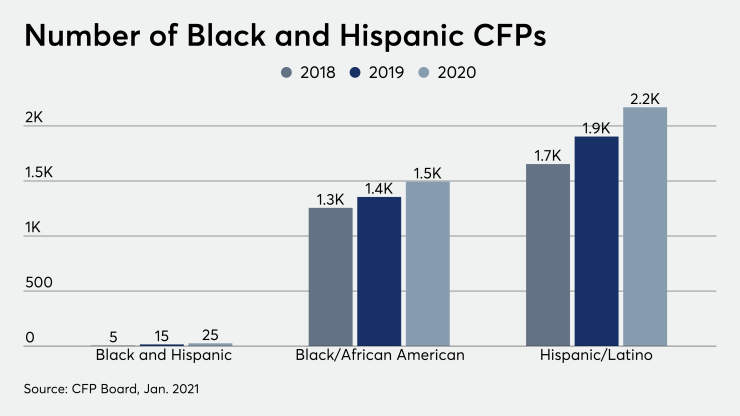

The ranks of CFPs are becoming more diverse, albeit slowly.

More than 400 Black and Hispanic financial planners received the CFP certification in 2020, according to new

Still, while there has been improvement, the numbers are still low. Fewer than 1.7% of CFPs are Black, and fewer than 2.5% are Hispanic.

“We are just scratching the surface,” says Charles Adi, who runs The Blueprint 360, an RIA in Houston. Adi is also currently a volunteer representative in the Center for Financial Planning Diversity Advisory Group, which the CFP Board launched in

“The real test is how do we ensure that we have consistent double-digit growth,” Adi says.

The CFP Board has reported two consecutive years of such growth, 12.6% for 2020 and 12.3% for 2019.

In recent years, the board has been promoting the profession among Black, Hispanic and other demographics interested in joining the industry.

In 2015, the board launched the Center for Financial Planning, which seeks to address problems including the industry’s lack of diversity, the shortage of young talent, and the dearth of professors teaching financial planning at universities.

The center administers four scholarship programs for underrepresented demographic groups and hosts an annual diversity conference. It started publishing research, as well as demographic data of its CFP certificate holders, in

Other organizations, such as the Investment & Wealth Institute, which oversees three certifications — the CIMA, CPWA and RMA designations — have since started launching their own diversity programs and scholarships as well as events.

Of IWI’s membership, 4.5% is Hispanic or Latino, 1.8% is Black or African American, and 3.5% is Asian, according to the organization’s three year-average.

Some professional organizations don’t publish detailed demographic data. The CFA Institute, for instance, says it does not ask members about their race or ethnicity, according to a spokeswoman.

Few companies publish these figures for their workforce, although some, such as

Adi, the Houston-based advisor, says certifying organizations need to demonstrate the value of professional designations to Black, Hispanic and other groups.

“To be honest, I didn't see the value of the CFP designation when I first entered the profession in 2010,” he says, noting that he became certified after the managing partner at his previous firm suggested he do so. “To date, only a handful of my African American clients have even inquired if I held the CFP designation. They don’t ask because they are not familiar with it.”

Credibility will stem from people of color “singing the praises of this certification,” he says, and that doesn’t happen overnight. The time it takes to go from a student to being a CFP can be seven years or more, Adi says.

Still, the signs of growing diversity are encouraging, Adi says, adding that he has witnessed the CFP Board constantly reevaluate its programs in hopes of improvement.

“I see the progress. I see the work being done. Now, you can question whether it’s the right work or the wrong work, but you won’t know until there’s time,” he says.

The growing diversity comes as the overall ranks of CFPs rose to more than 88,000 certificate holders in 2020, up 2.7% from 2019, according to the CFP Board. Less than one quarter — or 23.3% of CFPs — are women.

The CFP Board said it was exploring whether to publish other demographic data, which it tracks. For now, it focused on Black and Hispanic CFPs “as these are among the most underrepresented segments in the financial planning profession,” a spokesperson said.