BELLEVUE, Wash. — Lack of diversity within the advisory industry represents a “grave” threat, according to Pershing Advisor Solutions CEO Mark Tibergien.

“Our talent doesn’t reflect the face of our community, nor does it reflect what I think is important for the continuation of the independent financial adviser movement to address as a crisis,” Tibergien said in a speech Wednesday here at the NAPFA conference outside Seattle.

“To the extent that we do not address what our future is going to look like, what you have created here with NAPFA will become irrelevant in 10 or 15 years. It’s a call to action.”

Tibergien, the head of one of the country’s largest custodians, admitted that a 65-year-old white man is an ironic speaker for delivering such a message. He and other presenters at the conference, though, pointed out the sheer numbers highlighting the problem. They also proposed a series of changes they hope will lead to more advisers who are minorities or women.

“We as a society have overcome a lot of the overt sexism that is out there in the workplace. But I do believe that there’s still unconscious bias and gender-role expectations that still exist, most of the time unintentionally,” said Gretchen Halpin, principal of Hewins Financial Advisors in Chicago.

“In the financial services industry, a lot of the leaders of the firms are still from that past generation of thinking. And so that unconscious bias comes into play when young women are moving into the workforce, and those leaders are setting the tone of culture at the firms, they’re feeling like the opportunities are limited.”

THE EXTENT OF THE PROBLEM

Data displays stark gender and racial disparities. Only 8% of advisers at 18 large financial services firms are people of color, according to

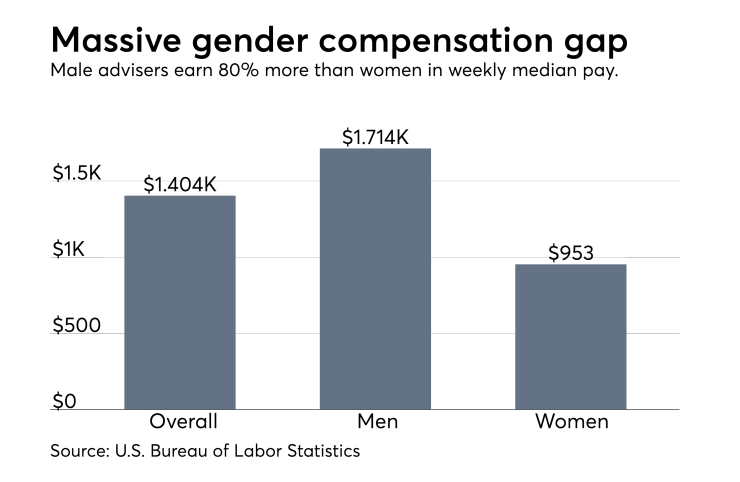

And just 48,631 advisors out of 310,504 overall — about 16% — are women, according to a study earlier this year by Cerulli Associates. Female advisers earned 80% less in weekly median pay in 2016 than their male colleagues, according

Shareholders have touched on the issue in proposals at companies’ annual meetings this year. Investors in Bank of America and Wells Fargo filed identical motions that would require the firms to disclose their gender pay gap in a comprehensive report.

-

While women are far less likely to engage in misconduct, they're punished much more harshly for any infractions, per a new study.

March 14 - FP magazine

The "I am a CFP Pro" campaign will feature younger, more diverse voices from the planning community.

April 6 -

One way to effect positive change is by helping clients invest through a gender lens, says ThirtyNorth Investments exec Suzanne Mestayer.

May 3

How many women advisers work for the leading independent broker-dealers?

Figures about race have proved more difficult to obtain, in part due to the confidentiality of companies’ Equal Employment Opportunity Commission surveys. New York City Comptroller Scott Stringer, who oversees city employees’ pensions, proposed in a proxy filing that Charles Schwab disclose its EEOC data.

“The financial services industry, of which the company is a part, is characterized by persistent and pervasive underrepresentation of minorities and women, particularly in senior positions,” Stringer wrote, noting that such peers as BNY Mellon, Morgan Stanley and others release their data.

At BNY Mellon, Pershing’s parent firm, about 39% of executives, managers and professionals are women, 13% are Asian-American and 8% are black, according to its latest figures. Pershing CEO Lisa Dolly is one of the few women atop a large advisory firm.

RECRUITING ISSUES

Forward-looking firms create career paths toward leadership roles for their advisers, Tibergien said. They also need to alter the tone of their recruiting pitches, specifically to correct the misperception that advisers are just salespeople, to appeal to millennials and other young people, he argued.

“This is a career where it’s intellectually stimulating, where you profoundly impact the lives of others. It’s financially rewarding, and, in fact, if you just add ‘long walks on the beach,’ it’s a pretty good personal ad,” Tibergien said, to laughter. “But somehow, we have created a perception of this business as being unworthy as a career choice.”

Yet the refrain among hiring executives remains that not enough women are qualified or even want to be advisers, according to Manisha Thakor, the Houston-based director of wealth strategies for women at Buckingham Strategic Wealth and the BAM Alliance. It’s a common misconception, she says.

Iwona Hill and Kahne Krause of Dimensional Fund Advisors showed a video they produced as part of a series with advisers talking about why women like the work. Undergraduate programs, such as those of Kansas State University and Texas Tech University, and mid-career internships have trained a lot of possible recruits, according to Thakor.

“I can see that there’s a chasm,” Thakor said. “There are women who want these jobs and there are firms that want to hire them, and it’s just bringing the two groups together.”

CULTURAL PROBLEMS

Another problem, she said, revolves around how women need to wear “armor” in the workplace to hide their sense of empathy.

“When women express warmth, often times they are penalized,” Thakor said. “In some sense, men may actually have an advantage in working with women clients going forward. We can’t be penalizing women advisers for letting some of their feminine traits show.”

The growing wealth of women worldwide could force changes at all firms, however. In order to tap into the new demographics, firms should take a close look at their leadership teams, said Eileen O’Connor, the CEO of Hemington Wealth Management in Falls Church, Virginia.

“There are not enough women in leadership positions,” O’Connor said. “You can do a lot of talking about culture, but I think having women in those positions is what’s going to attract women to the firm.”