Long-term care insurance may be going out of fashion, but long-term care coverage? That’s a different story.

While sales of traditional LTC policies have fallen sharply in recent years, life insurance policies and annuities that carry LTC benefits are surging in popularity.

“Many people don’t want to use the traditional LTC approach,” says Randy Becker, a planner and owner of Becker Retirement Group in Bellevue, Washington. “They’re concerned about rising premiums, the risk of a company failing or the possibility of not needing the care … all at a time when they will have limited resources.”

“Many people don’t want to use the traditional LTC approach.” -- Randy Becker, Becker Retirement Group.

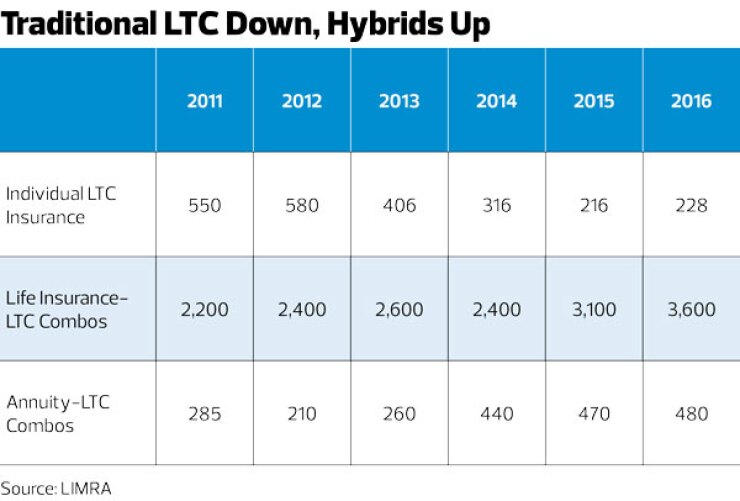

Sales of new standalone individual LTC policies fell to 91,000 in 2016 from 372,000 in 2004, according to LIMRA. Over that same time period, new premium dollars fell to $228 million from $716 million. From 2012 to 2016, the drop in both categories was particularly steep: over 65%. And in the first half of 2017, only 34,000 Americans bought new LTCI policies, down 30% from the first half of 2016.

Instead, Americans are turning to hybrid, or “combo” life insurance that can also pay for lifetime care. To a lesser extent, they’re also buying annuities that offer sizable payouts, if necessary, for long-term care. New premiums for combination life-LTC insurance rose to $3.6 billion last year from $2.4 billion in 2012, according to LIMRA; annuity-LTC hybrids more than doubled in sales, to $480 million from $210 million.

Why the rush to LTC combos? “Some clients are concerned about paying for standalone LTC insurance and not using it,” says Herb Daroff, an advisor with Baystate Financial Planning in Boston. “People don’t hope to get sick to use their health insurance, but LTC insurance has high premiums and the concern exists.”

NEW NEEDS, NEW RECOMMENDATIONS

As LTC insurance premiums have risen, many people lack enthusiasm for paying thousands of dollars, year after year, for coverage that might yield no benefit. “There is absolutely no acceptance of traditional long-term care insurance,” says Jeannette Bajalia, president and principal advisor of Petros Estate & Retirement Planning in Jacksonville, Florida. “The lifetime premium outlay is not predictable, and the cost may not be affordable.”

Jaime Cowper, president of Unity Financial Advisors in Bingham Farms, Michigan, reports that she has begun to recommend life-LTC combos and annuity-LTC combos to clients more often than she does traditional LTC insurance.

“The main reasons are that asset care products,” — her name for the hybrid life policies and annuities — “have guaranteed premiums, offer lifetime benefits, and provide for money for beneficiaries if a client never needs LTC,” she says. “Although a traditional policy initially may be a little less expensive than the asset care products, there is no guarantee that the premium will not go up in the future and become significantly more expensive,” she adds. “This, along with the option for lifetime benefits and the ability to leverage money to beneficiaries if clients never need it, has made asset care very attractive.”

Similarly, Becker refers to LTC hybrids he employs as “asset-based LTC.” Most of his clients, he says, are pleased with this approach. “They’re effectively parking money where it will do its job, if needed for LTC,” he says. “However, the death benefit will ‘bring those assets back home’ if the LTC portion is not needed.”

MONEY-BACK GUARANTEES

Becker says a key element of the products he selects is a return-of-premium feature. If clients’ circumstances change, and they need cash, they can get a refund.

“For example,” he says, “a 56-year-old client recently was approved for a single premium life insurance policy with an LTC benefit. For a $75,000 premium, the initial death benefit is $120,000, falling to about $106,000 at age 90.”

This client’s LTC benefit starts at around $230,000 (about $4,400 per month), rising to $484,000 (about $9,800 per month) at age 80. “Thanks to the return-of-premium feature, if he cancels his policy at any time, he will receive nothing less than the $75,000 single premium,” Becker says. “Such asset-based LTC products can be flexible, with the carrier putting together a simple grid that allows the advisor and client to choose the number of benefit years, inflation or no, and compound or simple growth.”

