Orion Advisor Solutions is the latest fintech company to help financial advisors offer cash management to clients, even as Federal Reserve policy

The Omaha, Nebraska-based technology firm and turnkey asset management platform is bringing aboard an assortment of cash and credit services for advisors developed by Focus Client Solutions, a subsidiary of RIA aggregator Focus Financial Partners.

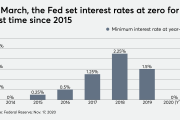

As Orion joins an increasingly crowded marketplace of cash management offerings for advisors, the ongoing low interest rates intended to help the economy through the coronavirus pandemic have made cash much less attractive than it was in 2019, when digital advisors like Wealthfront, Betterment and Personal Capital paired high-yield savings accounts with automated investing.

Orion has wanted to include cash management on its platform for some time, but vendors were only offering single services, says Orion CEO Eric Clarke. One fintech focused on cash deposits, another on mortgages, while yet another worked with securities-backed lending. Only Focus pulled it all together, Clarke says.

“Not only had they curated this series of banking products, but they had also wrapped a service layer on top of that,” he says.

Through an integration with Focus’ digital credit portal, independent advisors using Orion can access FDIC-insured deposit accounts and lending options tailored to high and ultra-high net worth clients, including commercial and business loans, securities-backed lines of credit and even aircraft financing.

Eventually, Orion plans to pull all of this data into its financial planning and portfolio management software, Clarke says: “This is really going to help us round out our client portal in significant ways.”

Focus will also provide a specialized service team to help connect advisors and clients to the right products. For independent advisors who don’t have experience in private banking, this support is key, Clarke says.

“It really creates the confidence that our advisors need to go out and know that they can provide a high degree of service to their clientele,” he adds.

Focus is offering an annual interest rate of 0.3% on cash, which is roughly half of what investors can find at some digital banks,

“I don’t think you can place $20 million, $30 million or $50 million at these terms anywhere else,” says Focus CEO Rudy Adolf.

Tailoring services to HNW and UHNW clients can differentiate the Orion and Focus partnership from other options on the market, like

There is also an opportunity to bring in some of the HNW-based offerings of Brinker Capital, the investment management firm

“This is really an interesting proposition that Orion is putting together here,” Pirker says. “We believe that banking as an add-on to wealth management is a big topic and could make the whole Orion proposition a lot more attractive to HNW practices.”

Despite low interest rates, cash is still important and there is advisor demand for these services, Adolf says. Just over a year since Focus first launched the program, about a quarter of the firms in Focus’s network are using it, he says.

And bringing together cash management and lending with financial planning and investment management can help independent financial advisors compete with larger firms. MassMutual

“The independent fiduciary advisors historically have competed with the brokerage houses, and those brokerage firms are starting to extend more capabilities out to the clients,” says Clarke. “This puts the independent advisor on an even footing.”

The partnership is also a big step for Focus, one of the most

“It’s a departure from their core strategy,” Pirker says. “I don’t think Rudy [Adolf] would do it if he didn’t think there was a sizable business opportunity here.”