When Carlos Garcia speaks about the Latino American community's lack of financial education, he offers himself as a prime example.

It wasn't until his third year at Merrill Lynch, he says, before he began investing in a 401(k).

"My parents taught me values of a strong work ethic, but we never talked about retirement," Garcia says. "I had no clue what it was."

The former-Merrill advisor heads the national launch of a new robo advisor, Finhabits, with roots in reaching out to Latino Americans and offering investing and advice through investment accounts and Roth IRAs with $5 minimums, comparable to other micro investing sites like Acorns.

Unlike those services, though, Finhabits is accessible in either English or Spanish, and is pricier — while accounts under $2,500 pay a monthly $1 fee, accounts over that amount pay 50 basis points a year.

Startups like Finhabits represent the broadening of digital advice offerings into even more niche audiences, fintech execs and observers say. Garcia, founder of Finhabits, notes the higher fees are accepted by his clients because the specialized platform's presence in those communities is a value in itself.

"We understand the consumer well, we speak their language and understand their culture," Garcia says. "They know they can go into a Wells Fargo branch and open an investment account, but they don't. There's a different dynamic."

'WE RELATE'

That dynamic partly is about creating awareness about saving for retirement, Garcia says, which is why the platform puts an emphasis on education and prodding clients into a habit of putting aside even small amounts.

But it's not all a digital outreach — Garcia, who grew up on the Texas border town of El Paso, and is a computer science and electrical engineering graduate from MIT — built up Finhabits' initial client base among Hispanic communities across his home state the old-fashioned way: lots of meetings, selling the service to small business owners, even getting the word out through segments on local radio stations.

-

From his offices in San Juan, Puerto Rico, and Chicago, this advisor counsels wealthy Hispanic entrepreneurs.

April 1 -

Senior financial services executives said the industry needed to move more quickly to promote diversity and inclusion throughout the organization.

November 21 -

Ellevest considers factors affecting women such as the gender pay gap, earnings power over time, risk preferences, longer lifespans and caretaking responsibilities.

May 11

"It's important to connect in communities and it’s important to be present," he says. "Our initial clients, they said, 'We relate to your story Carlos.' It is also important to them that this is Latino founded. They know about Schwab, but they are still coming to us."

He acknowledges there are banks in these communities with Latino roots or serving customers in Spanish, and the traditional wealth management industry has tried to appeal to Hispanic clients too.

"But they typically offer them high commission products the consumer doesn’t understand or need," he says. "We are simplifying the language, offering a transparent, easy to access service."

'STUCK IN AUM MODEL?'

Garcia adds that Finhabits, which he financed with the support of former wealth management clients of his, has been in talks with some regional banks about potential partnerships.

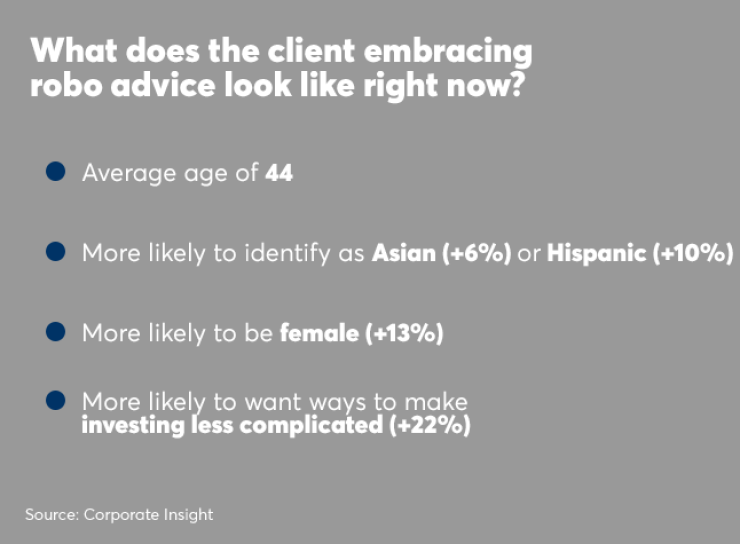

With close to 60 million Latinos in the U.S. alone, it represents a sizable niche market for wealth management, industry observers note. And digital is proving to be a wider gateway for wealth management -- a recent study by Corporate Insight found the profile of robo advice clients is more diverse than traditional wealth management.

Not that there haven't been outreach efforts already. But whether it's Hispanic or African-American clients, the industry hasn't been able to craft a compelling message that has changed attitudes about retirement planning, says James Brewer, president of the Association of African American Financial Advisors.

"So many advisors are stuck in the AUM model," Brewer says. "It takes a different kind of advisor to make a connection, not the asset gatherer, which is still pretty pervasive in the industry."

Brewer commends Garcia's efforts, but adds that digital platforms alone won't be enough to tap into underserved communities. A successful effort will go beyond the traditional managing net worth approach, he says.

"The highest need may be to fix a client's credit," Brewer says.

'ENOUGH OF A DIFFERENTIATOR?'

One fintech executive says he was impressed by the concept and effort behind Finhabits, but expressed skepticism over its ability to attract assets.

"It certainly is an interesting niche to go after," he says. "But obviously it’s a game of scale. Is offering a service in Spanish enough of a differentiator to reach that scale, especially when the cost is double of some of the biggest players in the space?

"It will no doubt attract early adopters, but beyond that is where it gets tough," he adds.

Garcia says that the strategy for the automated service is to gather assets through direct-to-consumer appeal and through small- and medium-sized networks in communities.

"It takes a different kind of adviser to make a connection, not the asset gatherer."

One of the strengths of Finhabits is its bilingual setup, says Grant Easterbrook, CEO of Dream Forward, a Newark, New Jersey-based startup focused on the 401(k) market.

"Often translations don't work well," Easterbrook says. "It's something the big guys in wealth management definitely struggle with."

The rise of such niche offerings in robo advice mirrors the diversity of human advice practices, which include specialists that serve particular professions, Easterbrook says.

"They've got a unique angle, and a unique market," he says. "The biggest challenge will be what all robos have -- distribution, distribution, distribution."