FREEDOM FROM TAXES

Any LTC benefits from such a product will be tax-free under the IRS guidelines for a tax-qualified LTC plans, says Becker. (Life insurance death benefits usually are untaxed, as well.) Although premiums paid for standalone LTC insurance may be tax-deductible, premiums paid for LTC hybrids are not deductible.

Nevertheless, any LTC benefits paid by a hybrid product probably will be tax-free if the contract is structured to reimburse the individual. “That can be true for qualified LTC expenses,” says Daroff, “delivered by licensed custodial care providers.”

Daroff adds that hybrid LTC benefits under the indemnity model (in which insurance payouts are a set amount) also can be untaxed. Such policies typically pay a full daily or monthly benefit amount directly to the policyholder, if specified conditions are met. The benefits received from an indemnity policy can be untaxed up to the larger of actual outlays for qualified LTC or a per diem limit ($360 a day in 2017).

DEVILISH DETAILS

Some aspects of LTC hybrids are relatively straightforward, Daroff says. Buyers of a life insurance-LTC combo, for instance, might get to use up to 90% of the death benefit during their lifetime for qualified custodial care expenses. “A client who buys $500,000 of coverage might be able to use up to $450,000 for LTC,” he says. “Then the beneficiary would get $50,000 at death. If only $150,000 is used during the insured individual’s lifetime, the beneficiary would get $350,000.”

But some of the finer points of these hybrids have to be carefully negotiated. Whether a hybrid is a whole life policy or a universal life policy, for example, can have a significant financial impact. “With universal life,” says Daroff, “the death benefit does not grow, so LTC benefits do not keep pace with the increased costs of custodial care. With whole life, dividends can increase cash value and death benefit. If the death benefit grows, the amount available for LTC also may grow.”

Henry Montag, CFP, a financial advisor in Uniondale, New York, warns about another potential pitfall in these hybrids. “Some have an LTC rider,” he says. “This acts like a traditional LTC contract, with buyers paying for the rider upfront. These products tend to be relatively liberal about when they’ll pay benefits.”

Other hybrids, however, come with a chronic care rider. “These tend to be more restrictive in their definition of what qualifies for a claim,” says Montag. “The buyer does not pay for the rider up front. Instead, there is an ongoing interest charge when the benefit is actually accessed.” Essentially, he explains, policyholders are borrowing to pay for qualifying care, but the loan amounts can be greater than would be available with loans up to the policy’s cash value.

DOUBLE DUTY

Among annuity-LTC combos, “doublers” are gaining ground. With these annuities, says Bajalia, if an individual is deemed as needing long term care, the income he or she is receiving will double for up to five years. Some annuities continue the doubler even if the cash value of the contract zeros out, says Bajalia, who cautions that advisors need to fully understand how these contracts work in various scenarios.

Despite all the variations in LTC hybrids, advisors report that clients get the message: They’re acquiring life insurance or an annuity as well as coverage for long-term care, if the need arises.

“Generally, I believe that my clients have found these types of products relatively easy to understand.” -- Jaime Cowper, Unity Financial Advisors.

“Generally, I believe that my clients have found these types of products relatively easy to understand,” says Cowper. Becker concurs: “With hybrid LTC,” he says, “I really don’t have a challenge explaining the products. I find it easier to explain combo products than traditional long-term care insurance.”

FINDING THE RIGHT FIT

Which clients are likely to be interested in LTC combos? Bajalia points to single, divorced or widowed women who do not want to be a burden on their children. “Clients with an interest in these products also include those who have been caregivers to their parents or spouses, as well as those who have seen friends and family members financially devastated by the cost of long stays in nursing homes,” she says. “Leaving a legacy to loved ones also can be a reason for buying.”

-

It’s better to have these conversations long before your clients need to use a policy.

May 9 -

Advisors must contend not only with the emotional and psychological issues facing their clients. They must also navigate complex family relationships, while juggling a slew of financial challenges that don't always have easy fixes.

September 6

Bajalia cites the example of a 69-year-old, now-single client of hers whose primary goal is to leave an inheritance to her daughter. “We determined that the best approach to achieving her goals was flexible premium life insurance coverage with a single premium of $150,000 for a total long-term care benefit of $451,000,” she says. “If death occurs prior to the need for long-term care, a death benefit will be paid to the beneficiary. This solution, coupled with a fixed annuity with a doubler, helped the client protect herself and her daughter’s inheritance.”

WHAT’S THE CATCH?

Of course, LTC hybrids are not without flaws. As mentioned, premiums are not tax-deductible. Combo products often require a large upfront outlay. Moreover, advisors may question the idea that clients should purchase life insurance or an annuity if they don’t have a true need or desire for such a product.

“We’ve looked at the combo policies but haven’t recommended any,” says Dave Yeske, managing director at Yeske Buie, a financial planning firm with offices in San Francisco and Vienna, Virginia. “It seems like they might be a fit where someone has a cash value policy that we want to convert. Also, in situations where someone may not medically qualify for straight LTC, my understanding is that the underwriting for the combo policies is more liberal.”

Without such client situations, Yeske’s firm has stayed with traditional LTC policies, for clients with that need. “We try to steer them toward companies that seem to have a long-term commitment to this product,” Yeske says.