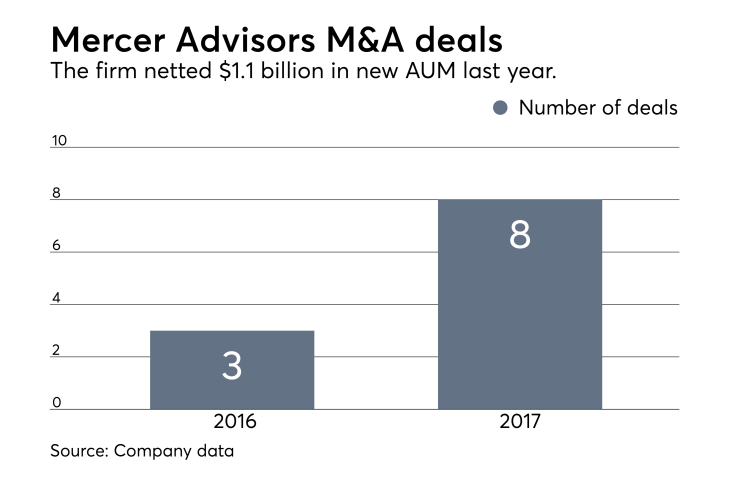

Mercer Advisors' M&A appetite, which resulted in eight deals last year, appears to be as voracious as ever.

The private equity-owned RIA jumped back in the industry's blistering deal-making race, snapping up GFS Private Wealth, a Clearwater, Florida-based wealth management firm with approximately $314 million in client assets, according to their latest Form ADV.

The Mercer deal is the latest in a fast-moving 2018 RIA M&A market. TD Ameritrade's FA Insight research unit recorded 12 announced transactions for the first three weeks of January alone, surpassing the 10 deals it recorded for the entire fourth quarter of 2017.

February has also been extremely active. Captrust Financial Advisors just bought a $300 million firm in Salt Lake City and earlier this week aggregator Wealth Partners Capital Group finalized its second deal in two weeks.

Mercer's deal for GFS expands the firm’s footprint in the Southeast and is a much-needed boost to Mercer’s advisor pool.

“Our industry is facing a talent shortage,” says Mercer vice chairman and former CEO David Barton, who now oversees M&A activity for the firm. “Adding financial planning acumen to our organization is extremely valuable … we fully intend to grow.”

The Santa Barbara, California-based firm is coming off a strong 2017 that netted approximately $3 billion in AUM. In December, Mercer closed on the

Their latest move underscores Mercer’s healthy appetite, according to newly minted Mercer CEO Dave Welling. The former chief of wealth management software provider Black Diamond took the reins from Barton last year. “Eight acquisitions with north of a billion dollars from last year, that pace is sustainable,” Welling says.

Mercer expects to announce another deal in the coming weeks, Welling says.

-

After a fourth-quarter slowdown, deal-making resumed with a vengeance in January.

February 2 -

The retirement powerhouse has made six deals so far this year, most recently acquiring Davidson & Garrard with $685 million in AUM.

September 20 -

The firm's aggregation model yields two RIA deals in two weeks.

February 12

Mercer’s AUM jumped 93% from $6 billion since Genstar Capital bought Mercer from fellow PE firm Lovell Minnick Partners in 2015. With approximately 200 employees and 8,000 clients, the firm now manages $12 billion in client assets as of February 1, according to company data.

GFS Private Wealth listed fewer than 100 clients on its latest Form ADV, most of which are HNW individuals, and eight employees, including advisors and staff. The move helps to expand the group’s reach in the Sunshine State and to deliver a wider range of services, says GFS cofounder Sandra Nesbit. The team will remain in their offices in Clearwater, says the firm. Mercer has offices located in nearby Tampa, Florida.

“GFS’s business model mirrors ours in that they offer … services geared toward HNW families seeking a one-stop solution to tall their financial needs,” Barton says.