firm, had design limitations that failed to uncover suspicious disbursements, the regulator says. An advisor was able to wire money from two of her clients directly into her own personal checking accounts, according to the order.

In another case, a surveillance system that compared change-of-address requests with a “hot list” of addresses of Ameriprise representatives malfunctioned and did not alert the anti-fraud team when an advisor and her daughter, the paraplanner, switched two clients’ home addresses to their own home and office addresses in 2013, according to the order.

“A critical obligation of an investment advisor is to safeguard investor assets,” Fuad Rana, an assistant director in the SEC’s Division of Enforcement, said in a statement. “Ameriprise failed to meet that obligation and as a consequence was unable to prevent the theft of its clients’ assets.”

The five reps were based in Minnesota, Ohio and Virginia, and Ameriprise terminated each of them for misappropriating client funds, according to the order. FINRA later barred all five of them, BrokerCheck shows, and three have pleaded guilty to criminal charges, the regulator says.

Ameriprise voluntarily retained a compliance consultant to manage the movement of clients’ funds. The Minneapolis-based firm, which has the second largest independent broker-dealer, also reimbursed all clients for their losses and developed a new money movement control system.

-

Can an RIA take the first bite of the apple when it comes to a dually registered rep’s brokerage commissions?

June 26 -

Some of the proceeds went to commission a song with the lyrics: “Pop champagne in L.A., New York to Florida; buy another bottle just to spray it all over ya,” says the SEC.

June 19 -

The regulator obtained an emergency asset freeze against the advisor.

June 14

“We are pleased to bring this matter to a resolution,” says an Ameriprise spokeswoman. “The actions of these five individuals were in clear violation of our policies and resulted in their immediate separation from the firm. We fully reimbursed clients who were impacted after the activity was discovered.”

Ameriprise neither admitted nor denied the findings, according to the order.

In February, the firm agreed to pay more than $2 million to settle SEC charges that it overcharged retail retirement clients on mutual fund shares. The firm disadvantaged their accounts by not properly ascertaining if they would be eligible for less expensive share classes, the SEC says. Approximately 1,800 customer accounts paid about $1.8 million in avoidable upfront sales charges, the regulator says.

“We continually review and improve our compliance program, and we’ve since enhanced controls to better detect this type of prohibited activity,” says a firm spokeswoman.

The settlement comes on the heels of a

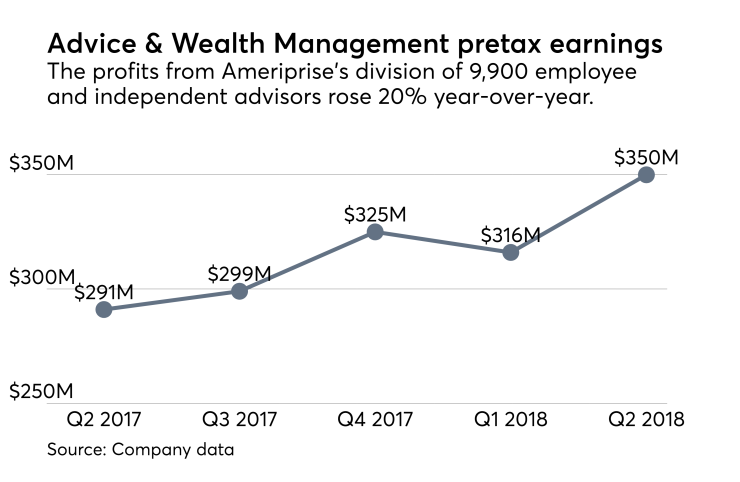

“What we’re really looking for is strong, quality advisors that will run a really good practice, deliver a strong value proposition, build our brand in that regard and serve their clients well,” Ameriprise CEO Jim Cracchiolo said in an earnings call in July. The firm’s wealth management segment consists of 2,176 employee brokerage advisors and 7,730 independent franchise advisors.