The long list of breakaways from National Planning Holdings keeps growing following LPL’s acquisition of the IBD network last August.

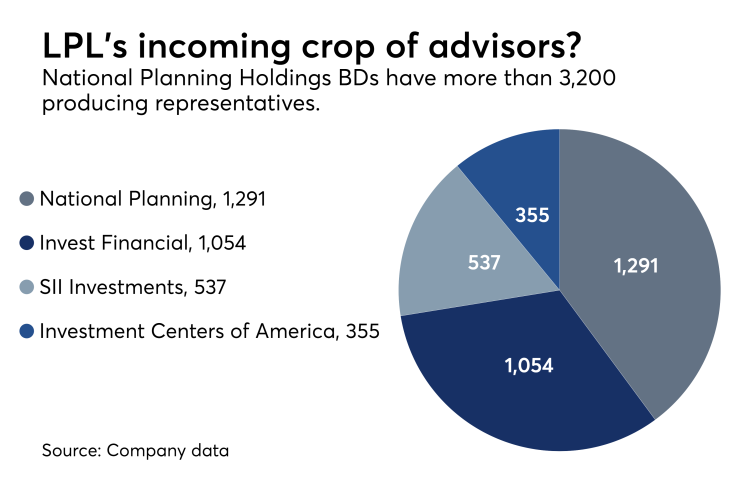

Phil Wood’s team, which oversees $380 million in assets under management, has opted to join Ameriprise Financial, ditching SII Investments. SII is one of the four broker-dealers in the NPH network, which also includes National Planning, Invest Financial and Investment Centers of America.

Wood joins Ameriprise’s franchise network under field vice president Britt Tappen. The group of eight advisors is based in Fremont, Nebraska, with offices also in Iowa and Florida.

The departure caps off Wood’s 19-year tenure at SII Investments, according to FINRA’s BrokerCheck. Wood began his career in 1988 with Kingland Capital Corporation.

Wood says he made the decision to join Ameriprise for three reasons: “First, the firm's values and history of focusing on client needs. Second, we wanted the financial planning and technology resources that only a large, self-clearing firm can offer. And finally, we wanted a firm who would partner with us to help grow our business,” he said in a statement.

A spokeswoman for SII Investments declined to comment, and a spokesman for LPL didn’t immediately respond to a request for comment.

In the past three weeks,

So far, more than 270 of NPH’s 3,200 advisors have been poached by rivals. LPL CEO Dan Arnold estimated last month that it would retain around 70% of NPH advisors from National Planning and Investment Centers of America, which comprise the first wave of the transition. The second wave, which includes the transition of advisors from SII investments and Invest Financial, is slated to begin in February.

-

Independent Financial’s haul includes a new affiliated RIA launched by five of the practices.

November 7 -

The No. 1 IBD unveiled a $1.1 billion firm that is part of the first incoming wave of NPH’s assets.

December 4 -

CEO Dan Arnold listed three reasons why the firm thinks its rivals peeled off some advisors.

November 8

The retention rate and associated production are being closely watched by the industry as an indicator for future large-scale M&A deals. LPL said that it would pay NPH parent Jackson National Life Insurance an added bonus — up to $123 million — for retained business above a 72% threshold.

Ameriprise had faced several quarters of declines in advisor headcount from late 2016 to mid-2017, but it reversed the trend with the