Wealth management dealmakers see signs that M&A transactions will rebound during the rest of the year after a lull tied to rising interest rates, struggling stocks and worries about a recession.

Industry deal volumes have

After "somewhat muted activity in late 2022" that spilled over into part of the first quarter, registered investment advisory M&A consulting and capital firm SkyView Partners is "expecting a much higher volume" in the late third quarter and last period of 2023, Managing Partner Katie Bruner said in an interview. She noted that the volume of loan applications the company received in the first three months of the year increased sharply. "It's a leading indicator of the fact that we believe that activity will pick up," Bruner added.

Contrast with worldwide M&A

Across all industries worldwide, the M&A picture looks much different as buyers and investors try to make sense of the steeper costs of capital due to higher interest rates and questions about whether the global economy will come to a hard or soft landing or go into a prolonged recession. Globally, the total value of M&A deals in every industry tumbled 42% year over year to just over $1 trillion in the first five months of the year, with the volume slipping by 14% to 21,301, according to a monthly snapshot from

"Global deal making finally [crept] past the trillion-dollar mark after the slowest January to May period since 2020, at the onset of the pandemic," LSEG Senior Manager for Deals Intelligence Lucille Jones said in a statement. "Geopolitical tensions, volatile stock markets, ongoing interest-rate hikes and the recent banking crisis have shaken boardroom confidence already dented by fears of recession."

She added that Europe is seeing the biggest decline, "with deal making at the lowest level in ten years as concerns about the broader economy continue to dampen the appetite for risk taking. Globally, dealmakers are cautious."

U.S. wealth management deals march forward

While the lower number of wealth management M&A deals in the United States reflects those trends, the regular flow of announcements of significant deals form a contrast.

This week, Overland Park, Kansas-based RIA consolidator Mariner Wealth Advisors

"The firm's differentiated service offering, which is centered on high net worth clients, is as impressive as its talented executive leaders and deep bench of advisors," Adviser Investments CEO Mario Ramos said in a statement. "Their expertise in trust, estate and tax planning will be a game-changing addition to our wealth management platform."

Billion-dollar sellers

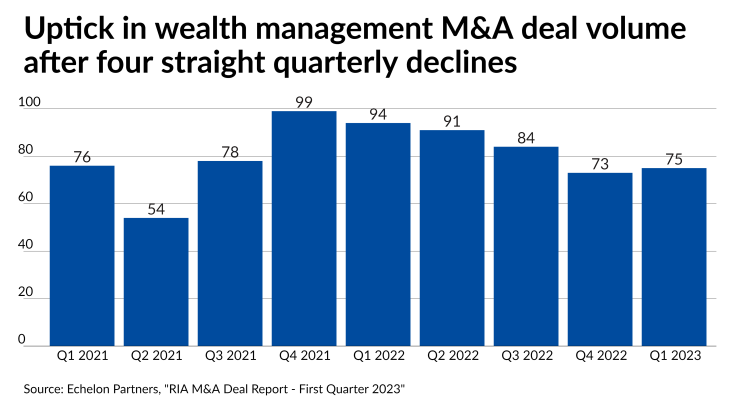

In the first quarter, the volume of wealth management M&A deals decreased 20% from the year-ago period to 75, while the average client assets changing hands in each transaction jumped 12% to $1.81 billion, according to Echelon. Sellers with at least $1 billion climbed by 94% to 33.

Beacon Pointe Advisors unveiled the most deals by any firm in the first three months of 2023, at 5, followed by Wealth Enhancement Group (4) in second place and a four-way tie in third at 3 transactions each by Mariner, Prime Capital Investment Advisors, Cerity Partners and Allworth Financial.

Echelon predicts "an uptick in activity" in the second half of the year and first part of 2024 "to account for any sellers that may have put off a deal in 2022."

Continuing momentum

Ongoing deals stem from trends such as an aging

RIAs "delayed" deals rather than deferring them altogether, Garcia said. "The firms we work with tell us that their pipelines are strong, that they're having conversations."

Newcomers

Some RIAs are making their first forays into M&A.

Boston-based Integrated Partners, which has about 200 advisors and $16 billion in assets under advisement,

The company is "in a really strong position to continue to grow," but Integrated plans to ensure that any incoming teams add value to the firm and share its focus on growth, financial planning and an entrepreneurial mindset, according to Rob Sandrew,

"It would be very easy for us or any firm to do M&A almost for the sake of doing M&A and that is definitely not what we're interested in," Sandrew said in an interview. "We have to be very disciplined, and I think that will pay dividends."