Two financial advisors at the forefront of the movement

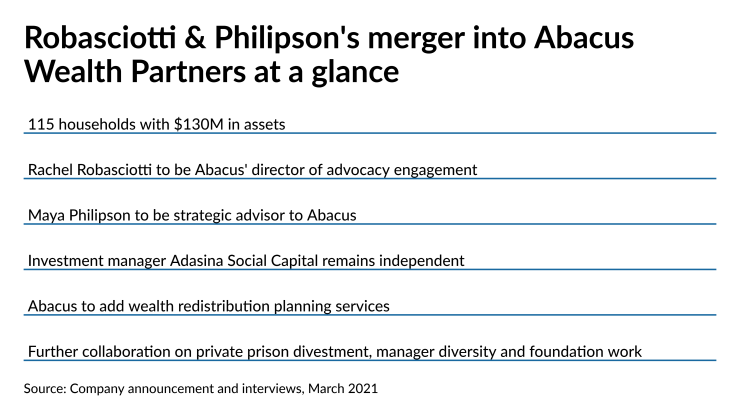

Rachel Robasciotti and Maya Philipson of San Francisco-based Robasciotti & Philipson are merging 115 client households with $130 million in assets into major fee-only RIA firm Abacus Wealth Partners, the firms

The talks between the firms “went very quickly” after starting at an impact investing conference a year ago, Abacus co-founder Brent Kessel says. The parties didn’t disclose terms of the deal, which transferred the wealth management practice to Abacus at the Jan. 1 close. In addition to collaborating in areas such as prison divestment and portfolio manager diversity, Robasciotti and Philipson bring expertise in wealth redistribution planning to the acquiring firm.

“There's a whole cohort of clients that don't want to just focus on the perpetual growth of their own wealth,” Kessel says. “They're working very closely with a number of advisors to train them on this different approach.”

Robasciotti opened the RIA in 2004, and she and Philipson

“We are extremely proud of Robasciotti & Philipson and the work we have done over these last 17 years and are confident that our legacy will continue through Abacus,” they wrote in an email blast to clients on March 3. “It is because of this incredible community that we had the opportunity to launch Adasina Social Capital — and now, we will focus our efforts on advancing racial, gender, economic, and climate justice through Adasina’s work as a bridge between financial markets and social justice movements.”

Kessel and Robasciotti are already working to alter traditional due diligence in asset manager selection. Alongside Tracy Gray of The 22 Fund, Erika Seth Davies of The Racial Equity Asset Lab and a dozen asset managers who are Black, Latino or other minorities, they designed a

“Diverse management teams, whether in investment management or corporate management, make better decisions and have better performance,” Kessel says. “That’s where you really get exposed to new opportunities and also better decision-making because you can't just take your assumptions for granted.”

With Philipson now serving as a strategic advisor to Abacus, and Robasciotti taking over the new position of director of advocacy engagement, they’ll be leading efforts by their new RIA in impact investing. For example, they plan to devise model custodian requests-for-proposal forms for RIAs that include ESG criteria and due diligence questionnaires in line with the new pledge.

Additionally, Philipson and Kessel intend to boost the firm’s services for “large foundations and families passionate about social justice,” Kessel says. Robasciotti and Abacus Chief of Innovation J.D. Bruce began a campaign aimed at convincing a large custodian to halt investments in companies that build prisons. Several Abacus clients have also expressed interest in plans to spread their wealth among deserving organizations, according to Kessel.

As the general partner to the Abacus Sustainable Fund and the Align Impact Fund, the Los Angeles-based firm has never been a stranger to impact investing. Partners of Abacus had first gotten to know Robasciotti through the firm’s women’s initiative in 2015, Kessel says. Abacus formed in 2004 through the merger of Abacus Wealth Management and Sherman Financial, according to its SEC Form ADV brochure. In 2019, it acquired the assets and clients of Workable Wealth, an RIA launched six years earlier by advisor Mary Beth Storjohann.

In its own blog

“Abacus welcomes the R&P family into our own and we look forward to reshaping the world of finance together for many years to come,” according to the blog.