The barrier for firms to enter into multiple financial services has dropped significantly and digital wealth management platforms are taking advantage of new technologies to offer an expanded suite of financial services products.

The latest robo advisor to go from offering advisory services to banking options — Personal Capital.

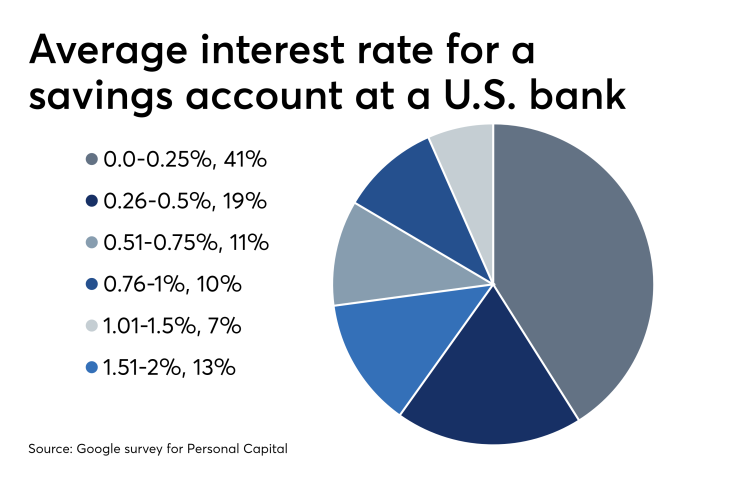

The new service, dubbed Personal Capital Cash, allows consumers to open a high-yield savings account on their mobile device with no minimum balance. Personal Capital offers a 2.3% annual percentage yield for non-clients and 2.35% APY for clients.

Recently

“They’re trying to capture more of the financial picture of the client,” Aite group research director Alois Pirker said. Firms are trying to create a product that fits into the natural flow of a person’s life and financial behavior.

Wealth management firms are also trying to meet clients where they are — online. A lot of firms are gearing up because the industry is heading toward a “technology-first” mindset, Pirker explained. But first, a lot of firms will have to figure out what works and be creative in understanding the client’s needs.

Personal Capital aims to reach every type of client and introduced Personal Capital Cash to allow consumers to get more out of their accounts.

“Our no minimum balance ensures this is a product that can be a fit for anyone who is looking to make their money work harder for them,” says Dan Stampf, Personal Capital’s vice president of Personal Capital Cash.

The Silicon Valley-based hybrid firm partnered with Institutional Banking at UMB Bank.

-

As robo advice expands into other services, such as debt management, the stakes rise to become a hub for a client's entire paycheck and financial life.

August 22 -

The robo strikes a deal to offer direct deposit service and debit cards.

June 3 -

The hybrid digital advice firm is expanding its marketing department in an attempt to outpace its competitors.

February 20

In addition, Personal Capital launched Savings Planner. It’s a tool designed to guide clients’ financial choices and track client activities in three key parts: retirement savings, emergency funds, and debt paydown. The emergency funds tab connects directly to clients’ bank accounts, including Personal Capital Cash.

The savings tool also takes into account monthly costs and the differences between taxable and tax-deferred accounts.

The company sees a market need for a savings service beyond retirement based on the Federal Reserve’s latest report on the Economic Well-Being of U.S. Households, which found that 40% of Americans couldn’t cover an unplanned $400 emergency with cash.

Personal Capital now has more than 2 million users who hold over $41 billion in cash or money market accounts and over 150 advisors who manage those accounts, according to the firm.