As incumbents race to buy turnkey asset management programs and wealthtech, a major annuity, life insurance and retirement firm is entering the arena.

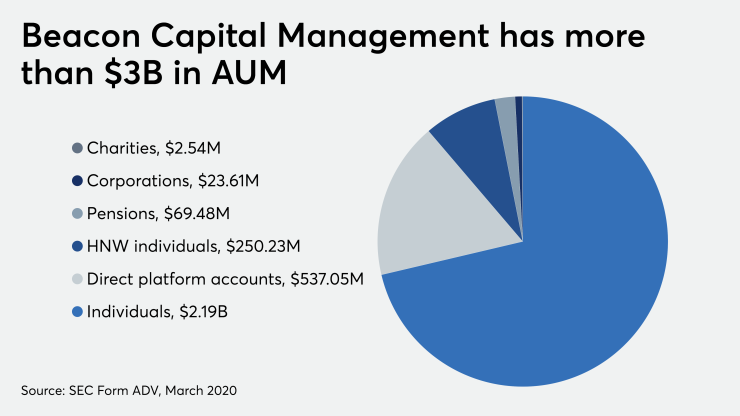

Sammons Financial Group agreed to acquire Beacon Capital Management, a Dayton, Ohio-based TAMP with more than $3 billion in assets under management through more than 100 broker-dealers and RIAs. The parties

The big players among insurers, asset managers and RIAs are fueling record wealthtech M&A that’s concentrated among firms like Beacon that offer modeling services. The three kinds of acquirers are “all trying to solve the problem of how you bring together guarantees with non-guarantees,” says Rob TeKolste, the president of Sammons Independent Annuity Group.

West Des Moines, Iowa-based Sammons — which the LIMRA Secure Retirement Institute

“I think we've just scratched the surface,” TeKolste said in an interview. “We need to meet the advisor where they do business today. RIAs do that exceptionally well. Insurance companies are well behind the curve.”

The idea of combining the firms’ capabilities was attractive to the seller. Beacon has turned down multiple suitors since Chris Cook launched the firm in 2000, especially after its growth over the past 10 years, he says. Fear of frequent ownership turnover prompted Cook to reject private equity capital, but Sammons “was very interesting” as a potential buyer, Cook says.

“They work in the same space that we do, just with different products,” he says. “It dovetails really well. We can serve the independent advisor and their clients in a much much better way, in a holistic way.”

Cook will remain CEO over the same team of 28 employees, and he adds that the most important thing for advisors to know is “nothing is changing with Beacon other than the ownership.” The firm works with advisors through wealth managers like LPL Financial and other third parties like Envestnet and Pershing’s Lockwood Advisors.

TAMPs attracted more insurers and asset managers to deals last year, such as AmeriLife Group’s

In addition, modeling and execution firms comprised more than a third of the record-breaking volume of wealthtech acquisitions in 2020. The number of deals across six kinds of wealthtech jumped 55% to 48, according to Echelon, which notes purchases in the modeling and execution “subsector” by Goldman Sachs, Charles Schwab, Morgan Stanley and BlackRock.

The incumbents each acquired firms that “help financial advisors build portfolios for clients and service them in a more efficient manner,” according to Echelon.

RIAs, particularly fee-only advisors, are showing more interest these days than they have in the past in annuity products as part of comprehensive plans, according to Cook and TeKolste. Sammons and Beacon will collaborate on integrating the products into the TAMP’s services and technology.

“That's an ongoing conversation,” TeKolste says. “We do not have specific synergies today. We do feel, long term, they will emerge.”