Charles Schwab rewarded its top executives for record revenues and profits in 2016 with bonus and incentive payments of more than $25 million, according to the company.

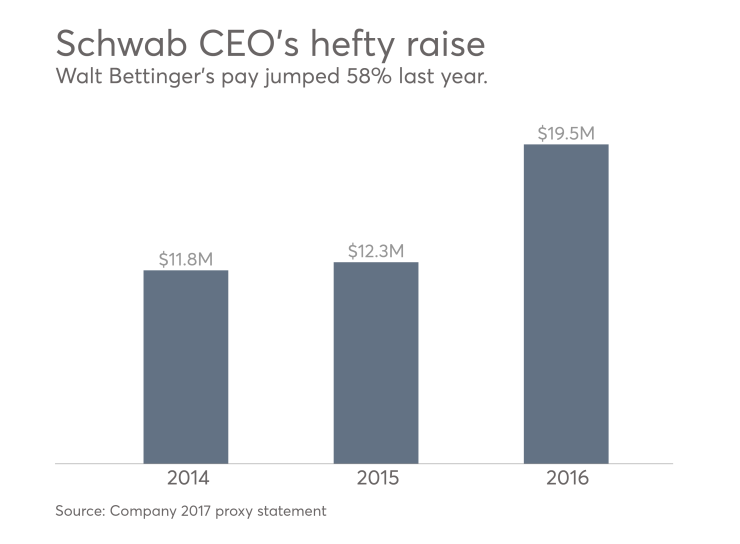

CEO Walt Bettinger received a 58% raise to $19.5 million in total compensation, while founder Charles Schwab’s grew 70% to $8.1 million and Schwab Advisor Services head Bernard Clark's jumped 96% to $5 million. The firm disclosed their pay last week in its annual proxy statement.

Bettinger’s paycheck for the year compared favorably with that of his counterparts at TD Ameritrade, LPL Financial and Raymond James, a few of the companies described by the proxy as part of Schwab’s peer group. The bonuses stemmed primarily from a four-year incentive plan payable Dec. 31.

A spokeswoman for Schwab declined to make Bettinger, Schwab or Clark available for an interview about their pay and declined further comment beyond the explanation in the San Francisco firm’s proxy statement filed with the SEC.

Schwab’s compensation committee launched a long-term cash incentive program in 2013 “to address retention issues during a time when the company and the financial services industry faced unique challenges, including among others, sustained historically low interest rates,” according to the proxy.

Schwab stockholders saw returns of 186% over the four-year period, according to the document. Other factors that led to the hefty raises included the firm’s $7.5 billion in revenue and $1.9 billion in profits after taxes in 2016, both new records for Schwab.

Bettinger, 56, received bonus and incentive payments of $10.6 million; the company’s founder got $4.6 million and Clark was paid $3 million. Additionally, CFO Joseph Martinetto received bonus and incentive pay of more than $3.6 million and Schwab Investment Management CEO Marie Chandoha got $3.3 million.

Stock and options awards worth more than $7.7 million and a salary of more than $1 million made up the rest of the compensation for Bettinger, who took over as CEO in 2008. He made $12.3 million in 2015 and $11.8 million in 2014, including bonuses of $7.9 million over the previous two years.

-

Some advisers expressed concern about the custodian now competing for the same clients they were courting with the institutional version of Schwab's robo.

December 14 -

"There is an effort underway in our industry to redefine value," Tim Hockey, TD Ameritrade's chief executive officer, said about the lower commissions.

March 1 -

The firm says its trading commission will be lower than even Vanguard's.

February 2

Schwab’s compensation committee in January approved a $100,000 raise in salary and $750,000 in additional long-term incentives this year for Bettinger in order to “reward and recognize his accomplishments as CEO,” according to the proxy.

Members of the committee believe “Mr. Bettinger’s leadership is a key factor in growing the long-term strength of our franchise by focusing on serving clients, operating in a disciplined manner and building a leadership team for the future,” the proxy said.

Schwab, the country’s largest custodian, also operates broker-dealer and banking subsidiaries. The company manages nearly $2.8 trillion in client assets. Its compensation committee selected 23 firms as peers while noting Schwab “has few competitors comparable” in business model and geographic reach.

Bettinger’s pay of $19.5 million outpaced the compensation received in 2016 by Raymond James CEO Paul Reilly ($8.4 million) and TD Ameritrade’s then-CEO Fred Tomczyk ($11.3 million). In late December, LPL disclosed a 2017 pay package