Will I run out of money?

It’s doubtful there’s a more compelling question, and every retiree will likely ask this question at some point.

Answering it is a complicated issue but a very important one, especially as the benchmark of retirement income, the defined benefit pension, has largely disappeared.

Pensions typically offered retirees a fixed amount each month for the rest of their life. Usually, the monthly income would never increase, but even so, the certainty of this approach was reassuring. The retiree often had no idea what rate of return the pension fund was earning — that was simply not their issue but rather the responsibility of the former employer.

Fast forward to today, and we now live in a defined contribution world where each person is essentially their own pension fund manager.

Is it possible to recreate the certainty of a pension in a 401(k) and IRA world? Yes, of course. But, there are tradeoffs.

In the “The Path of Certainty” table, I consider a $500,000 retirement portfolio that’s invested in an account with a fixed annual return of 2% (say, in laddered CD’s for example). If the retiree withdraws 5% of the starting balance, the fixed annual withdrawal would be $25,000. Thus, the retiree knows with certainty the annual return of their retirement portfolio (2%) and the amount they can withdraw annually ($25,000). In this case, the portfolio will last for 25 years before the bucket is empty. End of story.

If, however, the retiree only withdraws $20,000 each year (representing 4% of the beginning balance) the same retirement account will last for 35 years. Finally, if he or she chooses a 3% withdrawal rate instead (a $15,000 annual withdrawal), the portfolio will last for more than 40 years.

It’s important to note that the annual withdrawal in each scenario does not increase, meaning there is no annual inflation adjustment. If certainty is the goal, the retiree simply needs to lock in a 2% return and the portfolio slowly erodes right on schedule. The tradeoff in this approach is that the portfolio is completely liquidated at the end of 35 years (assuming a 4% withdrawal rate). There is nothing left if the retiree happens to live longer than 35 years.

Hence the gravity of the question “will I run out of money?” The world of certainty presents a problem if the retiree lives an unusually long life.

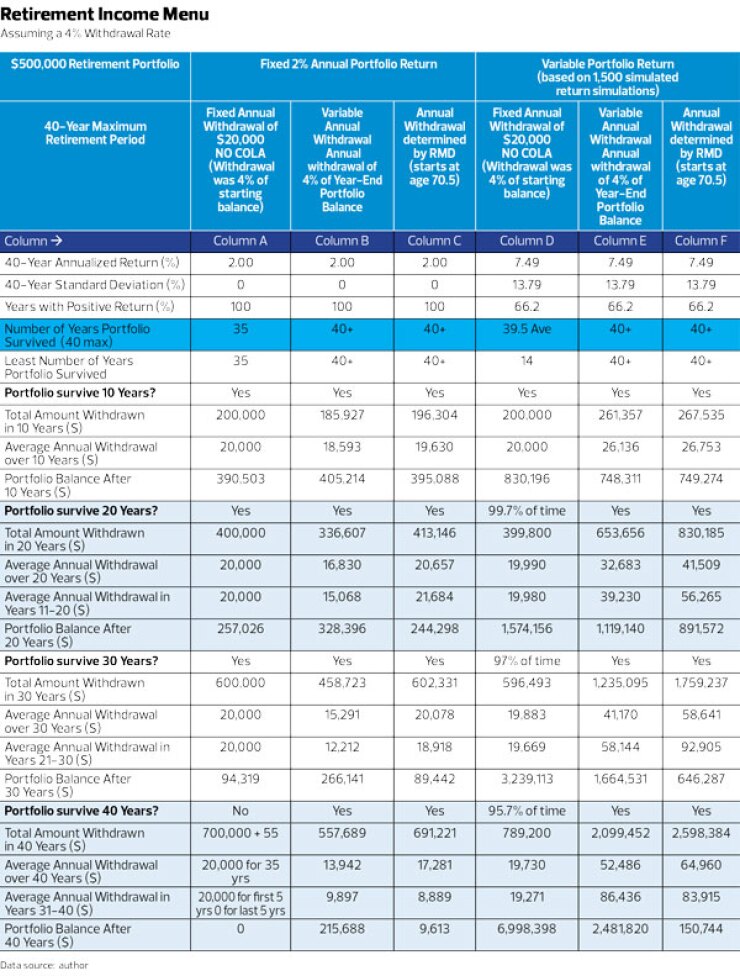

One solution to this problem is to surrender at least part of that certainty. That can happen in two key ways: the annual withdrawal is variable or the return of the portfolio is variable. To explore this world of semi-certainty, I have prepared the table, “Retirement Income Menu,” mapping out various retirement portfolio outcomes. You might liken it to the laminated playbook a football coach holds as he paces the sidelines.

Like in the prior examples, this table is also based on a retirement portfolio that starts with a $500,000 balance. The analysis assumes a maximum retirement period of 40 years. It also assumes that the retiree begins taking distributions from their retirement portfolio at age 70.5, in line with required minimum distributions.

The table is divided into two halves based on the performance of the retirement portfolio: a certain variable (in this case, the fixed 2% annual return) and an uncertain one (a retirement portfolio that has a variable return).

