The number of black and Latino CFP professionals grew 12% last year — the highest increase ever, according to the CFP Board.

“We’re making a small but impactful difference,” says D.A. Abrams, managing director of the board's Center for Financial Planning.

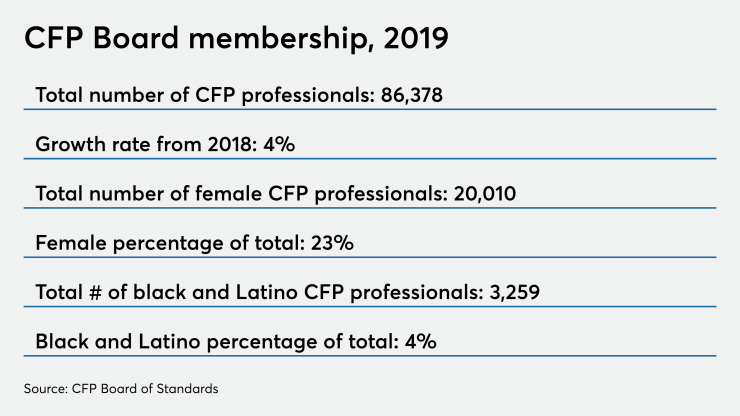

The growth rate for female CFP professionals, however, stayed the same, at just under 4%, although the total number of certified female advisors surpassed 20,000 for the first time.

Overall, the total number of certified advisors grew nearly 4% last year, about the same as 2018.

Despite last year’s gains, there are still only 3,259 black and Latino CFP professionals in total. They make up less than 4% of the 86,378 certified advisors, while blacks and Latinos account for nearly 30% of the country’s population, Abrams notes.

Communities of color still “don’t see enough people who look like them,” he says.

But Abrams says he expects continued gains for people of color in the advisory profession.

In addition to its annual Diversity Summit, set to be held this November in New York, the CFP Board has been holding regular meetings with “diverse and inclusive practitioners” to discuss best practices, according to Abrams.

As a result, a growing number of firms have established employee resource and focus groups to make the experience for people of color seeking financial advice and working for financial services firms better. Firms are also working on devising objectives for community outreach.

These groups are also focusing on professional development, Abrams says. “They want to make sure [minorities] have a path to leadership positions and access to senior leadership,” he says.

It's still new for women to see themselves in the profession.

The CFP Board will focus on building strategic partnerships to increase recruiting in communities of color this year, according to Abrams.

Organizations such as the Hispanic Association on Corporate Responsibility and the National Urban League are good examples of the groups the CFP Board has in mind, Abrams says.

In addition to institutional expertise, those organizations have valuable local connections around the country that can help advisory firms make both business and social responsibility contacts “at a deep level,” he explained.

Despite the lackluster gains for women advisors last year, Abrams is optimistic the growth rate will pick up.

Women still make up less than 25% of the total number of CFP professionals, he notes. “The numbers [of female advisors] don’t mirror that of the general population,” Abrams says. “It’s still new for women to see themselves in the profession.”

Citing CFP Board programs such as the Women’s Initiative, mentoring programs and volunteer advisory groups, Abrams is confident. “The wind is at our backs. The numbers will definitely go up,” he says.

One encouraging sign is the 1,298 women who became CFP professionals in 2019, the highest number ever.