While the majority of client-facing financial service workers see a bright future ahead for the industry, a large percentage admit to feeling less glowing about their own happiness within the field, a new survey by Charles Schwab reveals.

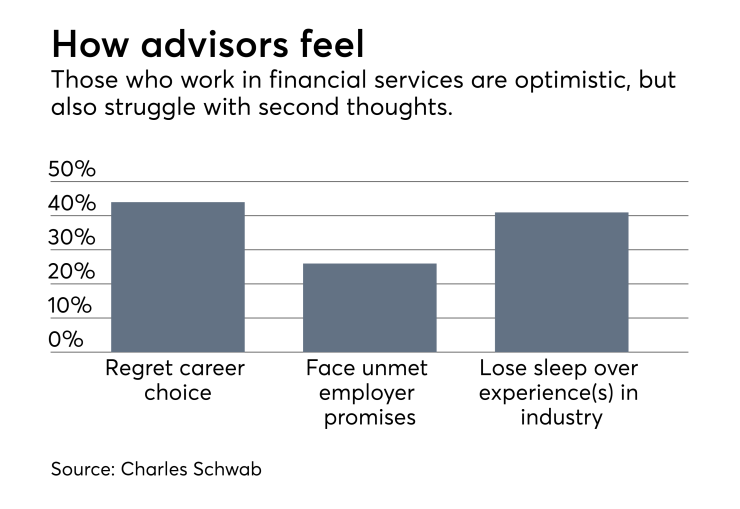

A majority of client-facing financial service workers did say they saw a bright future ahead for the industry. But 44% of the survey's nearly 1,000 respondents said they wouldn't choose to work in the financial sector if they could go back in time. What's more, 41% say they’ve had negative experiences within the profession that “still keep them up at night.”

The reason might stem from dual concerns about their firm and a lack of independence, says Craig Taucher, senior vice president of independent branch services for Charles Schwab. “People are looking for something different. Their frustrations are mostly related to their career, and many appear to want to strike out on their own.”

-

Follow these directions to keep your professional goals on the right track, Kelli Cruz says.

November 29 -

Success in financial planning comes down to just three things, says our contributor in his final column. Goal setting is just one.

May 11 -

The uncertainly of regulation and their own survival is at the root of advisors’ stress, but there are also some positives of the job.

April 30

How likely you are to re-enter financial services if given a do-over does indeed seem to be tied to the kind of job you’ve chosen to perform within the industry. Many RIAs whom Financial Planning spoke with talked positively of their career choices and said they would choose it all over again. But some also noted they’d feel differently if they held other roles in the industry.

“When you work in a brokerage or insurance company, there can be a lot of pressure to sell certain products and you may not feel that you’re able to give the kind of good advice you got into the financial services industry to give,” says Jane King, president of Fairfield Financial Advisors. “That day-to-day pressure to make a certain amount of money and the competition it can create among co-workers can create an awful environment.”

Ethical concerns and interaction with co-workers can have a big impact. Blueprint 360 financial advisor Charles Adi’s main negative with the field comes from “working with individuals who don’t share your ethical values. You often hear financial planning is more art then science … Well, some art I don’t like.”

John Gugle, principal of Alpha Financial Advisors, says he was turned off by witnessing “brokers bragging about selling awful variable annuities to elderly clients using fear as a sales technique.”

Another challenge that might leave finance workers second-guessing their career choice could also be attributed to the recent upheaval from technology.

“You often hear financial planning is more art then science … Well, some art I don’t like,” one advisor says.

Competition from robo advisors and index investing has put pressure on fees and lowered costs, says Gene McManus, an advisor with AP Wealth Management. “People have been doing things the same way for a long time, but in our business there is now a lot of fee compression and fee pressure, and that might led some people to feel concerned about their future and want to get out.”

More than a quarter of financial workers say they’ve been promised things by a firm that were never delivered, and three-fourths say professional obstacles are preventing them from being successful.

The No. 1 obstacle experienced: Being too busy servicing existing clients and lacking the support needed to pursue new business. The second biggest problem: having to continually adjust strategies because of new technology that disrupts the industry.

Other common stumbling blocks centered on firms having too much control over compensation, workers feeling constrained by regulations and/or policies, and firms not providing support necessary to grow.

Since many of those obstacles are tied to a worker’s place of employment, it is no surprise that nearly 80% said independence was important to them and more than half admitted to dreaming about owning their own business.