SAN DIEGO — Financial advisor Tony LaJeunesse didn’t take home a paycheck for a year and a half while his practice was giving up commissions. For five years, he says, TL Financial Group was “very, very careful” about expenses while converting to a fully advisory business.

“That was my investment back into the business,” LaJeunesse said in a session at last week’s FSI OneVoice conference. “I think, five years ago, we were at about $120 million under management. We're coming up on $200 million now, so my investment paid off.”

Other difficult aspects of the Detroit-area practice’s shift included letting go of a front-desk staffer while later adding another advisor, says LaJeunesse,

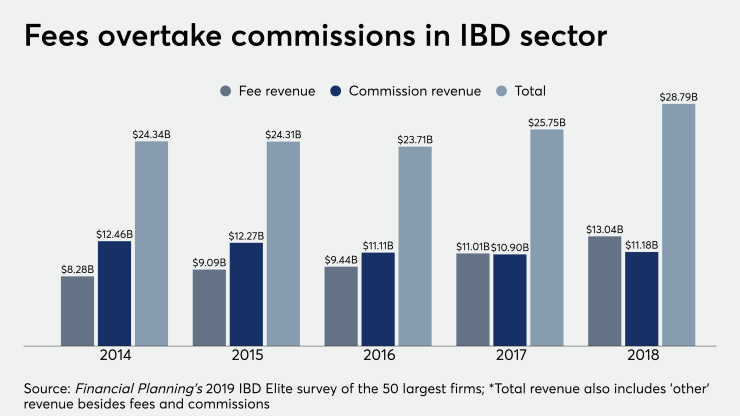

The transformation at LaJeunesse’s practice reflects the movement of billions of dollars across the IBD sector in recent years. In 2017, advisory fees outpaced commissions for the first time ever among the 50 largest firms,

While FSI's members advocate for preserving the choice of brokerage accounts moving forward, they’re also adapting to the ramp-up of advisory business. Adam Roosevelt, the head of corporate & hybrid RIA business strategy at BNY Mellon’s Pershing, pointed out that the growing source of revenue comes with advisor “attrition risk”

It’s no wonder, then, that custodians like Pershing and large IBDs are

“The thing I found probably the most difficult in that process was going back to existing clients. The things that you had been trained to tell them and and to sell them, basically, early in my career was very different than how I would work with them going forward,” Harman said.

“You're changing your strategy and how you're working with them,” he added. “So there's some psychological component to that, where you're almost embarrassed by how you're trained...Sitting on the backside of this 25 years later, it's just a completely seamless process.”

FSI AND RIA-ONLY FIRMS?

LaJeunesse and Harman — whose Houston-area practice is affiliated with Advisor Group’s SagePoint Financial — have served on FSI’s board. Without providing names, CEO Dale Brown had said earlier in a media briefing that the IBD trade group is approaching RIA-only firms that may see a “shared interest” in the value of advocacy on issues like

Dual-registered firms may find it hard to win support in the fee-only community, where advisors avoid common industry conflicts of interest and

Take the giant IBD custodian, Pershing, as an example. At the end of the third quarter, the firm says it had $1.9 trillion in client assets under custody, including $762 billion — about 40% — in advisory AUM at 740 RIAs. Subscriptions, retainers and other flat fees may become more appealing than the traditional AUM fee, Roosevelt said in an interview before the panel.

“Client demand will create a lot of the change that we’ll see,” Roosevelt said. “Advisors and enterprises are going to really need to demonstrate the value of their fee. I think we’re going to see new fee models come out of that. Clients are still very confused when it comes to transparency around the fees they’re paying advisors.”

NUMERIC AND CULTURAL CHANGE

With the rising equity values and regulatory oversight of recent years fueling the shift to advisory business, the fee revenue is forging a different sector. Between 2007 and 2018, commission revenue among the top 50 IBDs jumped by 25% to $11.18 billion,

IBDs are responding to the greater fee-based mix by bringing RIA principles like more custodial choice on their advisory platforms. Ladenburg Thalmann’s KMS Financial Services

The shift to advisory is even prompting IBDs to alter how they train their home-office employees. To encourage a more “service-oriented” company while connecting the corporate staff with the field, Cetera Financial Group holds monthly meetings featuring advisors who talk about their practices and how they got into the business, said Summer Pretzer, head of supervision at the network's largest IBD.

“Sometimes there's this misperception of like, ‘Oh those guys make so much money, you know, they have it so easy,’ and then you hear about how hard it is to build your business...It's been really eye-opening for us to hear their stories,” Pretzer said. “I think understanding how our advisors do business and how one advisor is different from another is really important.”

FINDING THE VALUE

Advisors appreciate getting help from more dedicated teams at the BD home office for needs like complex planning questions, according to LaJeunesse. He cites Commonwealth’s resources, like CPAs, attorneys and experts in Social Security and Medicare who can answer difficult questions within a couple of hours or less.

“We need back-office support that's going to be able to support and help us drive our revenues. So we need access to specialists,” LaJeunesse says. “We can really communicate our value proposition to our client very efficiently. They like that, they see strength in numbers and they know that I have a team — not only our team — but a team backing me up.”

For Harman, compliance services alone show the advantage of working with a BD in some form or another. BDs have an opportunity “to try to help advisors understand” the importance of their compliance department rather than viewing it “as an adversarial relationship,” he says.

“Advisors sometimes feel like, 'they won't let me do this' or 'I can't do that' or 'I have to get this supervised,’ but I see tremendous value in that because that costs a lot,” Harman says. “Broker-dealers are obviously helping us navigate FINRA and the SEC or different regulators.”

He made the point after Pretzer noted higher costs for full RIA practices, such as buying errors and omission insurance coverage, hiring a chief compliance officer, dealing with SEC audits and filing disclosure documents like Form ADV.

“Your broker-dealer has had a huge discount based on the volume, so paying your own E&O can be incredibly expensive,” Pretzer said. “There are a lot of services — and you're talking about margin — that the broker-dealer provides that, if you go completely RIA-only, you have to pick up. All of those responsibilities and expenses are on you, and it's a lot.”