Despite Pershing’s loss of major client firms in the past year, the giant custodian is growing and betting on a new turnkey asset management and technology platform.

The firm’s revenue rose modestly from the year-ago period because of higher equity values, as well as increased client balances and transactions, even though it lost a client it hasn’t publicly identified by name, Pershing’s parent company, Bank of New York Mellon, said in

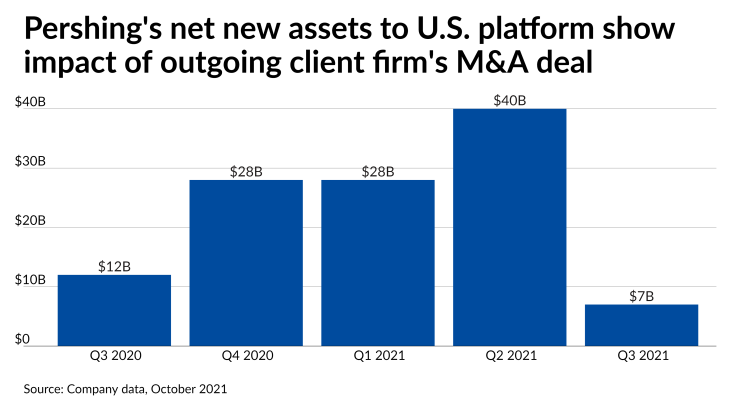

During an earnings call with analysts, BNY Mellon Chief Financial Officer Emily Portney said that “the lost business due to just being on the wrong side of M&A” will slash $15 million from Pershing’s earnings in the third and fourth quarters, which is $5 million less than previously anticipated. Representatives for Pershing declined to clarify which clients left in the deal.

Regardless, BNY Mellon CEO Todd Gibbons described

Since advisors often must tie together multiple tech tools in a way that hampers their productivity, Pershing is combining all of its services in areas such as planning, modeling or even banking services in one place, Gibbons said,

“There is really no solution out there today that can tie that all together,” Gibbons said. “It will be an open-architected, but an end-to-end solution. So we’ll be integrating best-in-class services amongst some of our own, and it will provide a digital capability and real good retail experience both to the advisor as well as to the investor themselves.”

Business in the quarter: Pershing’s revenue expanded by 5% year-over-year to $566 million in the third quarter, even after losses of $102 million to pay waivers for clients with holdings in cash affected by the low interest rates. BNY Mellon’s clearing services fees, which are nearly all generated by Pershing, surged by 7% above the year-ago period to $423 million by the end of the quarter. The custodian’s average active clearing accounts climbed 4% to 6.8 million, its average long-term mutual fund assets jumped 23% to $736.84 billion and its average investor margin loans soared by 40% to $13.05 billion.

Net new assets fall: Besides acquiring Waddell & Reed, LPL has scored three massive recruits away from Pershing in the bank and credit union channel in the past two years:

Pershing X: The new unit is building what will become “the industry’s leading end-to-end platform in the wealth advisory space” by pairing its custody and clearing services with other tech tools, according to Gibbons. The firm is eyeing more business among RIAs and throughout wealth management by pitching Pershing X to advisors, practices and companies whether or not they use the company’s custodian, Gibbons said later in the call. “We’d love to have the custodial business, but we’ll be able to provide these capabilities regardless of who the custodian is, and we are working on that capability right now,” he said. “We’re really investing for the future and I think, before you’ll really start to see the revenues that we expect in that business, that’s probably two years or three years out.”