Assuming a fixed annual return of 2%, the retiree has three options. The first choice is to simply withdraw a set amount of money each year (column A). In this analysis, the withdrawal was set to be $20,000. There was no variation in the annual withdrawal, meaning that there were no annual cost-of-living-adjustments. In this scenario, the portfolio lasted for 35 years, and the total amount withdrawn over 35 years was $700,000. If the retiree is still alive at this point, however, he or she has run out of money. Problem.

An alternative is to annually withdraw 4% of the portfolio’s end-of-year value (see column B). As can be seen, this results in gradually diminishing withdrawals each year ($18,593 on average over the first 10 years vs. fixed $20,000 withdrawals), but the tradeoff is that the portfolio lasts for over 40 years. A very simple solution to not outliving your retirement portfolio is to move from a fixed annual withdrawal to a percentage-of-ending-portfolio-balance annual withdrawal.

If the retirement account is governed by RMD rules, the only choice is whether or not the retiree invests their portfolio in a world of certainty, like the 2% fixed annual return in this analysis, or in a portfolio that will have variable returns. If the retiree chooses a 2% fixed return for their RMD-governed retirement portfolio, the outcome over the next 40 years will be astonishingly similar to having chosen a fixed withdrawal.

Let’s now turn our attention to the right-hand side of the “Retirement Income Menu”—the side that reflects a retirement portfolio that is invested in a diversified, multi-asset portfolio, or rather, a world of uncertainty. The results in this part of the analysis were derived from a 1,500 iterations of a Monte Carlo simulation of portfolio returns. The average annualized 40-year return across the 1,500 simulations was 7.49% with a 40-year standard deviation of returns of 13.79%. The randomized portfolio had positive annual returns 66.2% of the time. These performance characteristics were specifically chosen to represent the type of volatility that we have observed in capital markets over the past 15 to 20 years.

In a world of uncertainty, we observe that the retirement portfolio survived for at least 10 years in all 1,500 simulations. The average annual withdrawal during the first 10 years was highest if using the RMD guidelines ($26,753 in column F), but only slightly higher than if withdrawing 4% of the portfolio balance each year ($26,136 in column E).

What about 20 years? The portfolios lasted 99.7% of the time if withdrawing a fixed amount of $20,000 each year. In that scenario, the average ending balance was $1,574,156 after 20 years — far larger than any of the withdrawal scenarios if the portfolio was earning a fixed 2% annual return.

And 40 years? The portfolio survived in 95.7% of the simulations, with an average ending balance of just under $7 million. The average annual withdrawal over the full 40 years was $19,730 (or just slightly below the $20,000 figure, which accounts for the rare cases when the portfolio was liquidated before the 40th year).

If, however, the annual withdrawal was variable (in this case 4% of the year-end balance each year) the portfolio lasted the full 40 years 100% of the time. The average annual withdrawal over the 40-year period was $52,486 and the average ending balance in the 40th year was just under $2.5 million. Clearly, this approach gives the retiree more spending power compared to a fixed annual withdrawal of $20,000.

The RMD is clearly different: its job is to largely liquidate (and tax) the portfolio before the retiree is 110 years old. And it does it. But, it also guarantees the portfolio will not be empty prior to that age.

The average annual withdrawal over the 40-year period was $64,960. But, it’s worth noting that the RMD average withdrawal in the first 10 years (age 70-80) was $26,753 — very close to the variable annual withdrawal of 4% of $26,136. Then, between the ages of 81-90 the average annual RMD withdrawal was $56,265 — far higher than any other amount in that same row of the table. Between the ages of 91-100 the average annual RMD withdrawal was $92,905. The next closest amount was $58,144.

So, to the question “will I run out of money?” the answer is generally no. At least, not for 40 years.

Those accelerated withdrawals using the RMD guidelines take their toll on the portfolio. By the end of the 40th year, the average ending balance in the RMD-governed portfolio was $150,744 compared to nearly $7 million in the fixed annual withdrawal approach and $2.48 million in the 4% of balance variable annual withdrawal scenario.

In summary, retirees that crave certainty may want to consider a fixed return portfolio combined with a variable withdrawal, rather than a fixed annual withdrawal. The important distinction is that the variable annual withdrawal will result in declining withdrawals from the portfolio each and every year if the fixed return of the portfolio is lower than the withdrawal percentage (which was the case in this analysis). The benefit in choosing a variable annual withdrawal (based on a percentage of the portfolio’s value at the end of each year) is that you will still have money remaining after 40 years.

Conversely, if your client chooses a variable return retirement portfolio (such as in a broadly diversified, multi-asset class portfolio) and they want to maximize their retirement income, they will want to choose a variable annual withdrawal that is based on a percentage of the portfolio’s value each year, rather than a fixed annual withdrawal. They will need to understand that the annual cash withdrawal that is based on a percentage of the portfolio’s value each year can go down in some years. In other words, if the portfolio experiences a loss, the annual cash withdrawal will be reduced. While this may be frustrating, it is the exact mechanism that protects the portfolio from early failure.

So, to the question “will I run out of money?” the answer is generally no. At least, not for 40 years.

The real key is how much money do you need each year? If withdrawing 4% of the portfolio balance will be sufficient, then a diversified, multi-asset variable return portfolio is very compelling.