First, Plaid built a platform of application programming interfaces to make it easy for fintech developers to access client account data held at financial institutions. The venture was so successful, Visa snapped up Plaid

With its new Plaid Exchange, the data aggregator is giving firms the tools to better manage client data, connect that data with third parties and bring new digital capabilities to market.

The firm calls it “open finance in a box,” which Plaid says will improve data connectivity across the industry, leading to faster technology. For financial advisors, it could usher in a new era of integrated technology.

“One of the long-standing challenges in this space is feeling like all the parts in my technology don’t fit together,” says Niko Karvounis, Plaid’s head of product for institutions. “Plaid Exchange is trying to resolve some of that friction.”

Advisors need accurate aggregation to build and execute financial plans, and clients expect up-to-date information in their client portal, Karvounis says. Yet integrating with legacy systems remains a challenge.

“Our product has always been an API for fintech developers to build apps on, but when we connect back to the financial institution, it’s a little bit of a hodgepodge in terms of what is available,” he says.

The disparity between firms can result in broken connections or missing data. The APIs available on Plaid Exchange will help maintain connectivity and ensure reliable integrations, Karvounis says.

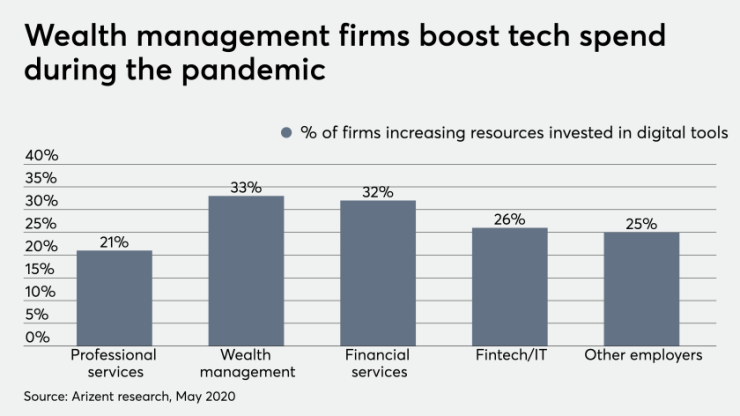

The coronavirus pandemic has highlighted the need for many firms to upgrade their infrastructure. Consumers are checking accounts more often in response to market volatility, and homebound business owners unable to visit a bank in person

Not every firm has been able to shoulder the load. Charles Schwab, Fidelity Investments and Vanguard Group

While these issues may not be directly related to data aggregation, they’re an example of the fragility of digital financial services. Karvounis says adapting a common API ecosystem that connects directly with a firm’s infrastructure will improve data flow, resulting in enhanced connection and increased reliability across the industry.

The challenge: getting financial institutions on board. Most, if not all, banks, broker-dealers and custodians are developing their own APIs in-house or acquiring fintech firms.

But developing APIs is an expensive, multi-year process, and not every firm has the resources to do it themselves. By using APIs on the Plaid Exchange, firms can bring new products to market in weeks and cut costs associated with building, testing and implementing new technology, Karvounis says. For example, fintechs were able to use Plaid APIs to build out Paycheck Protecion Program loan processing

“If you have connectivity as a foundation, that’s the kind of thing you can do,” Kavounis says.

Plaid is also not the only company hoping to provide an API ecosystem to financial institutions. There is MX, a startup out of Utah, and Akoya, an independent company

Then there is Envestnet Yodlee, which already has connections with firms across the industry. Though Yodlee saw an uptick in revenue in the first quarter, Envestnet chief financial officer Peter D'Arrigo said in the earnings call the company is looking at longer-term headwinds for the business.

“We expect some of the business that was starting to get into the pipeline will likely slow down,” D'Arrigo says, adding Envestnet is looking to diversify Yodlee’s client base.

This could provide opportunity for new challengers like Plaid to gain market share. Yodlee declined to comment on the new competition.

Yodlee is also still working through concerns about how it makes consumer data available to hedge funds and other interested third-parties. Though Envestnet says it “never sells data that identifies consumers,” follows industry best practices and is in compliance with all laws and regulations, the Federal Trade Commission is currently investigating

Both Akoya and Plaid emphasize how their API networks provide greater transparency, privacy and more consumer control over data than other aggregation methods.

“Consumers’ personal financial data should only be accessed with their explicit consent and they should have the ability to monitor and revoke that access,” said Fidelity Investments CEO Abigail Johnson in a statement. “For this reason, we created Akoya and are now joining with several financial institutions to accelerate the availability of a secure, transparent and more reliable network for the entire financial services industry.”

The Plaid Exchange includes an API for firms to create a dashboard showing consumers which companies have connected to their accounts and manage how data is shared.

“I think the fact that we don’t sell data, that we have built transparency and control as key principles into our product certainly is a competitive advantage,” says John Pitts, Plaid’s head of policy. “The consumer has to be in control of their own data. If you don’t provide that, you’re at a disadvantage.”

Some firms are already up and running on the Plaid Exchange, Kavounis says, but Plaid declined to specify which ones.