Private equity-backed buyers of advisory firms have dominated the RIA headlines for the past two years. Aggressive dealmakers KKR and Stone Point Capital, which bought Focus Financial in 2017, exemplify the trend.

But private equity firms aren't the only major players in the hyper-competitive M&A space, which is coming off its

Deep-pocketed, owner-controlled, strategic RIA buyers, led by Captrust Financial Partners, are also flexing their considerable M&A muscle and proving to be quite attractive to sellers.

Captrust just announced the final retail deal it completed in 2018, the acquisition of Watermark Asset Management, a Bay Area firm with $408 million in AUM, according to its latest Form ADV.

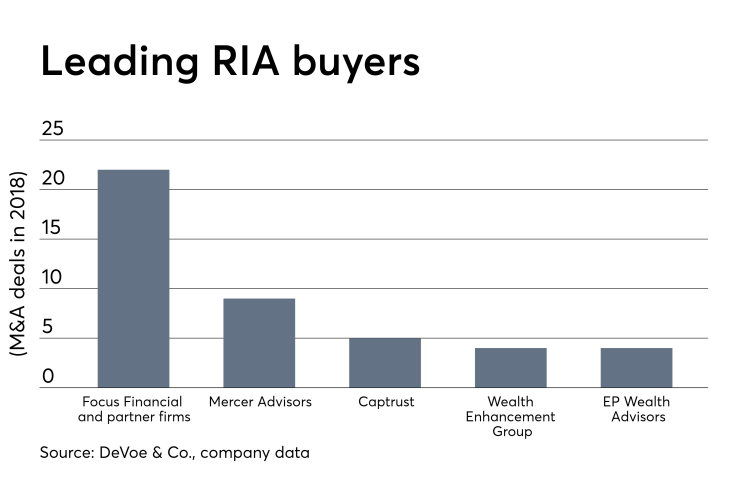

That gives Captrust a total of five retail RIA deals for the year (it also bought an institutional firm for its retirement planning business), making it the third-largest RIA buyer in 2018, according to DeVoe & Co. That’s just behind the 22 deals Focus-owned firms completed and nine transactions for private equity-backed Mercer Advisors.

“Captrust flies under the radar for many, but it has been an aggressive acquirer,” says industry analyst Chip Roame, managing partner of Tiburon Strategic Advisors.

Other RIA strategic buyers very much in the M&A mix include Mariner Wealth Advisors, Savant Capital Management, Wealth Partners Capital Group, Bronfman Rothschild and Dakota Wealth Management. Like Captrust, these firms are not funded by private equity.

This year alone has seen two more multi-billion dollar RIAs,

Owner-operated strategic RIA buyers "are not beholden to return requirements of a PE investor,” says M&A investment banker David Selig.

What advantages — and disadvantages — do these firms have when competing against consolidators backed by private equity?

The main advantage owner-operated firms like Captrust have “is they can be very selective in who to partner with,” according to M&A investment banker David Selig. “They can grow as fast or as moderately as they like because they're not beholden to return requirements of a PE investor.”

But Captrust and other RIA buyers are also burdened with a disadvantage, Selig, the CEO of Advice Dynamics Partners in San Francisco, points out.

“They don't have the capital a private equity-backed firm has,” he says. “So it's tough to compete on both valuation and deal structure. PE-backed firms generally offer far more cash at closing, for example, than an owner-operated firm can.”

A private equity partner can provide a seller with “nearly unlimited capital," says M&A consultant David DeVoe.

A private equity partner can provide a seller with “nearly unlimited capital [and] bold, strategic thinking that can unlock powerful combinations,” notes David DeVoe, managing partner of RIA M&A specialists DeVoe & Co., citing last year’s

But RIA buyers not tethered to private equity have a strong counter-argument, DeVoe says.

They can point out to sellers that PE firms often demand preferred positions in companies they buy and “influence over strategic decisions,” he points out.

What’s more, owner-operated strategic buyers, who are veterans of the advisory business, are better positioned to negotiate “unique deal terms” with sellers, such as delayed retirements and equity kickers in deals, according to Roame.

"We can offer owners a sense of comfort because we control our own destiny," says Rick Shoff, managing director of Captrust's Advisor Group.

The key differentiator for a buyer like Captrust is the “ability to control the clock,” versus a private equity-backed buyer’s need to monetize its investment within a certain period of time, says Rick Shoff, managing director of the RIA’s Advisor Group.

“Selling a firm is a big decision and we can offer owners a sense of comfort because we control our own destiny and can reinvest in the business and redistribute profits to the shareholders,” Shoff says.

So far, the pitch is working.

Captrust has bought 33 firms in the past 12 years, usually offering a combination of cash and equity to RIAs with assets under $1 billion who have clients with between $1 million and $10 million in investable assets.The RIA’s five deals in 2018 added around $3.4 billion to its retail AUM, which is just under $10 billion, according to its latest Form ADV.

- What makes for a successful merger? The head of one of the industry’s biggest buyers reveals his secrets.Lightning Round Sponsored by State Street Investment Management

-

The definition of independence for advisors is changing, according to a new report.

June 6 -

Capital is pouring into the RIA market, resulting in more deals, more competition and higher prices.

January 1

Shoff says he expects Captrust to close on at least five deals this year. The firm’s long-term goal is to match the reach of the National Football League and have offices in the country’s top 35 metropolitan markets, he says.

Chicago, Denver, California, Texas and the Pacific Northwest are immediate targets, Shoff adds.

The M&A market is “definitely accelerating,” according to Shoff. “It’s still a seller’s market and we’re seeing more activity. We’re paying more for firms than we were five years ago, but we’re more valuable too.”

Advisors seem to agree, says Louis Diamond, executive vice president at Diamond Consultants, an M&A and executive search firm in Morristown, New Jersey.

“Captrust has become an extremely appealing destination,” Diamond says. “They can offer advisors scale, growth and good service capabilities. But their goals have to align. The question for sellers is how much control they are willing to give up. Like United Capital and Mercer, Captrust expects advisors to do things a certain way.”