In the digital advice arms race, the biggest independent brands have embraced what some call a questionable marketing tactic to win clients: paid bloggers.

The strategy of online affiliate marketing — tapping parent companies and paid bloggers to attract prospective clients and paying for new prospects — is legal, and the industry’s leading independent players openly disclose their use of such marketers.

But industry observers suggest that the strategy crosses an ethical gray line and firms acknowledge in corporate filings that affiliate marketing can carry conflicts of interest.

Regulators have taken notice. Wealthfront was among the first of two robos to

“Making recommendations and suitability are potential areas of conflict of interests and overstep the influence that bloggers can and should have in wealth management — regardless of robo advisor or human advisor,” says April Rudin, a marketing strategist and founder of the consultancy firm The Rudin Group.

Digital advice firms, though, defend their use of affiliate marketing.

Personal Capital has one of the most popular affiliate marketing programs among financial services firms, according to a number of current and former industry bloggers. The Redwood City, California-based firm tacked on

“We have a diversified approach to marketing,” says Rebecca Neufeld, Personal Capital’s head of public relations. “Our marketing team is really proud of the work we do so Personal Capital can help as many people as possible gain clarity around, and confidence in, their financial lives.”

Personal Capital generally pays between $50 and $300 per referral depending on the size of the blog and the quality of the lead making them a popular choice among bloggers, according to Grant Sabatier, founder of the wealth management blog Millennial Money.

Betterment pays affiliate marketers even more, between $25 and $1,250 per onboarded client, according to the firm’s

“The way it tends to work is the more sign-ups you generate, the more commissions you're going to get,” says Sabatier, who says he has marketing relationships with Betterment and Personal Capital.

Betterment declined to comment.

Betterment, Wealthfront and Personal Capital all disclose they pay bloggers for referring new clients. While the bloggers are generally paid a finder’s fee for each referral, clients do not incur any additional costs, according to the disclosures.

“As a result of these arrangements, [affiliate marketers] will financially benefit from referring users to Personal Capital, which results in a conflict of interest as they are potentially making that referral for money and not because they believe a valuable service is being offered,” according to the firm’s disclosure.

In addition to the SEC filings,

“They use different channels to get people from the free services into their paid services,” says Roi Tavor, CEO of Nummo, a financial wellness platform that completed a comprehensive survey of robo advisors this year.

Paid bloggers refer prospective clients to the firm’s website, which offers free financial services. Once these prospects interact with the complimentary tools, the firm provides an opportunity for them to sign on for the RIA’s additional services.

“To me, there is an inherent conflict for any firm that uses this type of marketing strategy in wealth management,” Rudin says.

Affiliate marketing’s appeal has more to do with thin margins than skirting regulatory requirements, she says. Many automated firms still struggle with client acquisition costs eating into their profits. “This might appear to be a road less traveled instead of more expensive marketing tactics,” Rudin says.

But as online advertisements become more ubiquitous, affiliate marketing has turned into a multibillion-dollar cottage industry.

U.S. companies across a range of industries are forecast to spend

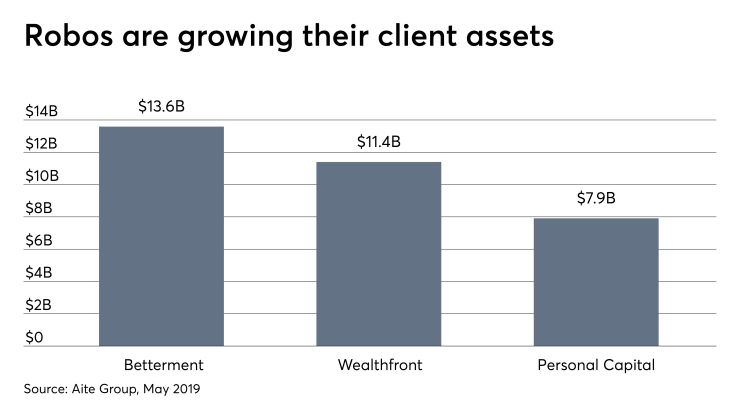

As affiliate marketing continues to grow, assets on digital platforms are expected to skyrocket in the coming years. The assets managed by robo advisors is expected to reach the $1.26 trillion mark by 2023, according to research firm Aite group.

The widespread practice does not escape regulator scrutiny.

In December, Wealthfront

Wealthfront violated the Cash Solicitation Rule, which requires the client to receive a copy of the firm’s Form ADV Part 2A and a disclosure explaining the financial interest a paid blogger has in referring the client to an investment advisor, according to the order. The client also has to sign that they received the disclosures.

“Technology is rapidly changing the way investment advisors are able to advertise and deliver their services to clients,” said C. Dabney O’Riordan, chief of the SEC Enforcement Division’s Asset Management Unit, in a statement at the time. “Regardless of their format, however, all advisors must take seriously their obligations to comply with the securities laws, which were put in place to protect investors.”

The SEC declined to comment further.

-

“When we think about these offerings, there are no hard lines that are drawn here,” said Merrill Lynch boss Andy Sieg.

June 12

The Redwood City, California-based firm paid approximately $97,000 to participating bloggers for referring new clients and received tens of millions of dollars in assets under management via its affiliate program, according to the order.

Under the Cash Solicitation Rule, Wealthfront was required to have a written agreement, provide certain disclosures and receive written acknowledgment of receipt of these documents by the solicited client.

Wealthfront

“When used properly, I don’t see anything wrong with affiliate marketing,” says Charles Adi, a previously registered broker and financial planner with the Houston-based RIA Blueprint 360. “Paid blogging is big business.”

Adi considered using affiliate marketing to increase his own revenue by monetizing the educational articles published on his firm’s blog. However, compliance concerns have complicated the plans, he says. “If an existing client goes over to the free site and uses the links that I get paid from, what is that going to look like to regulators?” Adi says.

Bloggers are generally required to disclose on their website that they are being compensated for their content, according to

But when it comes to testimonials, investment advisors are not supposed to be in control of the narrative, says Tavor. “Unfortunately, the consumer is not educated enough to really dig deep.”