Months after landing a

The application programming interface provider launched a new product specifically designed for investment platforms that is powered by technology from Quovo — the wealth management data aggregator bought by Plaid in January. Called Investments, the technology integrates the two firms and gives users the ability to access client account balances, holdings and transactions in a single view,

“As an API company, it’s rare to have the opportunity to go back and reopen the architecture,” says Lowell Putnam, Quovo’s founder and now head of partnerships at Plaid.

The API connects customer data streams and financial institutions to fintech developers such as

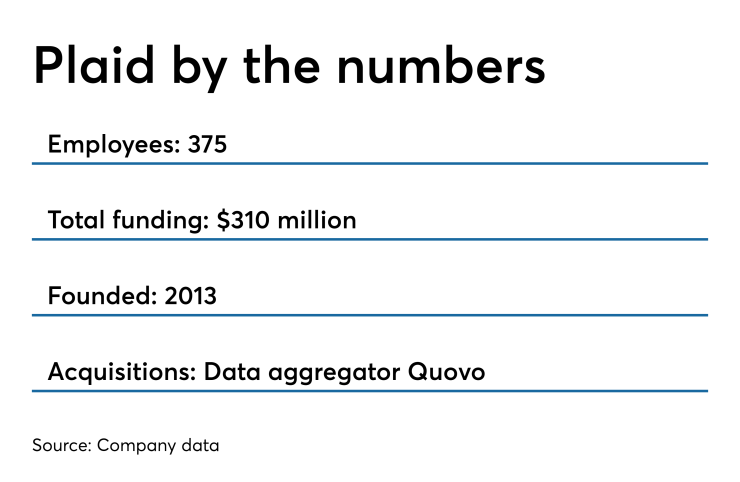

Plaid

In February, a month after the acquisition, teams from both companies met for an Investment product meeting where former Quovo employees explained what changes they wanted to make to the product, according to Putnam.

Although the two firms were competitors, they complemented each other and decided to focus on creating a single product, he says.

One of the biggest changes made to Quovo’s technology is access to more information on securities. The block of code, nicknamed the “baby security master,” has the ability to aggregate securities information such as names, tickers, security type and close price.

The client portal can also be directed by the client to add account information, Putnam says.

Putnam has seen many advisors still using excel sheets, PDFs and other documents to store data. The new product is designed to be easier for the consumer who can see their account information in a single view and could save time for advisors.

“APIs are very critical to the future of financial services — for the retail side and the commercial side,” says Gilles Ubaghs, an analyst for the research firm Aite Group.

Sixty-three percent of banks work with fintechs, according to a study by the Aite Group, while 11% are exploring the possibility of working with fintechs. Banks have traditionally treated fintechs as competition but have since shifted strategy to wanting to connect to them, Ubaghs says.

Plaid’s move into wealth management marks the latest fintech to expand into the investment space. Plaid now covers personal finances, banking, lending, payments, brokering and accounting.

Fintechs use their primary product to attract clients and create loyalty, Putnam explains. Then they continue to add new ones to enhance their services and expand the share of the client’s wallet.

“As our customers, or fintech companies, redefine the lines and blur those lines, we have to meet them there with new data sources and data types,” Putnam says adding that Plaid wouldn’t be able to enable these trends without access to different data services.

“Holistic financial planning isn't going away,” Putnam says.