Raymond James agreed to pay more than $15 million to settle SEC allegations it collected excess commissions and failed to conduct adequate suitability reviews. It's the firm's third major settlement of the year for a combined $37 million.

The SEC alleged in a Sept. 17 administrative

The latest case came after Raymond James

The firm received $4.9 million in advisory fees over 4 ½ years from 7,708 accounts it failed to properly review after they were inactive for at least a year, the new SEC order states. It also amassed $5.5 million in excess sales charges from 2,044 brokerage accounts that sold UIT positions before maturity and repurchased often-similar products, the SEC says.

“Investment advisors and broker-dealers have ongoing obligations to their clients and customers,” C. Dabney O’Riordan, co-chief of the SEC Enforcement Division’s asset management unit, said in a statement. “Raymond James’ failures cost their advisory clients and brokerage customers millions that will be repaid as part of this settlement."

Raymond James Vice President for Corporate Communications Steve Hollister issued an emailed statement about the case.

“We are pleased to have these matters concluded and have revised our policies and procedures to address the supervisory enhancements required by the SEC at Raymond James and a number of competitor firms,” Hollister said. “The firm has completed remediation with the appropriate clients and looks forward to continuing to provide best-in-industry service in support of their goals.”

The corporate RIA of the Raymond James IBD found that 1,703 inactive advisory accounts were unsuitable and converted them to brokerage accounts at the beginning of the SEC investigation, according to the order. It also closed another 2,112 inactive accounts.

Registered representatives in Raymond James’ employee and independent contractor channels obtained a portion of the sales expenses collected by selling UIT positions before their maturity and purchasing newly issued products over a five-year span, the order states.

The two brokerages also failed to disclose conflicts of interest in recommending UITs without applying $660,000 in sales-load discounts, according to the SEC. Furthermore, their corporate RIAs collected $51,000 in excess advisory fees because they used incorrect UIT valuations to calculate the management fees, the regulator states.

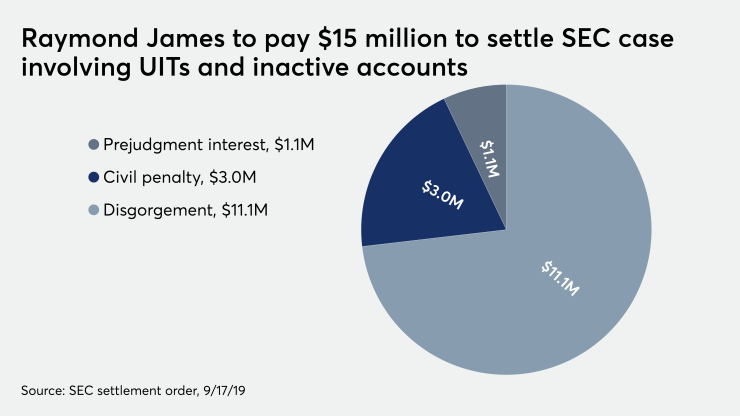

Raymond James’ brokerages violated provisions of the Securities Act, while its RIAs breached two Advisers Act guidelines, according to the three-count SEC order. The firm agreed to pay $15.2 million in disgorgement, restitution and a civil penalty.