For more than 30 years, the Dilbert comic strip has appeared in newspapers across the country, poking fun at the drudgery of office life and micromanagement, topics familiar to millions of working Americans.

While the audience and punchlines are a bit more niche, there’s now a cartoon out there specifically for financial advisors, especially those who are working in or have spent time at a wirehouse.

Eric Diton, one of the founders of The Wealth Alliance, an independent RIA with offices on Long Island and in Florida, had familiarity with cartoons through his uncle, who was a comic book artist. Diton and his partner, Rob Conzo, both of whom left a wirehouse to form their firm in 2019, thought a strip would be a novel way to depict the joys of wirehouse advisor life and engage potential advisors who might want to join the firm.

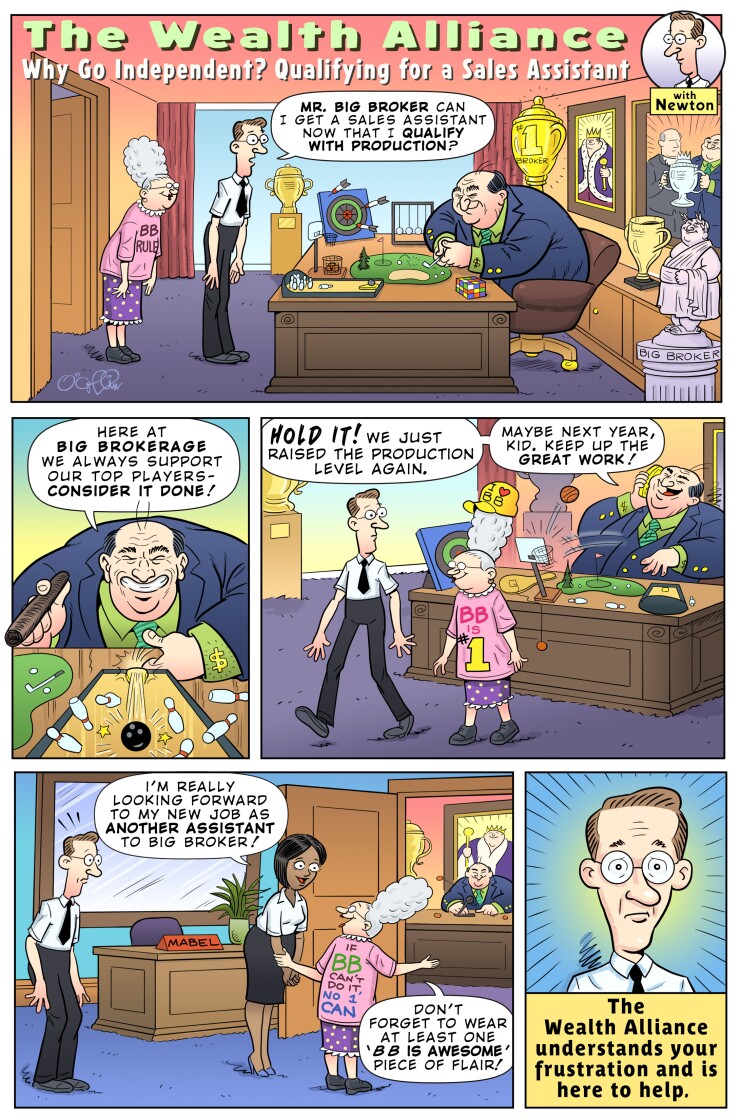

They hired a cartoonist last year to turn the daily experiences of working in a wirehouse into art, and created characters for the cartoons based on their own experiences. The series profiles Newton, a financial advisor, as he navigates the challenges of working under Big Broker, whom Diton calls “the stereotypical cigar-smoking guy in a three-piece suit.”

The first cartoon shows Newton’s seemingly impossible quest to qualify for a sales assistant. The second shows him trying to understand a presentation explaining his compensation structure.

There are plans for one about marketing your business, and another on retiring and/or selling your business back to the brokerage.

“These issues disturbed us,” said Diton. “And we figured they would resonate with most advisors. You want to feel like you have your own business, but in the end, you have no control over your company at all.

“Oh, by the way, this year there’s no pay on accounts under $250,000,” said Diton, relating some of what he said he often heard in wirehouse work. “Or you need X amount of production to get a client service associate, $1 million gets you one associate, $2 million gets two associates. They keep moving the finish line, and then some years ago they said it was mandatory to go into the deferred compensation plan. But if you leave, you lose money. Sometimes it’s even hard to understand what you’re being paid.”

He acknowledged that these issues have been reported in the media, “but no one has ever done cartoons. They’re eye-catching, make people laugh.”

Another character in the cartoons is Mabel. “Every one of these guys has an assistant who loves them. That’s Mabel.”

The first cartoon was posted on the firm’s website a few months ago, as part of a sponsored LinkedIn campaign to help recruit advisors.

“We’ve gotten positive feedback on it,” said Diton. “Advisors love it. They get it. They’re living it.”

He said even if it doesn’t end up bringing in advisors, he and Conzo liked the idea of bringing these issues to the forefront.

As for that cartoon on retiring and/or selling your business back to the brokerage, recruiter Danny Sarch, president of Leitner Sarch Consultants in White Plains, New York, said he would like to see that one. He said while wirehouse advisor work inflicts its own kind of pain, the independent channel presents its own set of challenges, and that is one of the biggest.

“I’m thrilled for them, it’s great. I appreciate what they’re trying to do,” he said. “But the independent movement has been thriving since 2008. All these issues are not news.”

As for the retirement issue, Sarch said when it comes time for the principals of a firm to retire, or cash in for whatever reason, they want to sell the business back to the firm. But those people may not have the money to buy it. That, Sarch said, can leave the principals with a difficult decision — going to private equity for money or selling the firm to another large firm, where life may be very different, perhaps not that different from a wirehouse.

“That bigger entity will likely have its own payout and sales assistant policies,” he said. “I’m skeptical of the RIA world because of this. When you sell an advisory practice, what are you selling? Just a trusted relationship. There’s no guarantee an advisory practice survives the retirement of its principals.”

Since leaving a wirehouse and going independent involves someone putting their livelihood at risk, the typical arsenal of recruitment tools, Sarch said, has to address this.

“If the advisor you are recruiting is already successful, you’ve got to make sure they can take their clients with them,” he said, “and make sure the advisor can do business the same way, has the same resources at the new firm. Are you fixing whatever they want to fix, support, money, etc.”

Sarch said overall advisor numbers are shrinking “because the industry has not successfully trained in decades, and it’s harder than ever today to start a practice from scratch. It’s hard to differentiate yourself.”

Still, a different set of numbers bears out the move away from wirehouses. The latest annual report tracking U.S. client assets, by consulting firm Aite-Novarica Group, predicts that by the end of 2021, client assets managed by wirehouses will have tumbled below those of independent RIAs and brokerages, with discount and online platforms expected to overtake them in 2022. RIAs will have 26% of assets, discount and online brokerages 24.3%, and wirehouses 24.2%, the report said.

Figures from market researcher Cerulli Associates of Boston show the wirehouse channel's headcount market share decreased from 16.8% in 2010 to 15.2% in 2020, and that 23% of wirehouse advisors are undecided or unlikely to remain affiliated with their current firm during the next 12 months.

The second cartoon hasn’t even been posted yet, and the comics have not yet brought in any advisors, but with advisors on the move out of wirehouses, something that grabs attention might be a way to attract those people to a growing RIA.

“It generates some interest,” Diton said. "They look us up, see that we’re two seasoned advisors. It’s a twist, a different approach.”