The pursuit of wealth may be materialistic, but for high-net-worth Americans, it’s also emotional.

A new

Two-thirds cited “living a comfortable life” as the biggest driver, with “providing my family with financial security” (53%) and “financial freedom” (50%) coming next.

Survey respondents also reported aspirations to achieve entrepreneurial success, foster change in society and give back to the community.

“This is all part of a broader trend,” says David Murphy, head of wealth advisory at Boston Private. “It falls under what I would call emotional intelligence. There is an emotion associated with making such financial decisions. It is therefore very important for investment advisors to know the pulse of their clients. It helps to better understand them.”

Please switch to landscape mode to view the interactive graphic.

What does wealth enable?

Click on the categories to see enablers by generation and investable assets.

Source: 2018 The WHY of Wealth Survey, Boston Private

-

A couple in their 60s had vastly different plans for retirement: One spouse envisioned Florida, the other Chicago.

February 12 -

Almost half of wealthy donors don’t have a strategy in place to guide their charitable giving.

November 27 -

Clients in their 30s offer long-term value and are cheap to acquire. But they can be time consuming, interacting almost 15 times a year on average with their advisors.

September 14

Millennials, in particular, are placing a greater emphasis on investing as the main driver of wealth accumulation, signaling a shift in how younger generations save money. Forty-nine percent of millennials polled prefer investing, as opposed to 37% 10 years ago. Advancements in digital banking have also contributed to the change.

“There are a variety of ways to engage with clients today,” says Murphy. “It could be digital, it could be through calls or it could be an in-person sit down. The quality of advice is what matters. We have to be sensitive to their needs.”

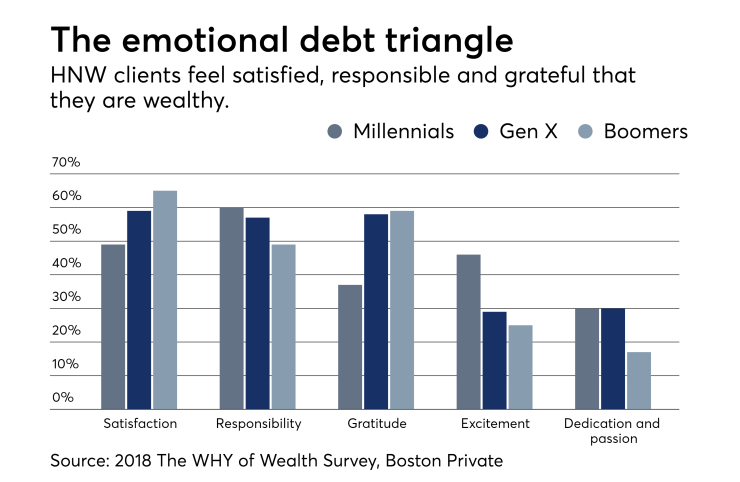

More than half of the respondents said thinking about their wealth triggered positive feelings of satisfaction (59%), responsibility (55%) and gratitude (54%), while others expressed happiness that their wealth gave them an opportunity to spend time with their families.

Some, however, regretted sacrificing their family time in pursuing a path of financial independence. Almost 47% the respondents said they would have spent more time with their family had they not been accumulating wealth.

“Regret about lost family time is more pronounced among UHNW individuals (64%) and business owners (55%) — individuals likely to devote more time to their work,” said the report.

“Business owners have a higher sense of regret than others,” says Murphy. “They spend a lot of time away from family. And in some sense, their employees become extended family.”

Such regret can be mitigated by reaching out to millennial clients at an early stage, Murphy says. “This reduces the regret they might have, say, 10 years later. It would also help them gain more satisfaction.”

The online survey, conducted by CoreData Research in February and March, polled affluent Americans between the ages 25 and 65 to get a grasp of their wealth priorities, feelings and goals.