A pro bono organization known for its phone services and seminars for women who can’t afford financial advice is expanding its helpline into longer-term, comprehensive relationships.

The idea came in part from feedback from CFP volunteers fielding questions from callers to the helpline who said they wanted to go further toward addressing their full needs, Ernst says. Savvy Ladies aims to create the “same ethos” as legal pro bono work by spending more time counseling the women, she says.

“The one-time engagement was good, but no one was feeling satisfied that they reached the finish line,” Ernst says. Surveys and studies reveal high stakes and a need for planning, and the organization hopes to help “change the idea that financial planning is for the wealthy,” she says.

Professional organizations and other nonprofits are ramping up their efforts and recognition for advisors’ good deeds, on top of notable existing programs such as pro bono advisors group the

NAPFA’s Consumer Education Foundation

Francis

“Stacy Francis has created a terrific platform to help women — particularly vulnerable women in transition — with their finances,” Schweiss said in an emailed statement. “We’re excited to see Savvy Ladies expand its footprint in this way, beyond one-time financial guidance to longer-term financial planning services. It’s needed, and it’s appreciated.”

-

This year’s Pro Bono Award goes to Amy Born, who gives one-on-one advice to Habitat for Humanity homeowners.

July 31 -

Didi Dorsett, 2018 Pro Bono Award runner-up, uses analytical skills she learned in the military to offer financial advice at no cost.

July 31 -

Planner Greg Phelps, one of the project volunteers, survived the shooting by sprinting across the concert grounds while bullets slugged into the ground.

April 6

These insiders are well placed to propel their firms forward and encourage colleagues to address the industry’s shortcomings.

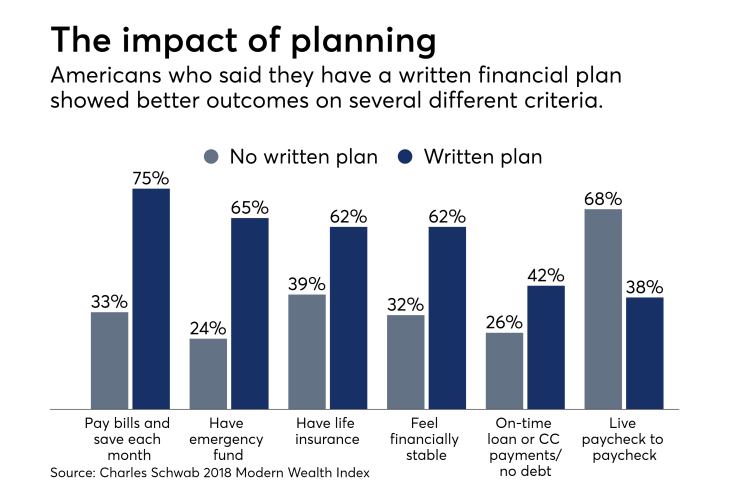

Only about a quarter of Americans have a written financial plan, which correlates with having less debt, feeling financially stable and several other positive outcomes,

In addition, a person’s perception of their immediate and long-term financial situation is “a key predictor of overall well-being” and comparable to more frequently cited metrics like jobs, relationships and health,

“Current money management stress and expected future financial security explain substantial variance in well-being beyond other life domains that have been the focus of prior research,” the authors wrote. “This is true when we control for objective measures of one’s financial situation (i.e., income).”

Francis, who keeps her New York-based practice Francis Financial separate from the organization, directed questions to Ernst, but she explains in a video on the Savvy Ladies

“Her fear was that she couldn’t support herself, that she wouldn’t be able to be on her own, and it’s because she didn’t understand how to deal with money,” Francis says. “And that is my life’s mission.”

Savvy Ladies’ helpline has been running in its current format for the past three years after a soft launch in late 2014. Its free phone service, seminars and webinars are open to both men and women of any income — but the helpline does pair up the CFP volunteers whose expertise matches the specific request.

The organization won’t prescribe any specific timeline on volunteers in terms of how often they speak with the callers or how long they continue providing their services, to avoid trying to fit the contacts into a “particular box,” Ernst says.

About 50 advisors volunteer with Savvy Ladies, according to Ernst, who says they’re looking for more. Callers and advisor volunteers alike came up with the idea for the expanded offering, and the matching system will ensure callers are willing to commit to it, as well, she says.

“They’re utilizing the professional’s time and it’s a gift, really,” Ernst says. “All women need to have access to this type of help. We really just feel that all women are at risk if they don’t understand their money.”