Raymond James notched record revenue and profit growth as it strives to brace itself for rising regulatory costs.

"This is a challenging time for the firm with the DoL rule," CEO Paul Reilly told analysts during its fiscal third-quarter earnings call Thursday.

The firm has been striving to prepare advisers for the fiduciary rule and explain service changes to clients, Reilly said.

Raymond James isn't alone. Ameriprise also said it's been engaged in similar costly and time-consuming efforts, including

Firms are making such efforts, Reilly noted, even as

"There are lots of activities on the DoL. It's on again, off again, on again," said Reilly, who anticipates the department will delay the second stage of the rule's implementation.

To mitigate the effect of rising regulatory demands, which add costs and raise scrutiny on conflicts of interest, the firm recently tweaked adviser pay for its independent and employee channels. For the latter group, Raymond James is lowering pay by 100 basis points

"Our back office is up almost a third over four years," Reilly explained.

He further noted that the fiduciary rule is adding new burdens for the St. Petersburg, Florida-based firm.

"If you look at our grids, they are still competitive. Some firms tend to make changes to their comp grid every year. We tend not to do that because we feel it shows up in adviser satisfaction," Reilly said. "But we did it because we're facing higher costs."

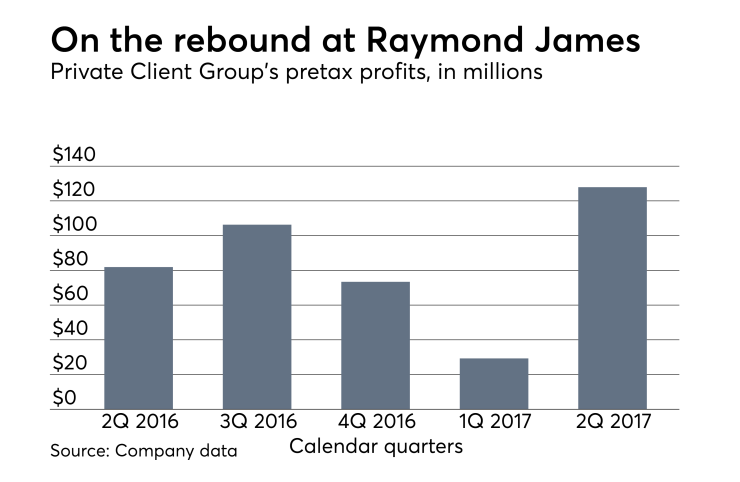

Yet even amidst so much change, the firm's Private Client Group reported record net revenue of $1.13 billion, up 25% year-over-year, as well as record pretax profit of $128 million, up 56%.

The unit had reported much lower profits for the prior quarter as legal expenses associated with

-

It seems that a long bull market in transition deals may be coming to an end.

May 23 -

"It's always nice when one poker player folds and it's down to two or three players," one recruiter says.

May 12 -

The wirehouse's executives think they've struck on the right formula to boost growth through a simplified comp plan, greater autonomy and an attractive retirement package.

April 17

HIRING MOMENTUM

The firm's long-running recruiting streak continues unabated. Headcount hit 7,285 advisers, up from 7,222 brokers for the prior quarter and 6,834 from the year-ago period.

The Private Client Group's assets under administration grew to $631 billion from $506 billion for the year-ago period, a 25% increase.

This year has seen more moves, bigger moves and more expensive moves.

Reilly said the firm would be renewing its focus on

He also said that Raymond James is trying to grow its training program as a second pipeline for adviser talent, to supplement its success in recruiting experienced advisers.

Some analysts and other industry observers have suggested that rising regulatory costs may spur more mergers and acquisitions within wealth management as firms look to gain scale in order to cope with the burdens. Though Raymond James has made three acquisitions in the past five years, including Alex. Brown and Morgan Keegan, Reilly said the firm wouldn't stray from its conservative approach to such deals.

"We don't get into bidding wars. Even if we love firms but they are too expensive, we don't do [a deal]," he says.

Equally important: Forced marriages often don't work.

"Integrations are hard. If both sides don't want to do it, then it doesn't work," Reilly said. “I think the way we do it works.”