Brokers may have idealistic visions of the benefits of breaking away from their wirehouses to go independent, but they should be extremely cautious before making the move, according to industry executives speaking at a roundtable forum sponsored by Schwab Advisor Services.

"The amount of due diligence [necessary to become an RIA] is incredibly overwhelming," said Christopher Forte, who left Wells Fargo Advisors with his wirehouse team to launch Integrated Investment Consultants in 2015. "For around a year, you're running an existing business with clients, while starting a new business at the same time."

Hubris can also be an issue, according to Chris Dupuy, who helps wirehouse brokers transition as president of Focus Financial Partners' Independence division.

"Successful lead advisers can be a very confident group," Dupuy said. "They risk underestimating the level of complexity [of going independent]. If we see signs of that, it's an enormous red flag. We try to remind them that you don't what you don't know."

DON'T BE NAÏVE

Wirehouse stars can be "naïve" about starting an RIA — or joining one that's already established, warns Shirl Penney, CEO of integrated platform provider Dynasty Financial Partners.

"They may hire the wrong people or the wrong partners," Penney says. "They may not understand a firm's capital structure or ask the right questions about a firm's preferred equity, debt or what the common equity is actually worth."

To be sure, the virtues of owning an independent business outweigh the hassles involved in starting one, the panelists agreed.

The rapid growth of the independent channel has meant an "explosion of opportunity" for advisers, according to Jon Beatty, SVP, sales and relationship management for Schwab Advisor Services.

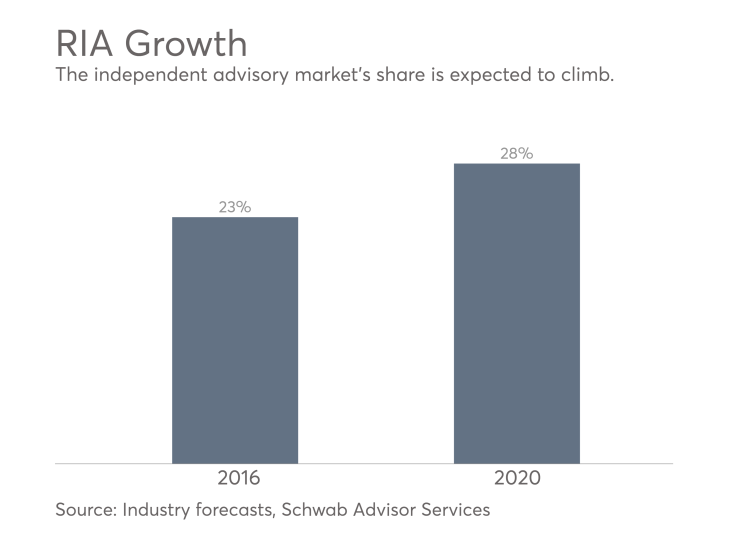

Schwab's own business with newly-formed RIAs has increased by 25% in the past two years, he said, and he noted industry forecasts predicting an increase of the RIA's share of the advisory market to 28% by 2020, up from 23% in 2016.

Forte said that existing and prospective clients of his Birmingham, Michigan-based firm have applauded the newly-minted RIA's entrepreneurial bona fides and embrace of the fiduciary standard.

"Having fiduciary language in contracts means something to clients," Forte said. What's more, he added, about half of Integrated Investment Consultants clients are entrepreneurs, who appreciated the fact that Forte and his partners knew the challenges involved in starting and running their own company.

'RAPID PROFESSIONALIZATION'

Breakaway brokers using firms like Dynasty and Focus to acquire state-of-the-art technology, middle-office services and capital for expansion are part of the "rapid professionalization" of the advisory industry, according to Penney.

These RIAs will have "a lot more ability to differentiate themselves" in an increasingly competitive marketplace than legacy advisory firms, he argued.

What's more, breakaways have the potential to capture more income as independents, Penney said, in addition to owning equity in their firm. Breakaway brokers can expect an "uptick in compensation," he said, in the form of gross margins of 60% to 65%, compared to 40% to 45% at wirehouses.

Success as an independent depends on the strength of a breakaway's team, the quality of its business, access to capital and good timing, Penney maintained.

The willingness of a wirehouse broker to take risks is also critical, but can't be forced, he cautioned.

"You can't sell somebody to be an entrepreneur, but you can educate them to be a successful one," Penney said.