CHANDLER, Ariz. — Financial advisors eyeing the new Tax Cuts and Jobs Act to find savings for their clients should take a close look at the 20% deduction for qualified business income on pass-through entities, according to tax planning experts.

“This is, without a doubt, one of the biggest areas of planning that we can have under the new law. This is why, in large part, they should have just renamed the TCJA the tax professional, lawyer and financial advisor job security act of 2017,” said Jeff Levine of BluePrint Wealth Alliance and Fully Vested Advice.

“The Section 199A deduction leaves a gaping hole in the tax code,” Levine continued in a May 17 session at NAPFA’s spring conference, “and the goal by the end of the presentation today is to make you guys the bus drivers, or the truck drivers, to drive right through that hole with your clients.”

In two sessions on the so-called pass-through deduction, Levine and Sheryl Rowling, head of rebalancing solutions for Morningstar and principal of her own firm, described why certain business owner clients should make employees W-2 employees rather than 1099 workers and consider changing firms’ classifications.

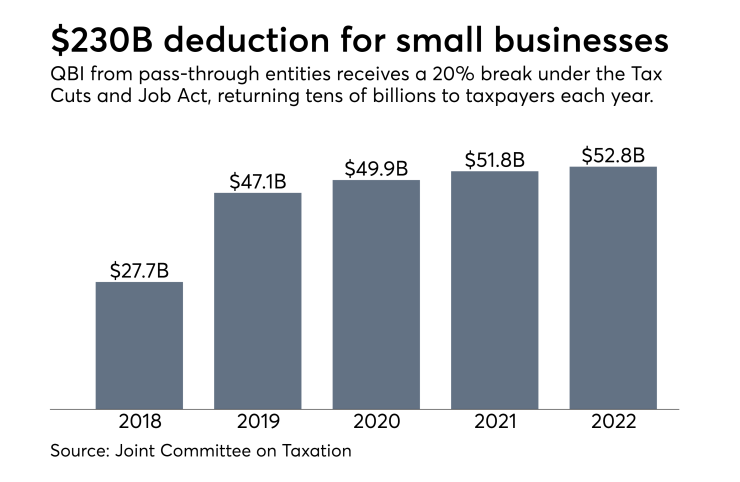

The new deduction for pass-through entities under the law

“The pass-through entity deduction is very complicated,” she told NAPFA advisors. “If you’re not a CPA, you probably want to be working with a CPA or your client’s CPA on this. If your client is entitled to that 20% deduction, and they’re not getting advice on how to take advantage of it, that’s a big liability.”

Rowling and Levine refer to the deduction as an “in-between” deduction because it’s not an itemized deduction or an adjustment to gross income. In the most straightforward cases, the break goes toward 20% of a business owner’s qualified business income.

Business owners with income below $157,500 for individuals and $315,000 for joint filers will qualify for the deduction regardless of their business, but it gets phased out or eliminated at higher levels for a “specified service business.” Advisors’ practices and other financial firms fall under this service category.

-

Congress created a juicy new tax break, yet hundreds of thousands of clients still don’t know if they can claim it.

March 13 -

Sometimes, crunching the numbers shows surprising results. Here’s how advisors can evaluate the tradeoffs of relocating to regions with lower taxes.

March 27 -

Holiday parties and team-building outings may still be deductible. What about entertaining prospects over dinner?

April 24

A majority of affluent Americans are likely to adjust their financial plans under the new law, according to the AICPA. Here's how advisors can help.

The thresholds affecting service businesses, which also include law firms, medical practices, athletes and musicians, make income reduction strategies especially useful. A traditional approach such as placing money in a retirement plan or boosting expenses could make a major difference.

“You probably want to do that kind of thing anyways,” Rowling said. “If you can get the income below the limitation, you can take the deduction.”

Alternate strategies include breaking joint filers into separate filers or creating a separate entity for various parts of a business or its real estate holdings, according to Levine. The new entity could then fall outside the service business category and qualify for the deduction.

For owners of non-service businesses, Levine and Rowling point out that firms which don’t pay W-2 wages will not be eligible for the break. Businesses with 1099 subcontractor employees should therefore change them to W-2 employees to take advantage of the deduction.

On the flip side, Levine laid out a scenario in which a high-value employee could mutually agree with their firm to turn into an independent contractor. If the employer agrees to terminate their W-2 status, the new independent contractor could then have applicable qualified business income, he says.

Advisors should also consider switching businesses’ classifications to an S-corporation or restructuring partnership agreements, since guaranteed payments to partners are not qualified business income, and some structures do not allow owners to pay themselves wages.

“Depending upon the nature of their business, there are scenarios where you could have S-corporation clients that should become partnerships, and you might have partnerships that should become S-corporations,” Levine said.

“So it’s very individualized planning, which is great for all of you, especially those of you that bill by the hour,” he continued, drawing laughter. “There is so much work to be done here.”

Levine and Rowling both cautioned that there are still major uncertainties, especially as to how the IRS will interpret the service business category.

In addition to identifying specific types of businesses, the classification also includes “any trade or business where the principal asset of the business is the reputation or skill of an employee or owner.” Rowling wondered whether such a description might apply to an author or a carpet cleaner's business.

“Where is the line drawn?” she asked. “And the answer to that is, we don’t know.”